※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

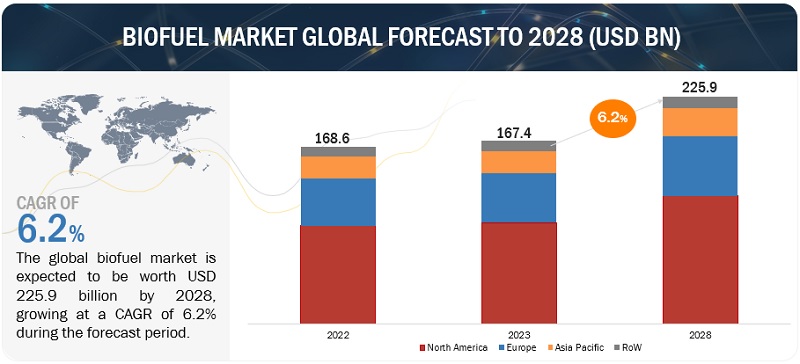

[225 Pages Report] The global biofuel market is estimated to grow from USD 167.4 Billion in 2023 to USD 225.9 Billion by 2028; it is expected to record a CAGR of 6.2% during the forecast period. The growing challenges on energy security and the need to mitigate greenhouse gas emissions are some of the major drivers for the growth of the biofuel market. Fuels derived from renewable sources act as a means of addressing the challenges while also providing a potential low-cost alternative to expensive fossil fuels. Domestic production of biofuels from renewable sources can reduce reliance on oil imports and improve energy security.

Biofuel Market Dynamics

Driver: Growing demand for cleaner fuels and favorable government policies

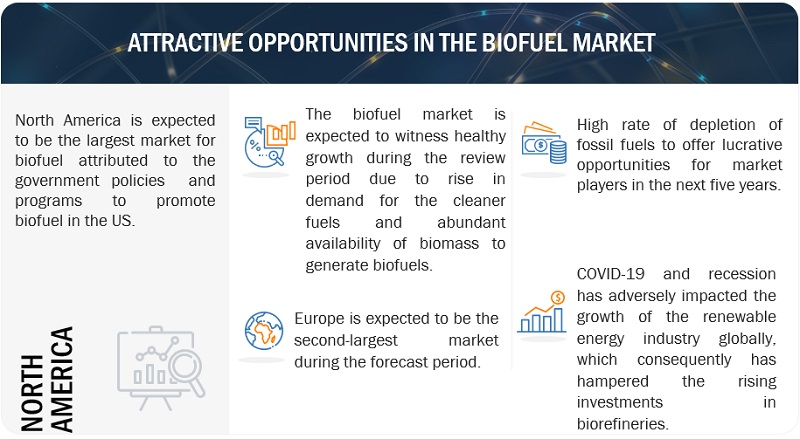

The growing demand for cleaner fuels is one of the major factors driving the biofuels market. Biofuels are renewable fuels that can be produced from a variety of biomass sources, such as crops, forestry residues, and municipal wastes. Several countries worldwide are trying to move away from dependence on oil imports. According to the Renewable Energy Directive (RED), the EU had set a goal of covering at least 20% of its total energy demand from renewable sources by 2020. The US Renewable Fuels Standards Program was created to reduce greenhouse gas emissions and expand the US renewable fuel sector. The implementation of stringent environmental regulations in several countries has also created the demand for efficient and less polluting energy sources, thus driving the growth of the biofuel market worldwide. For instance, the launch of the 2019 National Policy on Biofuel and the Food Safety and Standards Authority of India's (FSSAI) Repurposed Used Cooking Oil (RUCO) project has encouraged both established companies as well as startups to join the initiative. By 2040, India's primary energy demand is expected to double, with an increase in the usage of alternative fuels such as biodiesel. Biofuels are the most efficient alternative to fossil fuels, and they can be produced locally. As the final product is typically 95% carbon-free, these fuels also aid in reducing any negative effects on the environment.

Restraint: Requirement of high initial capital investment

The cost of building and operating a biofuels plant or biorefinery is significant, making it difficult for biofuels to compete with fossil fuels. The investment includes costs related to the installation of biorefineries, procurement, testing, maintenance, and cost of feedstock. Biofuel is a capital-intensive undertaking involving state-of-the-art technologies without prior experience or sufficient historical data. Energy-intensive processes require specialized energy production systems to co-generate heat or electricity. These are only a few factors that make investing in biofuels expensive and undesirable. The global inflation rate has been high, in part due to rising food and energy prices. This year, inflation is expected to be 6.6% in advanced economies and 9.5% in emerging markets and developing economies, and it is expected to stay higher for a longer period. Many economies have seen an increase in inflation as a result of supply chain disruptions, which have increased costs.

Opportunities: New oilfield discoveries to promote production activities

Fossil fuel reserves in the earth’s subsurface are limited. A finite resource will eventually run out if it is continuously used up. The demand for fuels is increasing day by day; it will directly drive the continuous rise in cost due to less availability of oil in the earth’s crust. Increased mining and extraction of high quantities of fossil fuels directly impact fossil fuel level depletion. According to Oil–Statistical Review of World Energy 2021, the earth has only the next 53 years of oil reserves left at the current consumption rate. According to the BP Statistical Review of World Energy 2021, fossil fuels accounted for 82% of primary energy use in 2020; in 2019, it was 83%, whereas five years ago, it used to be around 85%. So, as the quantity of fossil fuel reduces because of higher demand and less availability of crude oil, it will automatically impact its use every year. As the world faces the depletion of fossil fuels, many governments are promoting the use of biofuels instead of fossil fuels, creating opportunities for the biofuel industry.

Challenges: Variable and high cost of feedstock

The cost of the feedstock is a significant variable cost factor in the production of biofuel. To achieve high production and the longest possible onstream time, consistent feedstock quality is required. The variable and high feedstock cost is a challenge for the biofuels market. The cost of feedstock can vary depending on several factors, such as the type of feedstock, the location of the plant, and the market conditions. This can make it difficult for biofuels to compete with fossil fuels, which have a more stable price. The cost of different feedstock can vary significantly. For example, the cost of corn is relatively high, while the cost of sugarcane is relatively low. The feedstock cost can also vary depending on the plant’s location. For example, the cost of feedstock in Brazil is relatively low, while the cost in the US is relatively high. The cost of feedstock can also be affected by market conditions. For example, the cost of feedstock can increase during periods of high demand or when there is a shortage of feedstock.

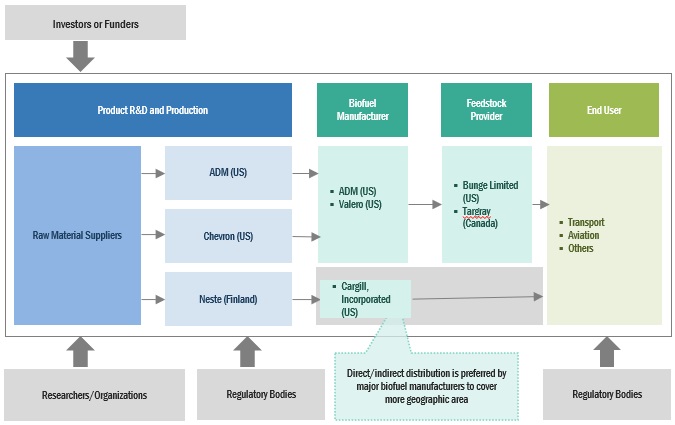

Biofuel Market Ecosystem

In this market, prominent companies stand out as well-established and financially stable providers of biofuel products and services. With years of experience, these companies boast a diverse product portfolio, cutting-edge technologies, and robust global sales and marketing networks. Their proven track record in the industry positions them as reliable and trusted partners for customers seeking biofuel solutions. These companies have demonstrated their ability to adapt to market dynamics and consistently deliver high-quality products and services, making them leaders in meeting the demands of the oil and gas sector. Prominent companies in this market include ADM (US), Chevron (US), Valero (US), Neste (Finland), and Cargill, Incorporated (US).

The biojets segment, by fuel type, is expected to be the fastest-growing market during the forecast period.

This report segments the biofuel market based on fuel type into four types: ethanol, biodiesel, renewable diesel, and biojets. The biojets segment is expected to be the fastest-growing market during the forecast period. The growing investment in the production of sustainable aviation fuel is one of the key factors driving the biojets segment. Governments and international organizations are implementing regulations and targets to reduce aviation emissions. For instance, the International Civil Aviation Organisation (ICAO) has established industry-wide emission reduction targets. Incentives and mandates for the use of sustainable aviation fuels are frequently included in these regulations, boosting its adoption.

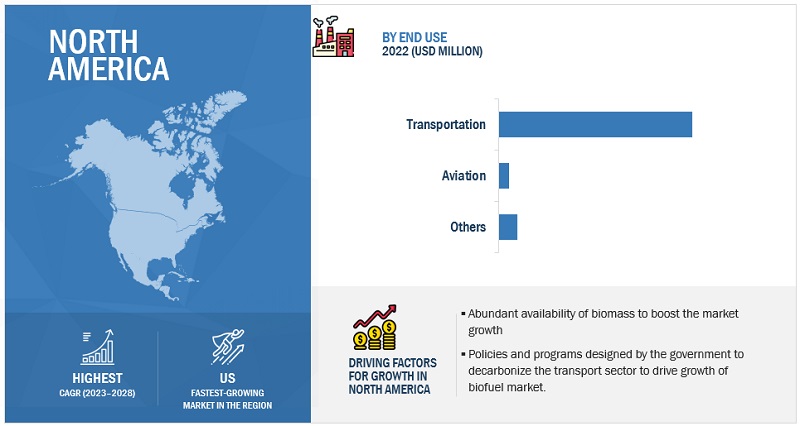

By end use, transportation is expected to be the largest segment during the forecast period.

This report segments the biofuel market based on end use into three segments: transportation, aviation, and others. The transportation sector is a major source of greenhouse gas emissions. Biofuels can assist in lowering these emissions because they emit less carbon dioxide when burned as compared to fossil fuels. Governments worldwide have introduced regulations to encourage the use of renewable energy, such as biofuels. For instance, the European Union, has set a target to decarbonize the transport sector by 15% by 2025 and 30% by 2030.

“North America: The largest in the biofuel market.”

North America is expected to be the largest region in the biofuel market between 2023–2028, followed by Europe and Asia Pacific. North America has been leading the biofuel market. The regional biofuel market is experiencing growth due to the presence of leading solution providers like ADM (US), Chevron (US), Valero (US), and Cargill, Incorporated (US). Notably, Valero invested around USD 315 million in January 2023 to enhance biofuel (sustainable aviation fuel) production, catering to North America's expanding market.

Key Market Players

The biofuel market is dominated by a few major players that have a wide regional presence. The major players in the biofuel market include ADM (US), Chevron (US), Valero (US), Neste (Finland), and Cargill, Incorporated (US). Between 2018 and 2023, Strategies such as new product launches, contracts, agreements, acquisitions, and expansions are followed by these companies to capture a larger share of the biofuel market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Biofuel market by Fuel Type, Generation, End Use, and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World |

|

Companies covered |

ADM (US), Chevron (US), Valero (US), Neste (Finland), Cargill, Incorporated (US), Wilmar International Ltd (Singapore), VERBIO AG (Germany), Borregaard AS (Norway), POET, LLC (US), The Andersons, Inc. (US), and Green Plains Inc. (US), BP p.l.c. (UK), FutureFuel Corporation (US), Münzer Bioindustrie GmbH (Austria), Aemetis, Inc. (US), CropEnergies AG (Germany), Raízen (Brazil), Blue Biofuels, Inc. (US), Pannonia Bio Zrt. (Hungary), GreenJoules (India), and Algenol (US). |

This research report categorizes the biofuel market based on fuel type, generation, end use, and region.

On the basis of Fuel Type:

- Ethanol

- Biodiesel

- Renewable Diesel

- Biojets

On the basis of Generation:

- First Generation

- Second Generation

- Third Generation

On the basis of End-Use:

- Transportation

- Aviation

-

Others

- Power Generation

- Heating

- Green Chemistry

On the basis of Region:

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In May 2023, Neste and ITOCHU entered into a licencing agreement that will allow ITOCHU to become the official distributor of Neste MY Renewable Diesel in Japan.

- In February 2023, Neste opened an Innovation Centre in Singapore to improve its worldwide innovation and R&D capabilities. Asia has been an important market for Neste, and the new center will help the company's growth in the Asia-Pacific region.

- In June 2022, Cargill established its first state-of-the-art advanced biodiesel plant in Ghent, Belgium. This facility turns waste oils and residues into renewable fuel. The advanced biodiesel generated at the facility will be used in the maritime and trucking industries, allowing clients to reduce their carbon footprint connected with maritime and road transport activities.

- In March 2022, Chevron Renewable Energy Group launched its line of branded fuel solutions, EnDura Fuels, the line which produced many types of renewable fuel including InfinD, PuriD which is next-generation biodiesel, UltraClean BlenDVelociD, and beyond. These products help aviation, marine, trucking, rail, and other industries reach sustainability targets by using cleaner-burning and lower-emission fuels.

Frequently Asked Questions (FAQ):

What is the current size of the biofuel market?

The current market size of the biofuel market is USD 167.4 billion in 2023.

What are the major drivers for the biofuel market?

Growing demand for cleaner fuels and the implementation of supportive government policies to decarbonize various sectors are some of the major drivers for the biofuel market.

Which is the largest region during the forecasted period in the biofuel market?

North America is expected to dominate the biofuel market between 2023–2028, followed by Europe and Asia Pacific.

Which is the largest segment, by fuel type, during the forecasted period in the biofuel market?

The ethanol segment is expected to be the largest market during the forecast period. Raw materials such as corn, wheat, and sugarcane are predominantly used in the production of ethanol, which is widely available in various countries.

Which is the fastest segment, by end-use, during the forecasted period in the biofuel market?

Aviation is expected to be the fastest market during the forecast period. The production of biojet fuel is expected to scale up rapidly in the coming decade due to developments in technological pathways to commercialize the use of alternative jet fuels.