※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

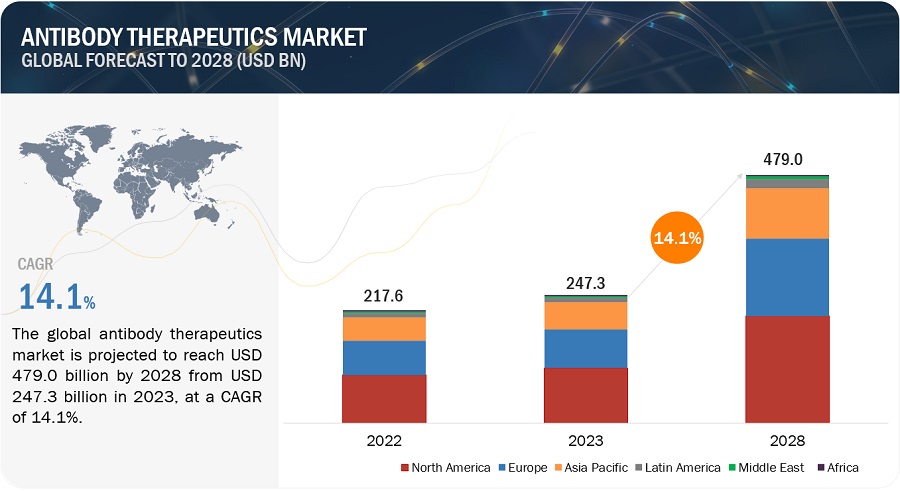

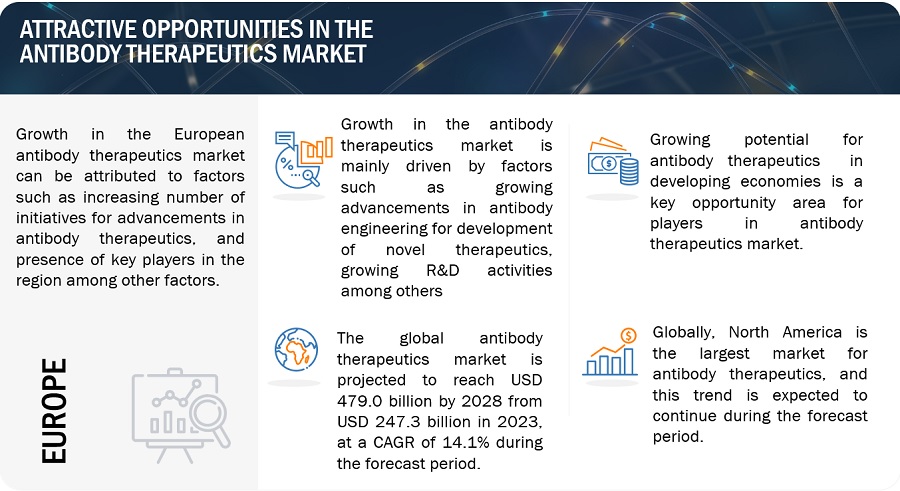

The global antibody therapeutics market in terms of revenue was estimated to be worth $247.3 billion in 2023 and is poised to reach $479.0 billion by 2028, growing at a CAGR of 14.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in this market is mainly due to the growing initiatives towards advancements in antibody engineering. Additionally, factors such as growing demand for oncology antibody therapeutics and a growing clinical pipeline focus on antibody therapeutics are supporting the growth of this market. Moreover, developing economies are expected to create lucrative offers for the growth of this market.

Attractive Opportunities in the Antibody Therapeutics Market

Antibody Therapeutics Market Dynamics

Driver: Growing advancements in antibody engineering

Antibody engineering is a specialized field that focuses on modifying antibodies to enhance their therapeutic properties. This process involves the application of technology and techniques to design antibodies with specific characteristics tailored for therapeutic applications. Antibody engineering offers several benefits such as customization for specific therapeutic indications, targeted effects and more. Severa antibody engineering techniques are being used for the production of antibody fragments. These include hybridoma technology, Phage Display, Single B-Cell Technology, and Transgenic Animals. Wacker's ESETEC secretion technology (by Wacker Chemie AG) is an approach for the expression and secretion of antibody fragments (Fab) exceeding 4.0 g/L and scFv exceeding 3.5 g/L into the fermentation broth. Another platform for the productive creation of a sizable number of antibody fragments is the Pelican Expression Technology Platform (by Ligand Pharmaceuticals) and the pOP prokaryotic expression vector. Such advancements in technology allow the development of novel antibody therapeutics, thus, supporting market growth.

Restraint: Stringent regulatory approval process

The US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) are the major regulatory authorities that regulate the commercialization of antibody therapeutics. The stringent regulatory guidelines imposed by the FDA in the US and the EMA in Europe during clinical trials have the potential to create significant restraints for companies. There have been instances of product regulatory rejections or withdrawals due to stringent regulatory parameters for antibody therapeutics. For instance, in December 2022, Y-mAbs Therapeutics issued a complete response letter (CRL) for the Biologics License Application (BLA) for the investigational medicine 131I-omburtamab (omburtamab) for the treatment of CNS/leptomeningeal metastasis from neuroblastoma for which the FDA completed the review of the application and concluded that it is unable to approve the BLA in its then presented form. Thus, the market players are required to mandatorily follow regulations put forth by the regulatory bodies to overcome this restraint.

Opportunity: Increasing collaboration of pharmaceutical companies with CROs, CDMOs and academic institutions

Market players are increasingly focusing on a collaborative approach with an aim to enhance their market position. This collaborative approach allows players to leverage the research and manufacturing capabilities as well as professional expertise from these organizations thus creating new avenues of growth for market players. For instance, AstraZeneca in collaboration with the University Health Network, Toronto, has been engaged in a phase II, open-label study to assess the efficacy of AZD2936 in terms of molecular residual disease (MRD) clearance and treatment outcome in patients with MRD after definitive treatment for high-risk locoregionally advanced head and neck squamous cell carcinoma (LA-HNSCC). Such

Challenge: Complexities in manufacturing processes

Manufacturing processes for antibody therapeutics involve several complexities with some challenges that impact production capacity and efficiency. For instance, bacterial systems can synthesize inactive proteins with the proper molecular structure, which can result in the creation of inclusion bodies. Additionally, bacteria can eliminate signal peptides but not preproteins like native coagulation growth factors, which they cannot break down. The purification process is challenging because endotoxins, which are created by bacteria during expression, are notoriously difficult to eliminate. Endotoxins and inclusion bodies present a hurdle to the final product's purity. Monoclonal antibodies which are the primary class of therapeutic antibodies, are large and complex molecules. Their manufacturing involves intricate processes due to the complicated nature of these molecules, presenting challenges distinct from small molecules, oral medicines, or vaccines. Therefore, low yields, protein misfolding, aggregation, post-translational modifications, immunogenicity, regulatory compliance, cost of goods, time-to-market, and process reproducibility are critical factors that can impact the efficiency, affordability, and accessibility of these therapies. Thus, market players also outsource manufacturing from service providers. This adds to the burden of costs incurred in manufacturing which creates a further challenge of manufacturing economically.

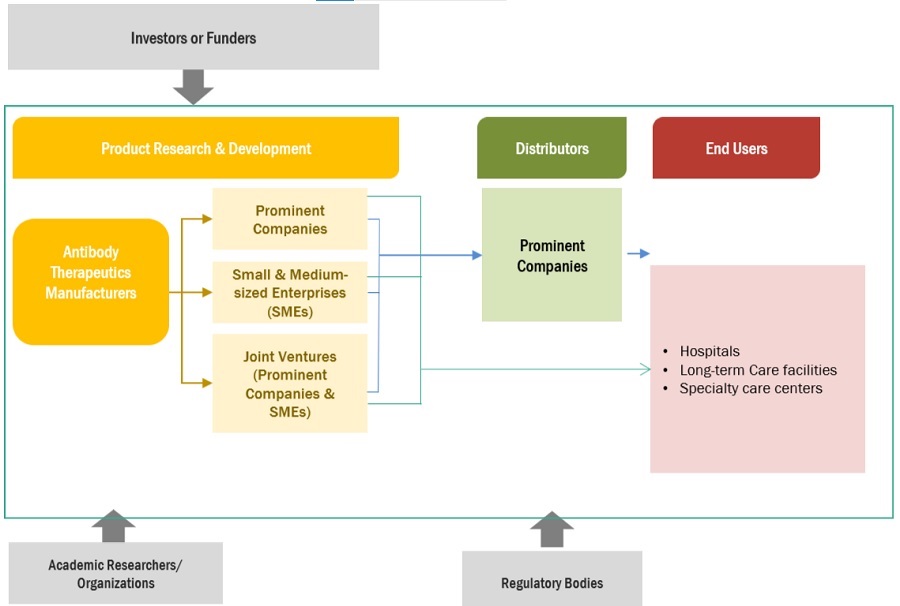

Antibody Therapeutics Market Ecosystem

Prominent companies in the market include companies operating in the market for several years and possessing a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in the antibody therapeutics industry include F. Hoffmann-La Roche Ltd. (Switzerland), AbbVie Inc. (US), Johnson & Johnson (US), Merck KGaA (Germany), Bristol-Myers Squibb (US), AstraZeneca (UK), Sanofi (France), Regeneron Pharmaceuticals, Inc. (US), Novartis AG (Switzerland), Amgen, Inc. (US), Biogen Inc. (US) among others.

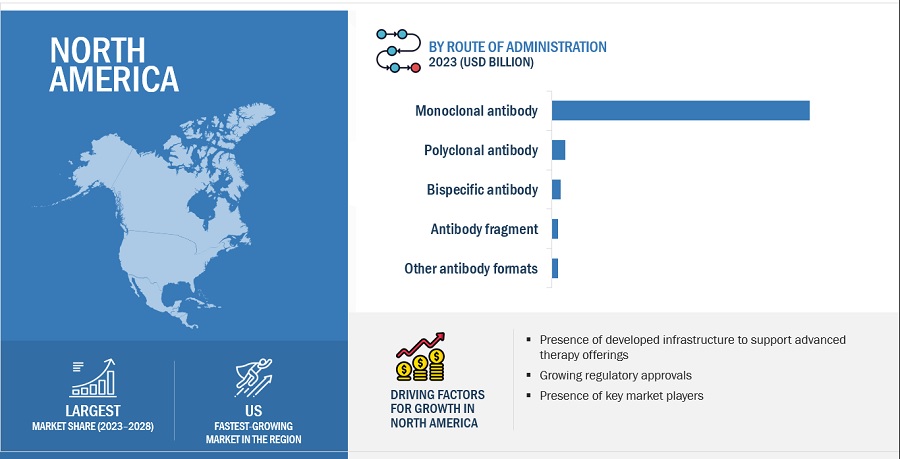

The monoclonal antibodies accounted for the largest share of the format segment in the overall antibody therapeutics industry in 2023.

On the basis of format, the antibody therapeutics market is segmented into monoclonal antibodies, polyclonal antibodies, antibody fragments, bispecific antibodies, and other novel antibody therapies. In 2022, the monoclonal antibodies segment accounted for the largest share of the market. The presence of a large number of pipeline monoclonal antibodies and the specificity of the target offered by mAbs are the major factors driving the market growth of this segment.

The autoimmune and inflammatory disorders segment dominated the disease area segment in the antibody therapeutics industry in 2023.

On the basis of disease area, the antibody therapeutics market is segmented into autoimmune & inflammatory diseases, oncology, hematology, infectious diseases, osteology, immunology, neurology, and other disease areas. In 2022, the autoimmune & inflammatory diseases segment accounted for the largest share of the market. This can be attributed to one of the major factors- the presence of a large number of marketed antibody therapeutics against autoimmune & inflammatory conditions.

North America was the largest market for overall antibody therapeutics industry in 2022 and also during the forecast period.

Geographically, the antibody therapeutics market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East and Africa. The market was dominated by North America in 2022 and this dominance is anticipated to continue throughout the forecast period between 2023 and 2028. The market for antibody therapeutics is expanding in the region as a result of factors like major antibody therapeutics sales revenue generated from the region and availability of advanced infrastructure in hospitals among others.

The prominent players in the antibody therapeutics market are F. Hoffmann-La Roche Ltd. (Switzerland), AbbVie Inc. (US), Johnson & Johnson (US), Merck KGaA (Germany), Bristol-Myers Squibb (US), AstraZeneca (UK), Sanofi (France), Regeneron Pharmaceuticals, Inc. (US), Novartis AG (Switzerland), Amgen, Inc. (US), Biogen Inc. (US) among others.

Scope of the Antibody Therapeutics Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$247.3 billion |

|

Projected Revenue by 2028 |

$479.0 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 14.1% |

|

Market Driver |

Growing advancements in antibody engineering |

|

Market Opportunity |

Increasing collaboration of pharmaceutical companies with CROs, CDMOs and academic institutions |

All the market segments have been divided for the Antibody Therapeutics market to forecast revenue and analyze trends in each of the following submarkets:

By Format

- Monoclonal antibody

- Polyclonal antibody therapy

- Bispecific antibody

- Antibody fragment

- Other antibody formats

By Disease Areas

- Autoimmune & inflammatory diseases

- Oncology

- Hematology

- Infectious diseases

- Osteology

- Immunology

- Neurology

- Other disease areas

By Route of Administration

- Intravenous

- Subcutaneous

- Other routes of administration

By Source

- Human

- Humanized

- Chimeric

- Other sources

By End User

- Hospitals

- Long-term care facilities

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Rest of Latin America

- Middle East

- Africa

Recent Developments of Antibody Therapeutics Industry

- In October 2023, F. Hoffmann-La Roche Ltd. entered into a definitive agreement to acquire Televant. Through this agreement, Roche received the development, manufacturing and commercialization rights in the US and Japan for Telavant’s RVT-3101, a novel TL1A directed antibody.

- In January 2023, AbbVie Inc. and Immunome, Inc. entered into strategic collaboration to identify up to 10 novel target-antibody pairs leveraging Immunome's Discovery Engine.

- In December 2022, AbbVie Inc. and HotSpot Therapeutics entered into a strategic collaboration and option to license agreement for HotSpot’s discovery-stage IRF5 program for the treatment of autoimmune diseases.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global antibody therapeutics market?

The global antibody therapeutics market boasts a total revenue value of $479.0 billion by 2028.

What is the estimated growth rate (CAGR) of the global antibody therapeutics market?

The global antibody therapeutics market has an estimated compound annual growth rate (CAGR) of 14.1% and a revenue size in the region of $247.3 billion in 2023.