※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

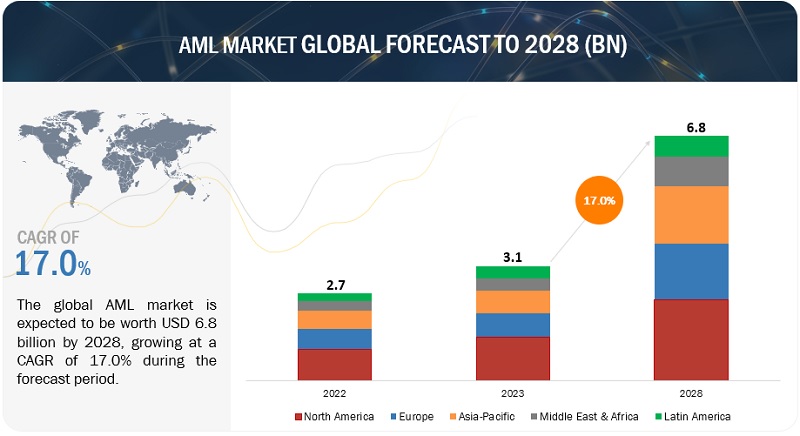

The global AML market size is projected to grow from USD 3.1 billion in 2023 to USD 6.8 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 17.0% during the forecast period. The expansion of the AML market can be attributed to the adoption of cloud-based AML solutions to combat financial crimes.

Moreover, the AML market is experiencing growth due to the introduction of AI/ML-powered solutions and services. These factors contribute to the market’s promising growth potential, providing organizations with enhanced security measures.

AML Market Dynamics

Driver: Growth in focus toward digital payments and internet banking

Digital payment and online banking services have grown phenomenally over the past ten years. These platforms have fundamentally changed how financial transactions are carried out, driven by technical improvements and shifting customer preferences. The economic environment has changed because of the accessibility and convenience provided by digital payment methods and online banking. The growth of e-commerce has accelerated digital payments as more and more online shoppers choose cashless purchases. User confidence has also increased because of the introduction of contactless payments and security features like biometric authentication. The increased use of digital payments allows fraudsters to commit financial crimes by stealing passwords, committing identity thefts, and impersonating clients’ identities for economic benefits. Therefore, financial institutions are adopting AML solutions on a large scale to counter such threats.

Restraint: Increased technological complexities and sophistication of attacks

Cybercriminals use sophisticated strategies to hide the source of illegal income, including ransomware attacks, identity theft, and cryptocurrency-related scams. Because of the serious risk that these activities represent to the integrity of financial systems, institutions must improve their AML skills to stay one step ahead of criminals. The techniques criminals use to finance illegal operations and launder money also advance with technology. The sophisticated cyber-attacks specifically target financial institutions to compromise their security protocols and get unauthorized access to private client information and transaction logs. By influencing or hiding illegal financial activity, these breaches might jeopardize the integrity of AML procedures and undermine AML efforts.

Opportunity: Increased use of AML in the real estate sector

The real estate sector is an attractive target for money launderers due to the large sums of money involved in property transactions and the perceived anonymity that the sector can offer. As a result, the real estate market is more vulnerable to money laundering, with criminals exploiting it to support terrorism, launder illegal cash, and avoid paying taxes. It can be challenging to track the movement of money and spot suspected money laundering activities when buying and selling real estate in multiple countries.

Governments and regulators worldwide have recently introduced new rules and policies to address the issue of rising anti-money laundering (AML) threats in the real estate industry. Certain governments are considering the establishment of public registers or registries that provide accessible information about property ownership and beneficial ownership. The utilization of real estate for money laundering will be discouraged by this transparency. Government disclosure of beneficial ownership information by real estate entities is a step towards greater transparency. It helps law enforcement identify the funding source and inhibits shell companies' use to hide real property owners.

Challenge: Lack of awareness related to government regulations and deployment of AML solutions

Some businesses might not realize how vulnerable they are to being used as a money laundering target. They may ignore the need for comprehensive AML solutions because they think their business or sector is not exposed to such hazards. They may become exposed due to this misunderstanding to criminal groups looking to take advantage of flaws in their financial systems. The lack of expertise in deploying AML solutions must be addressed in several ways. By offering instructional materials, workshops, and guidelines on the significance of AML compliance, industry groups, regulatory authorities, and governments may play a significant role in raising awareness. To show the practical advantages of efficient AML solutions, collaborative efforts combining financial institutions, technology suppliers, and industry organizations may promote best practices and share success stories.

AML Market Ecosystem

By end user, insurance is expected to grow at the highest CAGR during the forecast period.

The insurance sector encompasses a range of segments, including life insurance, health insurance, travel insurance, corporate insurance, and vehicle insurance. Insurance companies provide customers with adaptable policies as well as investment products and services that permit substantial cash deposits and withdrawals. However, the malleability of these offerings elevates the risk of illicit activities, such as money laundering, within the insurance industry. Vulnerable aspects within life insurance offerings susceptible to money laundering comprise single premium policies, high regular premium services, policy surrenders, ownership transfers, policy loans, and top-ups.

By offering, the solution segment is to grow at the highest CAGR during the forecast period.

AML solutions offer a range of benefits, including preventing money laundering and terrorism financing, fortifying the financial system's integrity against illicit activities, enhancing customer due diligence and risk assessment, ensuring regulatory compliance, mitigating the risk of penalties, and bolstering the reputation of financial institutions. Integrating AML solutions is imperative for any financial entity to safeguard its operations and clients from financial crimes. Chosen solutions must be comprehensive, scalable, user-friendly, cost-effective, and tailored to the institution's unique needs, risk level, and transaction volume. Implementing AML solutions empowers financial institutions to uphold the safety and stability of the financial ecosystem.

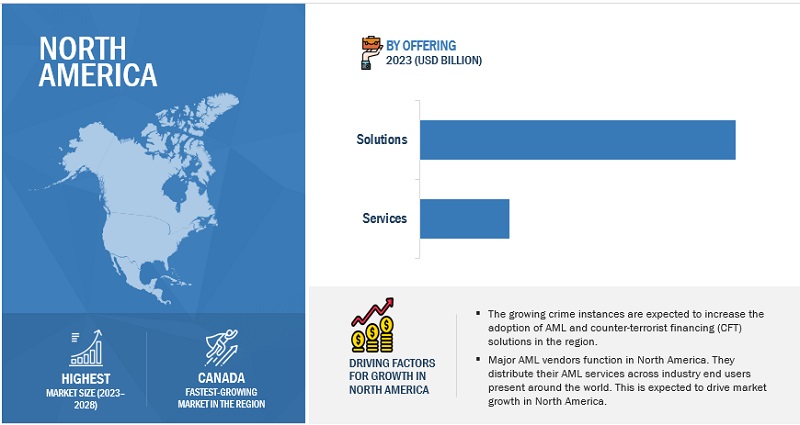

By region, North America accounts for the highest market size during the forecast period.

North America is estimated to be the largest contributor in terms of the market size in the AML market. It is one of the most affected regions in the world by money laundering and terrorist financing crime activities; as a result, it has the highest number of AML solution providers. Money laundering is a significant issue in the United States. The region is an appealing target for money launderers looking to take advantage of vulnerabilities in various businesses and sectors due to its immense size and economic diversity. The sophisticated financial system in North America, along with the anonymity provided by digital transactions and intricate corporate networks, creates an ideal environment for blending criminal funds with the legal economy. The banking system's accessibility is the main source of laundered money. Another form of money laundering used by criminals in the USA is trade-based money laundering.

Key Market Players

The key players in the AML market are LexisNexis (US), Oracle (US), FIS (US), Fiserv (US), Jumio (US), NICE Actimize (US), SAS Institute (US), GB Group (UK), FICO (US), ACI Worldwide (US), Experian (Ireland) and others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

offering, solution, service, organization size, deployment mode, end users, and regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors in the global AML market include LexisNexis (US), Oracle (US), FIS (US), Fiserv (US), Jumio (US), NICE Actimize (US), SAS Institute (US), GB Group (UK), FICO (US), ACI Worldwide (US), Experian (Ireland), Nelito Systems (India), Wolter Kluwer (Netherlands), Comarch (Poland), Allsec Technologies (india), Dixtior (Portugal), Temenos (Switzerland), TCS (India), ComplyAdvantage (UK), Featurespace (UK), Feedzai (Portugal), Tier1 Financial Solutions (Canada), Finacus Solutions (india), FRISS ( Netherlands), TransUnion (US), SymphonyAI (US), Napier (UK), IDMERIT (US), IMTF (Switzerlands), Innovative Systems (US), Sedicii (Ireland), Trulioo (Canada), NameScan (Australia), DataVisor (US), Gurucul (US) |

The study categorizes the AML market by offering, solution, service, organization size, deployment mode, end users, and regions.

By offerings:

- Solutions

- Services

By Solution:

- KYC/CDD and Sanction Screening

- Transaction Monitoring

- Case Management and Reporting

By Services:

- Professional Services

- Managed services

By Deployment mode:

- On-Premises

- Cloud

By Organization size:

- SMEs

- Large Enterprises

By End-user:

- Banks & Financial Institutes

- Insurance

- Gaming & Gambling

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In April 2023, NICE Actimize launched SAM-10 as Part of its Anti-Money Laundering suite of solutions. It is an AI-Based AML Transaction Monitoring Innovation With Multilayered Analytics to Better Detect Suspicious Activity.

- In January 2023, IMTF acquired the Siron anti-money laundering and compliance solutions developed by US-based FICO Corporation, a leading analytical business intelligence software provider. With this acquisition, IMTF has now taken over the management of all Siron anti-financial crime solutions worldwide.

- In December 2022, NICE Actimized Partners with The Knoble. The Knoble's Financial Crimes Working Group will get expertise from NICE Actimize in the areas of technology, research, and other resources to aid in the identification and elimination of fraud in human trafficking-related operations.

- In November 2022, Hoist Finance partnered with SAS anti-money laundering (AML) technology supported by Consortix, a strategic SAS AML partner, to fight against financial crime. Hoist Finance is a Swedish credit management company operating in several European countries.

- In February 2022, GB Group acquired Verifi Identity Services Limited, commonly known as “Cloudcheck,” a provider of electronic identity verification (IDV) and anti-money laundering (AML) solutions in New Zealand.

Frequently Asked Questions (FAQ):

What are the opportunities in the global AML market?

Higher adoption of advanced analytics in AML, Integration of AI, ML, and big data technologies in developing AML solutions, adoption of cloud-based AML solutions to combat financial crimes, and Increased use of AML in the real estate sector are a few factors contributing to the growth and creating new opportunities for the AML market.

What is the definition of the AML market?

MarketsandMarkets defines anti-money laundering as a practice by financial institutes such as banks, insurance, or gaming & gambling enterprises to monitor and prevent illegal activities supporting money laundering and terrorist financing. These banks and financial institutes follow policies and regulations during KYC/CDD, transaction screening, and monitoring and compliance to avoid fraudulent and illegal activities around the financial systems.

Which region is expected to show the highest market share in the AML market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include LexisNexis (US), Oracle (US), FIS (US), Fiserv (US), Jumio (US), NICE Actimize (US), SAS Institute (US), GB Group (UK), FICO (US), ACI Worldwide (US), Experian (Ireland).

What is the current size of the global AML market?

The global AML market size is projected to grow from USD 3.1 billion in 2023 to USD 6.8 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 17.0% during the forecast period.