※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

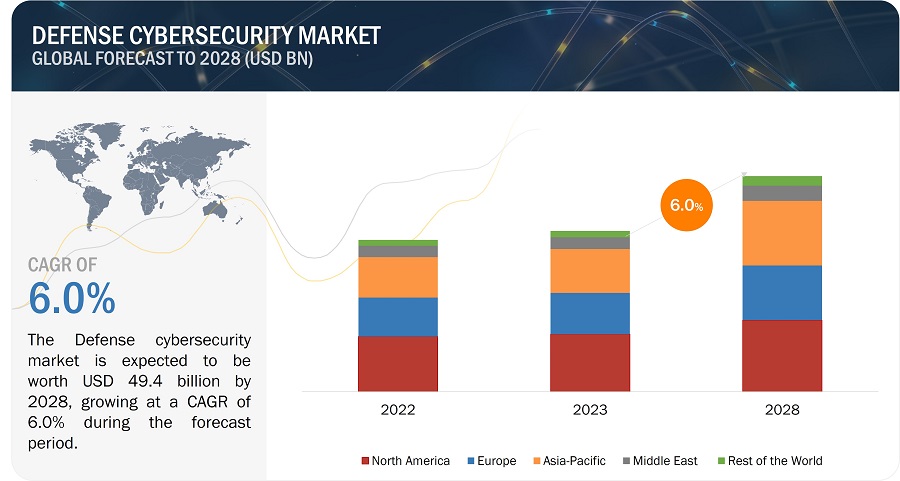

[239 Pages Report] The Defense Cybersecurity Market is estimated to be USD 36.9 Billion in 2023 and is projected to reach USD 49.4 Billion by 2028, at a CAGR of 6.0% from 2023 to 2028. The key driving factor for the growth of the Defense Cybersecurity Industry is the continuously evolving and increasingly sophisticated nature of cyber threats. As technological advancements permeate military operations, the attack surface expands, and cyber adversaries develop new tactics to exploit vulnerabilities. The growing complexity of military systems, coupled with the interconnectedness of defense networks, makes them lucrative targets for various malicious actors, including state-sponsored entities, cybercriminals, and hacktivists.

To counter these evolving threats, defense organizations worldwide are compelled to invest significantly in cybersecurity measures. This includes the development and deployment of advanced technologies such as artificial intelligence, and machine learning, among others, to stay ahead of cyber adversaries. The constant need to innovate and enhance cybersecurity capabilities is a fundamental driving force behind the growth of the defense cybersecurity market.

Defense Cybersecurity Market Forecast to 2028

Defense Cybersecurity Market Dynamics:

Drivers: Expanding Cyberattacks Across Various Defense Industries

In recent years, there has been a substantial rise in the frequency, sophistication, and severity of cyber threats worldwide. These threats come from various sources, including nation-states, hacktivists, cybercriminal organizations, and insider threats. Defense organizations are prime targets for these cyberattacks due to the sensitive and classified nature of the information they handle. For example, in October 2022, the Federal Bureau of Organizations (FBI) National Security agency (NSA) announced State sponsored Cyber attackers successfully breached a defense organization, securing and retaining long-term access to its network, and had illicitly extracted sensitive data from the compromised system from January 2021 till November 2021.

The increasing cyber threats pose a significant challenge to national security. State-sponsored cyberattacks have become a means of waging digital warfare, and defense organizations must be prepared to defend against these attacks. These threats can take many forms, from espionage through Advanced Persistent Threats (APTs), Intellectual Property Theft, and infiltration aimed at stealing classified information to disrupting critical infrastructure and military operations. The consequences of a successful cyberattack on a defense organization can be severe, potentially compromising national security and putting lives at risk.

To mitigate these threats, defense organizations are compelled to invest in robust cybersecurity measures. This includes the development of advanced threat detection and prevention systems, secure communication protocols, and incident response capabilities. Additionally, they must continually adapt and evolve their cybersecurity strategies to keep pace with the ever-changing threat landscape. Thus, the defense cybersecurity market is driven by the need to safeguard national security interests and protect sensitive military information in the face of a growing and evolving cyber threat landscape.

Restraints: Inefficiency of Legacy Systems in the Modern Cybersecurity Landscape

Security legacy systems refer to older, often outdated, technological infrastructures, software, and hardware that have been used within defense organizations for an extended period. These systems were developed in an era when cybersecurity was not a primary concern, and they now pose several restraints in the context of modern cybersecurity efforts.

Legacy systems are typically not designed with robust security features and considerations that contemporary systems benefit from. This makes them highly susceptible to cyberattacks and vulnerabilities. Attackers often target legacy systems because they are aware that these systems may lack the latest security patches, updates, or the capacity to implement advanced security protocols. Updating or replacing these legacy systems can be challenging. The cost associated with updating or replacing these systems is also substantial, requiring a considerable allocation of resources, which may compete with other defense priorities. The rapidly changing nature of cybersecurity requires systems that can be regularly updated and modified to respond to new threats. Legacy systems, with their fixed architectures and limitations, are ill-suited for this purpose.

Opportunities: Boost in International Collaborations

International collaborations refer to the potential for defense organizations from different nations to work together in a coordinated effort to enhance cybersecurity capabilities. In an increasingly interconnected world, where cyber threats often transcend national borders, collaboration on defense cybersecurity is becoming necessary.

One of the key benefits of international collaboration in defense cybersecurity is the pooling of resources, expertise, and threat intelligence. No single nation possesses a monopoly on cybersecurity knowledge or technology. By sharing information, experiences, and best practices, nations can collectively bolster their cybersecurity defenses. This collaboration allows for a more comprehensive understanding of evolving cyber threats and the development of effective countermeasures.

Furthermore, international collaboration can foster the development of global standards and norms in cybersecurity. These standards can guide responsible behavior in cyberspace and establish guidelines for addressing cyberattacks. For example, countries can agree on rules of engagement and response mechanisms in the event of a cyber incident. This reduces the risk of misunderstandings or escalations in a cyber conflict.

Additionally, collaborative efforts can lead to joint research and development initiatives, enabling the creation of cutting-edge cybersecurity technologies. This can reduce duplication of effort, drive cost-efficiency, and accelerate innovation in the field of defense cybersecurity. International collaboration also enhances incident response capabilities. In the event of a large-scale cyberattack, nations can coordinate their responses, share threat intelligence, and work together to identify and neutralize threats, minimizing the impact of the attack.

Challenges: Shortage of Skilled Personnel

The foremost challenge facing the defense cybersecurity landscape involves the shortage of skilled personnel. As the complexity and frequency of cyber threats continue to escalate, the demand for qualified cybersecurity professionals has reached unprecedented levels. The shortage is multifaceted, stemming from the rapid evolution of cyber threats, the expanding attack surface resulting from increased digital connectivity and the intricate nature of the cybersecurity domain.

The field of cybersecurity is marked by its dynamic and ever-changing nature. Cyber threats evolve at an alarming rate, with malicious actors continuously devising new techniques and tactics to breach defense systems. This rapid evolution necessitates a workforce with current knowledge and the agility to adapt swiftly to emerging threats. The shortage is exacerbated by the time it takes to train and educate cybersecurity professionals, creating a perpetual lag between the skills required and those available in the workforce. The expanding attack surface, driven by the increasing interconnectedness of defense networks and the adoption of emerging technologies, puts immense pressure on cybersecurity personnel. The Internet of Things (IoT), cloud computing, and other innovations broaden the scope of potential vulnerabilities, demanding a workforce capable of securing diverse and complex systems. This widening attack surface requires cybersecurity professionals with specialized expertise in cloud security, IoT security, and industrial control systems.

Lastly, the intricacy of the cybersecurity domain itself contributes to the scarcity of skilled personnel. Cybersecurity is not a monolithic field but comprises various specialized domains, including penetration testing, threat intelligence, incident response, and risk management. Each domain requires a unique skill set, and individuals proficient in one area may not necessarily possess expertise in others.

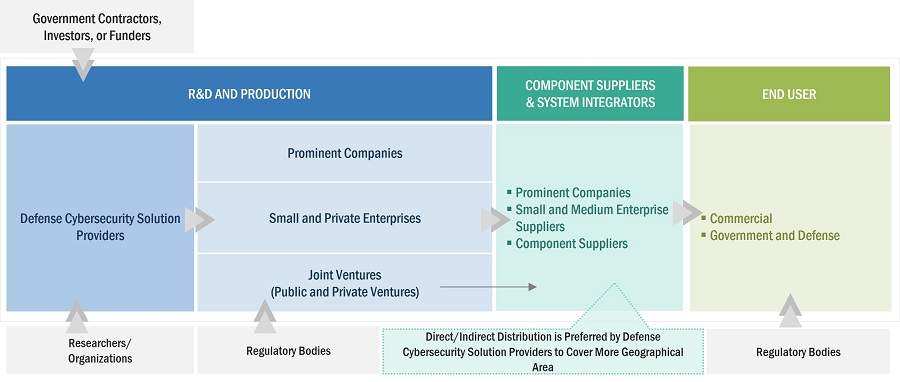

Defense Cybersecurity Market Ecosystem

Booz Allen Hamilton Inc. (US), General Dynamics Corporation (US), Cisco Systems, Inc. (US), Microsoft (US), Leidos (US), IBM (US), Thales (France), Lockheed Martin Corporation (US), Northrop Grumman (US), Raytheon technologies (US), L3Harris Technologies Inc. (US), Leonardo S.p.A (Italy), CACI International Inc (US), Elbit Systems Ltd (Israel), and BAE Systems (UK) are some of the leading companies in the defense cybersecurity market.

Based on End Users, the Navy Segment Accounts for the Highest Market Share in Defense Cybersecurity Market During the Forecast Period

The Navy segment is expected to account for the highest market share during the forecast period. Naval forces rely extensively on network-centric operations, where ships, submarines, aircraft, and shore-based facilities are interconnected to enhance situational awareness and operational effectiveness. The complexity and scale of maritime networks make them prime targets for cyber threats, necessitating advanced cybersecurity measures. The Navy's emphasis on network-centric warfare positions it at the forefront of investing in robust defense cybersecurity solutions. Naval assets represent critical infrastructure, including aircraft carriers, submarines, and communication hubs. Securing these assets against cyber threats is vital for maintaining operational capabilities and strategic advantage. The Navy's focus on protecting critical maritime infrastructure contributes to its leadership role in driving advancements in defense cybersecurity.

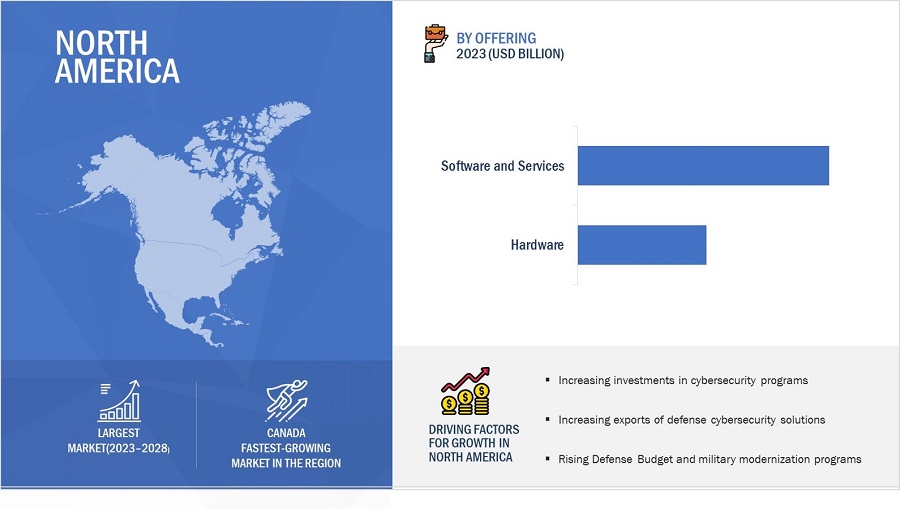

Based on Offering, the Software and Services Segment Accounts for the Largest Market Share in the Defense Cybersecurity Market During the Forecast Period

The Software and Services segment is anticipated to account for the highest market share in the defense cybersecurity market during the forecast period due to several key factors:

The defense sector is witnessing a rapid integration of cutting-edge technologies, such as artificial intelligence, machine learning, and quantum-resistant cryptography. Software solutions play a crucial role in implementing and adapting to these advancements, providing the agility required to stay ahead of emerging cyber threats.

The adoption of cloud computing in defense operations requires robust software solutions to secure data stored and processed in cloud environments. Cloud-based cybersecurity services offer scalability and flexibility, allowing defense organizations to adapt to changing requirements efficiently.

Based on Security Type, the Network Security Segment is Projected to Account for the Largest Market Share During the Forecast Period

Network Security is projected to lead the defense cybersecurity market by Security Type. The expanding attack surface resulting from the integration of advanced technologies, such as the Internet of Things (IoT), cloud computing, and 5G networks, introduces new vulnerabilities. Network Security is crucial for protecting against cyber threats targeting these diverse entry points, preventing unauthorized access, and ensuring the secure exchange of information. Network Security solutions enable real-time monitoring of network traffic, allowing for the rapid detection of anomalies and potential cyber threats. The ability to respond promptly to security incidents is critical in minimizing the impact of cyber attacks and maintaining operational continuity.

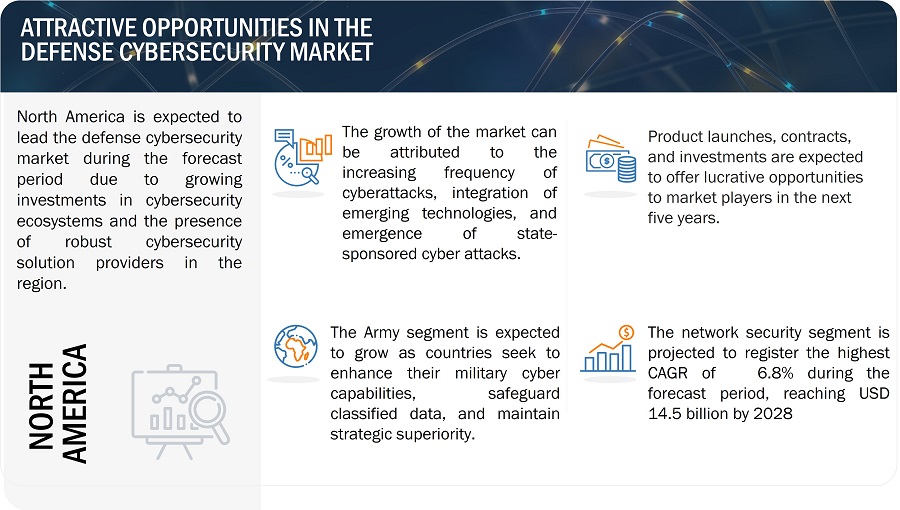

North America is Expected to Lead the Defense Cybersecurity Market in 2023

The Defense Cybersecurity market in the North American region is experiencing significant growth due to several key factors.

- Military Modernization: North American nations, especially the U.S., are actively modernizing their military capabilities, integrating advanced technologies such as artificial intelligence, autonomous systems, and network-centric operations. The need to protect these sophisticated military assets against cyber threats propels the demand for advanced defense cybersecurity solutions, further solidifying North America's leadership in the market.

- Global Cybersecurity Standards: North America plays a leading role in shaping global cybersecurity standards and practices. The region's commitment to establishing and adhering to high cybersecurity standards enhances its influence in international collaborations, making North American solutions and expertise widely recognized and adopted.

- Large Defense Budgets: The United States, in particular, allocates substantial budgets to defense and cybersecurity initiatives. The significant financial investments in research and development, infrastructure, and cybersecurity capabilities contribute to the region's dominance in the defense cybersecurity market. The financial commitment enables the deployment of state-of-the-art technologies and the continuous improvement of cybersecurity measures.

Defense Cybersecurity Market by Region

Defense Cybersecurity Industry Companies - Top Key Market Players

Booz Allen Hamilton Inc. (US), General Dynamics Corporation (US), Cisco Systems, Inc. (US), Microsoft (US), Leidos (US), IBM (US), Thales (France), Lockheed Martin Corporation (US), Northrop Grumman (US), Raytheon technologies (US), L3Harris Technologies Inc. (US), Leonardo S.p.A (Italy), CACI International Inc (US), Elbit Systems Ltd (Israel), and BAE Systems (UK) are some of the leading companies in the Defense Cybersecurity Companies. These companies have well-equipped manufacturing facilities and strong distribution networks across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 36.9 Billion in 2023 |

|

Projected Market Size |

USD 49.4 Billion by 2028 |

|

Growth Rate |

6.0% |

|

Market Size Available for Years |

2019–2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD million) |

|

Segments Covered |

By Offering, By Security Type, By End User, By Application and by Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, the Middle East Rest of the World |

|

Companies Covered |

Booz Allen Hamilton Inc. (US), General Dynamics Corporation (US), Cisco Systems, Inc. (US), Microsoft (US), Leidos (US), IBM (US), Thales (France), Lockheed Martin Corporation (US), Northrop Grumman (US), Raytheon technologies (US), L3Harris Technologies Inc. (US), Leonardo S.p.A (Italy), CACI International Inc (US), Elbit Systems Ltd (Israel), BAE Systems (UK), SAIC (US), ASGN Incorporated (US), AT&T (US), Echelon Services (US), Five Stones Research Corporation (US), Rite-Solutions Inc., Sealing Technologies (US), Axellio (US), Hub Security (Israel), Countercraft (Spain) |

Defense Cybersecurity Market Highlights

This research report categorizes the Defense Cybersecurity market based on Offering, Security Type, End User, Application, and Region

|

Segment |

Subsegment |

|

By Security Type : |

|

|

By Offering : |

|

|

By Application : |

|

|

By End User: |

|

|

By Region: |

|

Recent Developments

- In October 2023, the US Defense Information Systems Agency (DISA) (US) developed a Zero Trust Network named Thunderdome. The contract is valued at USD 1.86 Billion.

- In January NATO awarded a contract to IBM, which will encompass the integration of cyber defense capabilities and related configuration services, extending through 2025, with an additional two-year option. The contract is valued at USD 33.6 million.

- In June 2021, Cisco Systems, Inc. (US) received an investment worth USD 1.18 Billion to provide Smart Net Total Care and software services.

Key Questions Addressed by the Report:

What is the current size of the defense cybersecurity market?

The Defense Cybersecurity market is estimated to be USD 36.9 Billion in 2023 and is projected to reach USD 49.4 Billion by 2028, at a CAGR of 6.0% from 2023 to 2028.

What are the key sustainability strategies adopted by leading players operating in the defense cybersecurity market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the defense cybersecurity market. Booz Allen Hamilton Inc. (US), General Dynamics Corporation (US), Cisco Systems, Inc. (US), Microsoft (US), Leidos (US), IBM (US), Thales (France), Lockheed Martin Corporation (US), Northrop Grumman (US), Raytheon technologies (US), L3Harris Technologies Inc. (US), Leonardo S.p.A (Italy) are some of the leading companies in the defense cybersecurity market.

What new emerging technologies and use cases disrupt the defense cybersecurity market?

Response: Emerging technologies, such as Biometric Technologies, Blockchain Technology, and Quantum Computing, could disrupt the software aspects of defense cybersecurity.

Who are the key players and innovators in the ecosystem of the defense cybersecurity market?

Response: Booz Allen Hamilton Inc. (US), General Dynamics Corporation (US), Cisco Systems, Inc. (US), Microsoft (US), Leidos (US), IBM (US), Thales (France), Lockheed Martin Corporation (US), Northrop Grumman (US), Raytheon technologies (US), L3Harris Technologies Inc. (US), Leonardo S.p.A (Italy).

Which region is expected to hold the highest market share in the defense cybersecurity market?

Response: In 2023, North America is expected to hold the greatest market share for the defense cybersecurity market during the forecast period, and Canada is anticipated to grow at the highest CAGR.