※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

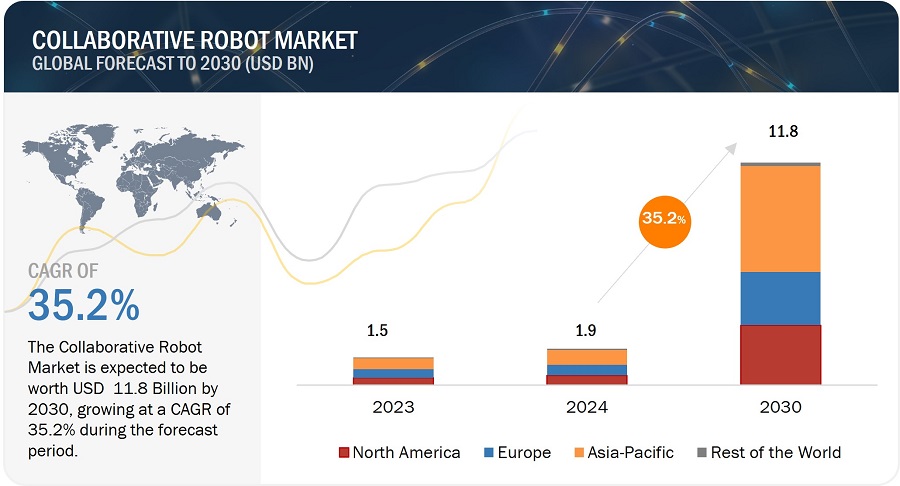

The global Collaborative Robot market share was valued at USD 1.9 billion in 2024 and is estimated to reach USD 11.8 billion by 2030, registering a CAGR of 35.2% during the forecast period.

The growth of Collaborative Robot market is driven by the higher return on investment than traditional industrial robotic systems, increased demand in e-commerce and logistics sectors, significant benefits in businesses of all sizes, and easy programming of cobots.

Collaborative Robot Market Forecast to 20360

Collaborative Robot Market Dynamics:

Drivers: Increased demand in e-commerce and logistics sectors

The surging demand in e-commerce and logistics has become a smart driving force for the collaborative robot (cobot) market, addressing critical challenges and propelling operational efficiency. With increasing e-commerce sales, the need for warehouse workers is immense, and cobots bridge the labor gap by handling repetitive tasks, ensuring a more attractive work environment. Cobots boost operational efficiency through 24/7 operations, precision, scalability, and flexibility, maximizing warehouse utilization and improving order fulfilment. They integrate seamlessly with human workers, offering cost-effectiveness, data-driven optimization, and application in emerging areas like delivery automation and warehouse security. The synergy between the growing e-commerce landscape and advancing cobot technology foretells exponential growth, reshaping efficiency and transforming the dynamics of e-commerce and logistics.

Restraint: Higher preference for low-payload-capacity robots in heavy-duty industrial applications

The Collaborative Robot (Cobot) market encounters a significant obstacle as the limited payload capacity of cobots hampers their adoption in heavy industries like automotive and machinery manufacturing. While cobots excel in light-duty tasks, their inability to handle heavier materials crucial in heavy-duty applications impedes market growth. This mismatch results in restricted market access, increased competition from traditional robots, and slower technological advancements in heavy-duty cobots. To overcome this restraint, efforts include developing high-payload cobots, industry-specific customization, fostering collaboration, and highlighting cobot advantages. By addressing the payload gap and emphasizing unique benefits, stakeholders can unlock the full potential of cobots in diverse manufacturing sectors.

Opportunities: Increasing focus of automation experts on pairing robotic arms with mobile platforms such as AMRs or AGVs

The collaborative robot (cobot) market is experiencing significant growth through the integration of robotic arms with mobile platforms like Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs). This dynamic shift expands cobots' application scope, enabling tasks in dynamic warehouse automation, flexible manufacturing, and remote operations. The synergy enhances productivity, agility, and smart collaboration, with opportunities to boost throughput, reduce labor costs, and improve scalability. Stakeholders can maximize these opportunities by focusing on agile cobot platforms, investing in advanced software, ensuring standardization, promoting industry-specific solutions, and addressing safety and security concerns. This trend heralds a future where cobots move freely, collaborate intelligently, and revolutionize automation across industries. With the rise of Autonomous Mobile Robots (AMRs) and Autonomous Ground Vehicles (AGVs) designed for collaborative use, companies have started to combine mobility technology with collaborative robots. For instance, in December 2023, Robotize ApS (Denmark) launched the GoPal P35, its first platform Autonomous Mobile Robot (AMR), entering this segment alongside its existing pallet AMRs. With a compact footprint of 960 x 660 mm, the GoPal P35 accommodates various top modules and accessories, fulfilling customer requests for a platform AMR with high uptime and operational reliability.

Challenge: Payload and speed limitations of collaborative robots owing to their inherent design.

The collaborative robot (cobot) market faces substantial challenges due to inherent design limitations in payload and speed. Cobots, with payload capacities typically under 20 kg, struggle with heavy-duty tasks, limiting their application in industries like heavy manufacturing and construction. Additionally, their slower speeds impede adoption in fast-paced sectors such as electronics assembly. Despite their advantages in human-robot collaboration, cobots often carry a higher per-unit cost, making it challenging to justify investments compared to traditional industrial robots. Market competition and user demand may drive manufacturers to improve payload and speed capabilities, but emerging technologies like exoskeletons pose alternative solutions. The cobot market may experience slower overall growth, emphasizing the need for technological advancements and strategic focus on niche applications to overcome these limitations and foster sustained market expansion.

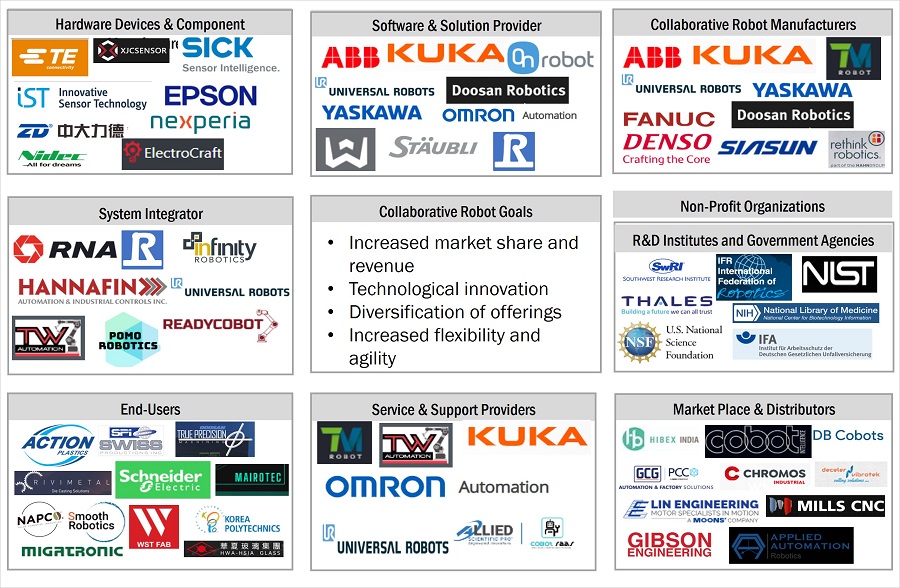

Collaborative Robot Ecosystem

Collaborative robots (cobots) with a payload capacity of up to 5kg present a compelling solution across industries, offering advantages in flexibility, ease of use, improved productivity, cost-effectiveness, and increased versatility. Their user-friendly programming interfaces enable quick deployment and adaptation to change tasks, making them accessible even to individuals with limited technical expertise. The lightweight and compact design of these cobots allows for easy integration into existing workspaces without extensive modifications, facilitating greater adaptability in production lines. They contribute to increased productivity by performing repetitive tasks with high accuracy, reducing the burden on human labor, and improving worker safety by handling potentially hazardous activities. With lower upfront costs and a faster return on investment, these cobots are an ideal choice for small and medium-sized enterprises, extending a wide range of applications from assembly and soldering to quality inspection and material handling.

Market for handling segment is projected to hold for largest share during the forecast timeline.

Collaborative robots, or cobots, play a pivotal role in shared workspaces, excelling in four key handling tasks. In pick-and-place operations, cobots showcase high repeatability, programmability, and lightweight flexibility, making them ideal for accurate and repetitive tasks. For material handling, their versatility with different grippers and tools enhances efficiency, improves ergonomics, and increases overall productivity by taking over manual tasks. In packaging and palletizing, cobots exhibit dexterity, speed, and consistency, leading to reduced labor costs as they automate repetitive packaging duties. In machine tending, cobots ensure uninterrupted machinery operation with their reliability, precision, and enhanced safety, handling tasks near potentially hazardous machinery. Overall, collaborative robots prove invaluable in diverse industries, offering several benefits such as improved efficiency, safety, and productivity in handling applications.

Automotive segment in industry to hold the highest market share of the Collaborative Robot market during the forecast period

The incorporation of collaborative robots (cobots) in the automotive sector has revolutionized manufacturing processes, bringing about increased productivity, enhanced worker safety, adaptability, and cost-effectiveness. Cobots, designed to collaborate with human workers, excel in automating light and repetitive tasks, boosting production rates and maintaining consistent quality. The advanced sensors and vision systems of cobots ensure a safe working environment by detecting human presence and triggering appropriate responses. The adaptability of cobots allows for easy reprogramming and redeployment, facilitating a swift response to changing production requirements. Despite a potentially higher initial investment, the cost-effectiveness of cobots becomes evident through faster returns on investment, minimal setup times, and reduced reliance on specialized technicians. In essence, collaborative robots have become integral assets in the automotive industry, shaping the future of manufacturing practices.

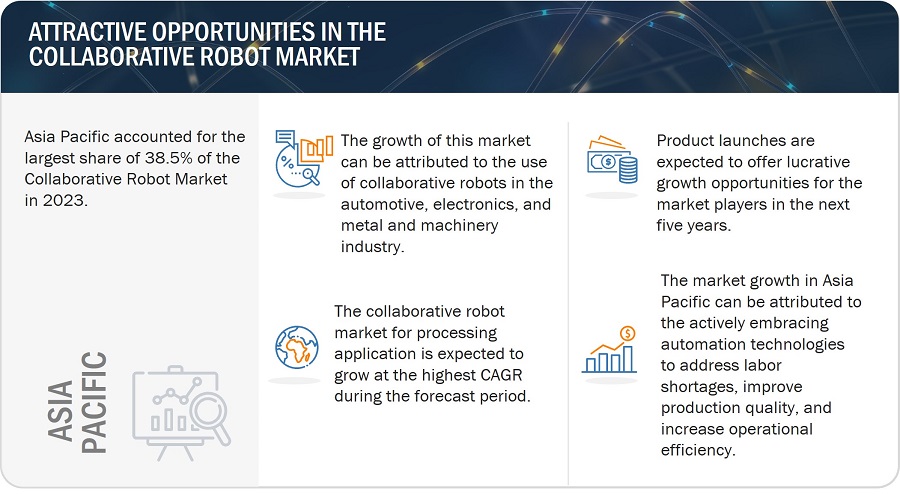

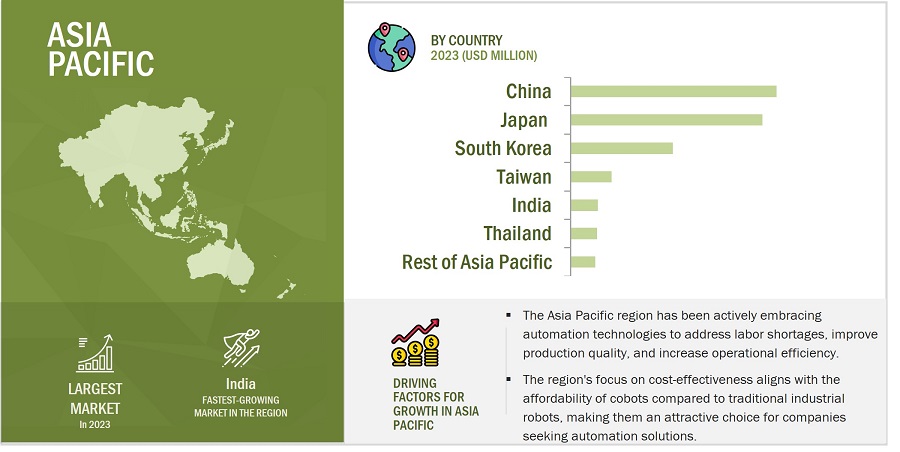

The Collaborative Robot market in the Asia Pacific is estimated to grow at a higher CAGR during the forecast period.

The aging population in China and Japan has resulted in rising labor costs, leading to the growing adoption of automation. This is compelling companies to adopt automation and collaborative robots to reduce costs. With increasing labor costs, China is expected to further increase investments in automation to maintain its cost advantage in production. As a result, China's collaborative robot (cobot) market will remain dominant during the forecast period. China is moving from labour-intensive simple industries toward manufacturing high-tech goods, such as semiconductors, through its Made in China 2025 policy. The presence of some of the most prominent players in the collaborative robot (cobot) market space, such as FANUC Corporation (Japan), Yaskawa Electric Corporation (Japan), DENSO Corporation (Japan), Techman Robot (Thailand), and Doosan Robotics (South Korea), is another major factor driving the market in this region.

Collaborative Robot Market by Region

Collaborative Robot Companies - Key Market Players

Major vendors in the Collaborative Robot companies include Universal Robots A/S (Denmark), FANUC CORPORATION (Japan), ABB (Switzerland), TECHMAN ROBOT INC. (Taiwan), and AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD (China), KUKA AG (Germany), Doosan Robotics Inc. (South Korea), Denso Corporation (South Korea), YASKAWA ELECTRIC CORPORATION (Japan), Rethink Robotics GmBH (Germany).

Apart from this, Siasun. Robot & Automation Co., Ltd. (China), Franka Emika GmbH (Germany), Comau S.p.A. (Italy), F&P Robotics AG (Switzerland), Stäubli International AG (Switzerland), Bosch Rexroth AG (Germany), Productive Robotics, LLC (US), NEURA Robotics GmbH (Germany), ElephantRobotics (China), Elite Robots (China), Niryo (France), Hanwa Corporation (South Korea), OMRON Corporation (Japan), Wyzo (Switzerland), MIP Robotics (France), Kawasaki Heavy Industries, Ltd. (US), Dobot (China), JAKA Robotics (China), Huiling Tech (China) are among a few emerging companies in the Collaborative Robot market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020—2030 |

|

Base year |

2023 |

|

Forecast period |

2024—2030 |

|

Segments covered |

Payload, Application, Industry and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major players include Universal Robots A/S (Denmark), FANUC CORPORATION (Japan), ABB (Switzerland), TECHMAN ROBOT INC. (Taiwan), and AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD (China), KUKA AG (Germany), Doosan Robotics Inc. (South Korea), Denso Corporation (South Korea), YASKAWA ELECTRIC CORPORATION (Japan), Rethink Robotics GmBH (Germany) and Others- total 29 players have been covered. |

Collaborative Robot Market Highlights

This research report categorizes the Collaborative Robot market payload, industry, application, and Region.

|

Segment |

Subsegment |

|

By Payload: |

|

|

By Application: |

|

|

By Industry: |

|

|

By Region: |

|

Recent Developments

- In November 2023, TECHMAN ROBOT INC. (Taiwan) revealed the TM AI Cobot TM25S at iREX 2023, showcasing its 25kg payload capacity and advanced features for precision tasks. The cobot's integration with NVIDIA's Isaac Sim platform streamlined production line inspections, reducing programming times by 70% and cycle times by 20%.

- In June 2023, Universal Robots A/S (Denmark) and SICK AG (Germany) collaborated on an innovative safety solution addressing the need for enhanced safety measures in specific human-robot collaborative applications. The SICK safety extension, designed in close partnership with Universal Robots, offers a protective volume around the robot tool and handled objects, facilitating easier deployment. The system, showcased at Automatica in Munich, Germany, demonstrated its deep integration into the UR robot system through a PolyScope update, making cobot safety solutions more accessible for customers. The solution, aimed at fostering spatial cooperation while meeting stringent safety requirements, is set for sale post the UR PolyScope update in early Q2 2024.

Key Questions Addressed in the Report

What is the total CAGR expected to be recorded for the Collaborative Robot market during 2024-2030?

The global Collaborative Robot market is expected to record a CAGR of 35.2% from 2024-2030.

Which regions are expected to pose significant demand for the Collaborative Robot market from 2024-2030?

Asia Pacific & Europe are expected to pose significant demand from 2024 to 2030. Major economies such as US, Germany, China, Japan, and South Korea are expected to have a high potential for the future growth of the market.

What are the major market opportunities for the Collaborative Robot market?

Increasing focus of automation experts on pairing robotic arms with mobile platforms such as AMRs or AGVs, growing number of subscriptions for Raas model, and rising demand for automation in healthcare industry are the significant market opportunities in the Collaborative Robot market during the forecast period.

Which are the significant players operating in the Collaborative Robot market?

Key players operating in the Collaborative Robot market are Universal Robots A/S (Denmark), FANUC CORPORATION (Japan), ABB (Switzerland), TECHMAN ROBOT INC. (Taiwan), AUBO (BEIJING) ROBOTICS TECHNOLOGY CO., LTD (China), KUKA AG (Germany), Doosan Robotics Inc. (South Korea), Denso Corporation (South Korea), YASKAWA ELECTRIC CORPORATION (Japan), Rethink Robotics GmbH (Germany).

What are the major industries of the Collaborative Robot market?

Automotive, Electronics, Metals & Machining, Plastics & Polymers, Food & Beverages, Furniture & Equipment, Healthcare, Logistics, and Others are the major applications of Collaborative Robot market.