※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

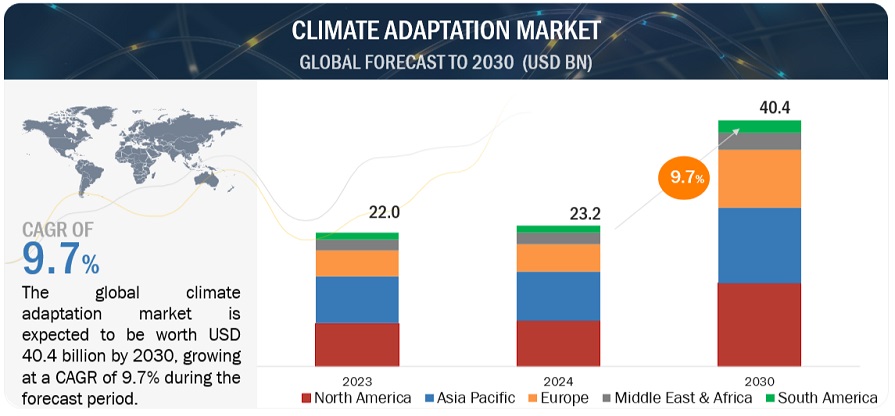

[255 Pages Report] The global climate adaptation market in terms of revenue was estimated to be worth $23.2 billion in 2024 and is poised to reach $40.4 billion by 2030, growing at a CAGR of 9.7% from 2024 to 2030. Government policies and regulations are pivotal drivers shaping the market for climate adaptation, particularly in the context of addressing pressing environmental challenges and increasing carbon emissions. Across the globe, governments are increasingly recognizing the urgent need to curb greenhouse gas emissions and mitigate the impacts of climate change.

Climate Adaptation Market Dynamics

Driver: Increasing extreme weather events

The world is experiencing extreme weather events, such as heatwaves, droughts, and floods. Recently, many regions have faced severe conditions. For example, according to Frontline, the Northern Hemisphere had its hottest summer in 2023; globally, 2024 is expected to be even warmer. In 2024, the US was hit by a high number of tornadoes. Over 100 tornadoes struck the Midwest and the Great Plains in just four days, causing significant damage and loss of life.

According to the Center for Science and Environment (CSE), between January 2023 and September 2023, extreme weather events in India resulted in 2,923 deaths, destruction of almost two million hectares of crops, 80,000 destroyed homes, and the death of over 92,000 animals. These weather events, caused by climate change, can lead to significant damage and loss of life.

Urgent climate adaptation measures are needed to mitigate these impacts. The Jet Propulsion Laboratory reports that the sea level is rising at an increasing rate. From 2022 to 2023, the sea level has increased by approximately 0.3 inches (0.76 centimeters). Rising sea levels may pose threats to coastal communities, disrupt coastal wetlands, and worsen the impact of storms. The primary cause for the rise in sea levels is the increasing temperature of the environment. Therefore, the rising sea level, a major consequence of climate change, augments the adoption of climate adaptation solutions.

Restraint: High upfront and operational cost

The significant investment needed is a major hindrance to adopting climate adaptation solutions, such as direct air capture and carbon Storage (DACCS), Bioenergy with Carbon Capture and Storage (BECCS), and various early climate warning and environmental monitoring solutions.

According to the Environmental Defense Fund (EDF), DAC has high upfront and operational costs. In addition, the cost of carbon removal, including storage, must decrease from USD 500–1,000 per ton to below USD 100 per ton for the technology to be widely adopted, as noted by the World Economic Forum (WEF). The substantial upfront investment required, which includes acquiring and integrating hardware and software, conducting workforce training, and potentially retrofitting existing infrastructure, can pose a barrier for end users of early climate warning and environmental monitoring solutions.

End users operating within tight budgets or facing economic uncertainties may find committing substantial funds to these technologies challenging. The perceived risk associated with uncertainty regarding the return on investment further contributes to hesitation in embracing these technologies.

Opportunities: Mounting investment in carbon removal technologies

Various countries and companies have been investing in climate tech to combat climate change. For instance, India’s climate-tech sector has seen a 29% increase in overall funding from 2019 to 2022, reaching a total investment of over USD 5 billion. This demonstrates strong confidence in the sector’s potential for impact.

In the US, the Department of Energy (DOE) has announced a USD 1.2 billion investment under the Bipartisan Infrastructure Law to support the development of two commercial-scale direct air capture facilities in Texas and Louisiana. Additionally, the Inflation Reduction Act has allocated USD 14.36 million to fund ten projects under the National Oceanic and Atmospheric Administration (NOAA’s) US Integrated Ocean Observing System Office as part of the Investing in Coastal Communities and Climate Resilience provision. Furthermore, the European Union’s Horizon Europe funding program for research and innovation plans to announce a tender for BECCS and DAC projects in September 2024.

Moreover, the US has allocated approximately USD 100 million for Carbon Dioxide Removal (CDR) pilot projects, which include Bioenergy with Carbon Capture and Storage (BECCS), as announced in February 2024). Investment in these technologies creates lucrative opportunities for climate adaptation.

Challenges: Complexities associated with integrating climate adaptation solutions in industrial sector

The United Nations Industrial Development Organization (UNIDO) reported a 2.3% growth in global industrial sectors in 2023, including manufacturing, mining, electricity, water supply, waste management, and other utilities. However, many of these industries contribute significantly to climate change.

For example, in 2023, the manufacturing sector in India became the second-largest source of greenhouse gas emissions. IBM refers to the current era as the fourth industrial revolution (Industry 4.0), characterized by automation, digitalization, and data exchange in manufacturing technologies. The adoption of these advanced technologies drives the manufacturing sector and increases productivity.

As industrialization surges, it has a pronounced impact on the climate, which requires integrating climate adaptation solutions within the industrial sector. However, adopting these solutions faces numerous challenges, including high implementation costs, technological complexity, regulatory uncertainties, and the need to align adaptation strategies with existing business models and objectives.

Climate adaptation market Ecosystem

In the climate adaptation sector, key companies are recognized for their stability and strong financial foundation. These firms offer a broad range of products, leveraging state-of-the-art technologies and extensive marketing networks. Their solid industry reputation makes them reliable and trusted partners for those seeking climate adaptation solutions. They have consistently demonstrated an ability to respond to market shifts and deliver superior products and services. Prominent companies in this market are Baker Hughes Company (US), Exxon Mobil Corporation (US), Climeworks (Switzerland), INTERNATIONAL BUSINESS MACHINES CORPORATION (US), and Vaisala (Finland).

The early climate warning & environmental monitoring solutions segment, by solution, is expected to be the largest market during the forecast period.

This report segments the climate adaptation market based on solution into two categories: technology-based solution and early climate warning & environmental monitoring solutions. The climate adaptation market is seeing a surge in demand for early climate warning systems and environmental monitoring. This growth is driven by the need to proactively address the escalating impacts of climate change. By gathering real-time data and issuing timely alerts, these solutions empower communities and businesses to prepare for extreme weather events, rising sea levels, and other climate-related disruptions. This proactive approach helps minimize damage and fosters resilience in a changing environment.

By end user, industries segment is expected to be the largest segment share during the forecast period.

This report segments the climate adaptation market based on end user into three segments: government agencies, academia & research institutions, and industries. The rise in global temperatures is primarily driven by increasing carbon dioxide (CO2) and greenhouse gases (GHGs). The industrial sector was responsible for nearly 23% of total GHG emissions in the US in 2022, according to the US Environmental Protection Agency (US EPA).

To address this issue and mitigate climate change, it is crucial to implement climate adaptation technologies, such as DAC, CCS, BECCS, afforestation, and reforestation, to capture emissions caused by industries. The International Energy Agency (IEA) suggests that carbon capture, utilization, and storage (CCUS) technology can be added to existing power and industrial plants to continue their operation while reducing emissions, particularly in hard-to-abate sectors, including heavy industries. Additionally, bioenergy with carbon capture & storage (BECCS) can help capture CO2 from processes where biomass is converted into fuels or directly burned for energy generation.

North America: The second largest region in the Climate adaptation market.

North America is expected to be the second largest market in the climate adaptation market between 2024–2030. Climate adaptation in North America increasingly relies on innovative technology-based solutions and advanced early warning and monitoring systems to mitigate the impacts of climate change. Additionally, integrating renewable energy sources, such as solar and wind power, is crucial in transitioning to sustainable energy systems.

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the climate adaptation market include Baker Hughes Company (US), Exxon Mobil Corporation (US), Climeworks (Switzerland), INTERNATIONAL BUSINESS MACHINES CORPORATION (US), and Vaisala (Finland). Between 2020 and 2024, Strategies such as new product launches, contracts, agreements, partnerships, collaborations, acquisitions, and expansions are followed by these companies to capture a larger share of the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024–20 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Solution, and By End user |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East and Africa, and South America |

|

Companies covered |

INTERNATIONAL BUSINESS MACHINES CORPORATION (US), AccuWeather, Inc. (US), Earth Networks (US), DTN (US), Campbell Scientific, Inc. (US), Vaisala (Finland), Esri (US), OnSolve (US), Metasensing (Italy), METER Group (US), AEM (US), Nielsen-Kellerman Co. (US), BARANI DESIGN Technologies s. r. o. (Slovakia), Adolf Thies GmbH & Co. KG (Germany), Previsico Limited (UK), Climeworks (Switzerland), Carbon Engineering ULC. (Canada), Global Thermostat (US), Heirloom Carbon Technologies (US), Soletair Power (Finland), SLB (US), Baker Hughes Company (US), Fluor Corporation (US), Exxon Mobil Corporation (US), Equinor ASA (Norway), Drax Group plc (UK), Clean Energy Systems (US), Babcock & Wilcox Enterprises, Inc (US), CRYOCOLLECT (France), and Carbon Clean Solutions Limited (UK) |

The market is classified in this research report based on Solution, end user, and region.

Based on solution, the Climate adaptation market has been segmented as follows:

- Nature-Based Solutions (Afforestation & Reforestation and Coastal & Marine Habitat Restoration)

- Enhanced Natural Process Solutions (Land Management, Enhanced Weathering, and Ocean Fertilization)

- Technology-based Solutions [Bioenergy with Carbon Capture & Storage (BECCS), Direct Air Capture & Carbon Storage (DACCS), and Carbon Capture & Storage (CCS)]

- Early Climate Warning & Environment Monitoring Solutions (Solution and Application)

Based on End user, the Climate adaptation market has been segmented as follows:

- Government Agencies

- Academia and Research institutions

- Industries (Oil & Gas, Power Generation, Chemical & Petrochemical, and Other Industries)

Based on regions, the climate adaptation market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East and Africa

Recent Developments

- In May 2024, Pertamina (the natural energy company of Indonesia), the national energy company, and Exxon Mobil Corporation collaborated to conduct appraisal drilling for a carbon capture and storage (CCS) hub in Indonesia, with the companies signing an initial storage deal with South Korea's KNOC in 2024. Indonesia, which estimates its depleted oil and gas reservoirs and saline aquifers could provide storage for hundreds of gigatons of CO2.

- In April 2024, AccuWeather and Ambient Weather, a modern weather station technology leader, entered an exclusive partnership to offer superior real-time hyperlocal weather data and private weather station networks for local TV stations for the first time at NAB.

- In March 2024, CGG, a multinational geoscience technology services company, signed a Memorandum of Understanding with Baker Hughes, an energy technology company, to explore jointly offered carbon capture & storage (CCS) solutions. The collaboration aims to support the growth of CCS projects by providing integrated solutions for screening, selecting, and monitoring carbon storage sites globally.

Frequently Asked Questions (FAQ):

What is the current size of the climate adaptation market?

The current market size of the climate adaptation market is 23.2 billion in 2024.

What are the major drivers for the climate adaptation market?

Growing demand to reduce carbon emissions for different end user, including government agencies, research institutions, and industries.

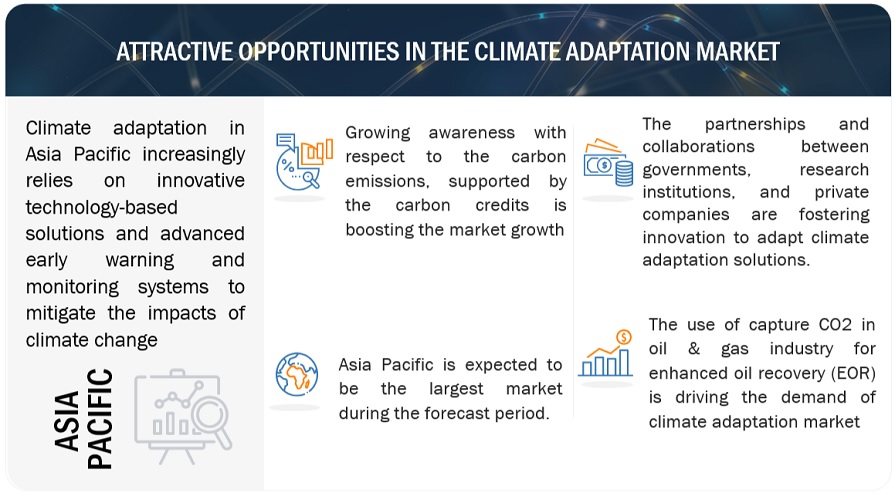

Which is the largest region during the forecasted period in the climate adaptation market?

Asia Pacific is expected to dominate the climate adaptation market between 2024–2035, followed by North America and Europe.

Which is the largest segment, by end user, during the forecasted period in climate adaptation market?

The industries segment is expected to be the largest market during the forecast period owing to rising carbon emission from the industrial process.

Which is the largest segment, by solution, during the forecasted period in the climate adaptation market?

Early climate waring & environmental monitoring solutions is expected to be the largest market during the forecast period by solutions. .