※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

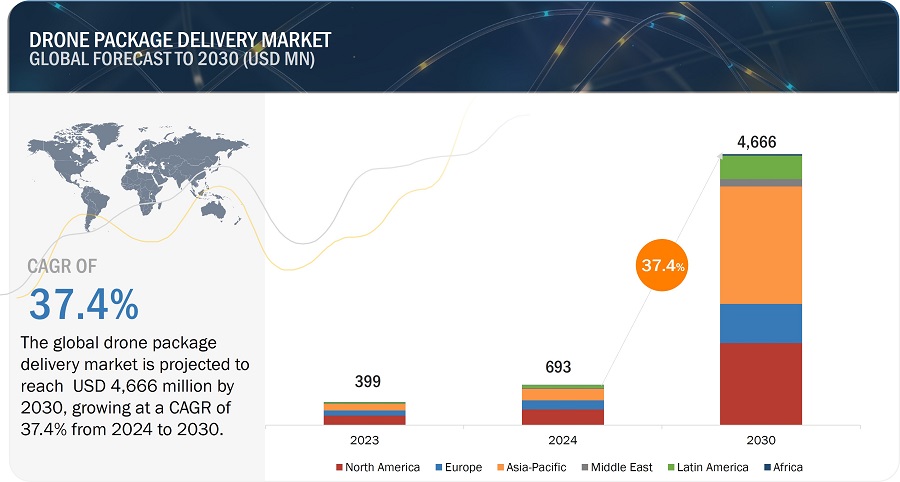

[291 Pages Report] The volume of package delivery drones is projected to grow from 32,456 (In units) in 2024 to 275,703 (In units) by 2030. The Drone Package Delivery Market is projected to grow from USD 693 Million in 2024 to USD 4,666 Million by 2030, at a CAGR of 37.4%. There is rise in deployment of drones for quick and same day package delivery. Government approvals, cost-effectiveness delivery, reducing carbon emissions and instant package delivery are main reasons for the Drone Package Delivery Industry growth.

Drone Package Delivery Market Forecast to 2030

Drone Package Delivery Market Dynamics

Driver: Increasing Demand for Fast Delivery Services

With customers willing to pay a premium for same-day delivery, the demand for fast delivery services is increasing rapidly. Innovations in cargo transportation and a rise in investments from logistics & transportation companies have spurred the use of delivery drones in e-commerce, quick-service restaurants, convenience stores, and healthcare. According to Invesp (US), approximately 51% of retail shoppers offer same-day delivery over long-duration deliveries as of January 2024. These factors have boosted the adoption of aerial delivery drones in the global e-commerce industry. Retailers are also trying to lower their delivery lead times and enhance the flexibility and speed of deliveries by maintaining stock-keeping units (SKUs) assisted by drones. In January 2024, Zipline (US) announced the integration of a new home delivery solution into Walmart stores in the Dallas-Fort Worth metro area. This expansion will increase the number of Walmart customers that Zipline serves by more than 1,000 times compared to the current operations with the retailer. Similarly, in February 2024, Wellspan Health (US) partnered with Zipline for medical delivery. WellSpan will use Zipline’s electric, autonomous drones to transport prescriptions directly to patients’ homes and move lab samples and medical products between its facilities, making deliveries up to 7 times faster than current automotive delivery.

Restraints: Extreme Weather Fluctuations

Weather significantly influences drone delivery services. In hot temperatures, air density decreases, affecting the lifting capacity of the drone. Similarly, cold weather impacts the energy capacity of the drone. Nature Scientific Reports conducted a study on the impact of weather on drone delivery services. The study suggests that most drones used for commercial applications should not fly in rain or snow, but they can tolerate temperatures between 0°C (32º F) and 40°C (104º F) and winds up to 36 km/h. It also examined the weather in 100 of the world’s most populous cities. It found that, on average, there are only 10 hours a day when the weather lets drones fly safely. Therefore, drone delivery systems must handle all weather conditions, including snow, fog, rain, and wind. However, companies find it challenging to build a reliable delivery system, thereby hindering market growth.

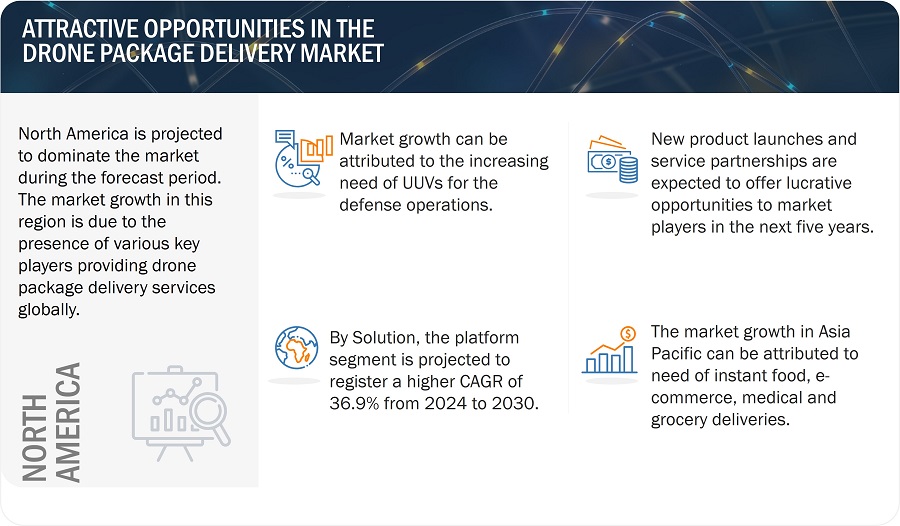

Opportunities: Use of Drones for Delivery in Military Operations

The use of drones for the delivery of military goods offers significant potential for the drone package delivery market. These drones can be used to resupply soldiers on the battlefield. Currently, a substantial portion of military supplies are transported through road convoys, which makes them vulnerable to enemy attacks. Meanwhile, drones take aerial routes, which can be changed to reduce the risks of enemy attacks on convoys. The use of drones to deliver military cargo further eliminates high-risk situations for soldiers in convoys. Deliveries using drones are also expected to be faster and safer than traditional road convoys. In response, drones are increasingly adopted in military settings for intelligence, surveillance, reconnaissance, and battle damage assessment. Additionally, autonomous drones are being employed to reduce the risks associated with defense logistics. These drones aid in supplying soldiers with crucial resources such as food, ammunition, fuel, and spare parts.

Challenges: Data Security Breaches

Operational security is a primary concern with the use of aerial delivery drones in civil and commercial applications. The growing use of drones in commercial applications has also increased drone hacking incidents. Drone manufacturers and associated service providers offer drone analytics software-as-a-service to their clients. This software uses cloud-based servers for data processing. Since data is transmitted and stored in external cloud networks, it is prone to hacking.

Additionally, countries such as the US, Colombia, France, and Mexico have witnessed the use of drones for drug smuggling. For instance, in April 2024, drone was caught delivering drugs in Prison of southern France. In 2023 more than 1,000 drones were detected in flight over prisons, 400 of which were “blocked” due to breaching the government regulations. Technically, unauthorized access to flight and control systems can lead to rerouted deliveries. Additionally, compromising customer data can undermine trust and compliance with privacy regulations. Such breaches necessitate strong encryption and severe cybersecurity measures to protect sensitive information and ensure operational integrity

Drones can also conduct surveillance operations, perform intelligence gathering, and move money or valuable messages over short distances without being detected. Thus, issues with the safety, security, and illegal use of these delivery drones may lead to a ban on their use in civil and commercial applications by government agencies, thereby reducing drone package deliveries globally.

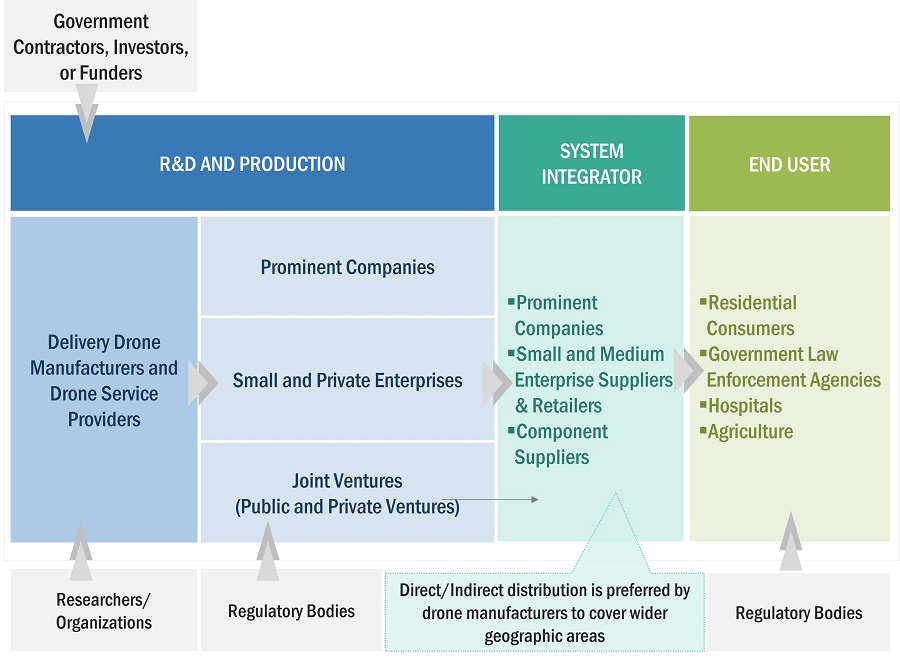

Drone Package Delivery Market Ecosystem

Companies that design and manufacture Drone Package Delivery solutions, include government firms and industries as key stakeholders in Drone Package Delivery Market. Investors, funders, academic researchers, integrators, service providers, and licensing authorities are the major influencers in this market. Prominent companies in this market include Alphabet Inc. (US), Zipline International, Inc. (US), United Parcel Service of America, Inc. (US), Wingcopter (Wingcopter) and Matternet, Inc. (US).

Based on the Range, the Short Range (<25 Km) Segment is Estimated to Account for the Largest Market Share During the Forecast Period

Based on the range, the short range (<25 km) segment is estimated to account for the largest market share during the forecast period. The market growth is attributed to the increasing use of drones for delivering food, medicine and e-commerce items within urban and suburban areas as it reduces the delivery time significantly by enabling instant and same-day delivery. The development in battery technology have improved the power efficiency and payload capacity of drones for enhanced short-range deliveries. The support from regulatory framework for apporval of delivery drone is driving the market growth of the segment.

Based on the End Use, the Medical Aid Segment is Anticipated to Dominate the Market

Based End Use , the Medical Aid segment holds the largest market share. The growth of segment is primarily driven by need to deliver important medical supplies within the shortest time possible, especially to hard to reach or inaccessible areas. The increasing use of drones for supplies in the emergences situations and disaster management where quickest delivery can be a matter of life and death are driving the market growth of the segment.

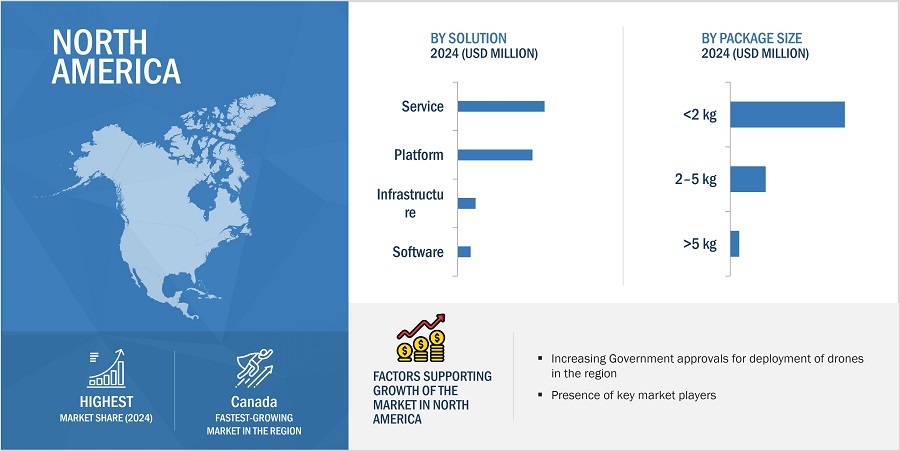

The North America Market is Projected to Account Largest Share for the Drone Package Delivery Market

North America is projected to account largest share for the Drone Package Delivery market during the forecast period. Canada is projected to show the highest growth rate for the Drone Package Delivery market in North America. The domination of the Drone Package Delivery market in the North America can be attributed due to the presence of various key drone package delivery service providers and increasing FAA approvals for development and deployment of drones for delivering packages.

Drone Package Delivery Market by Region

Key Market Players

The Drone Package Delivery Companies is dominated by a few globally established players such as Alphabet Inc. (US), Zipline International, Inc. (US), United Parcel Service of America, Inc. (US), Wingcopter (Germany) and Matternet, Inc. (US) are some of the leading players operating in the Drone Package Delivery market; they are the key service and solution providers that secured Drone Package Delivery partnerships in the last few years. Major focus was given to the partnerships and new product development due to the increasing demand of drone deliveries.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 693 Million in 2024 |

|

Projected Market Size |

USD 4,666 Million by 2030 |

|

Growth Rate |

37.4% |

|

Market Size Available for Years |

2020–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024-2030 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By Solution, by Type, by Range, by Package Size, by Duration, by Operation Mode, by End Use, by Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East, Latin America, Africa. |

|

Companies Covered |

Alphabet Inc. (US), Zipline International Inc. (US), United Parcel Service of America, Inc. (US), Wingcopter (Germany) and Matternet, Inc. (US) are some of the major players in the Drone Package Delivery Market. |

Drone Package Delivery Market Highlights

The study categorizes the drone package delivery market based on Solution, Type, Range, Package Size, Operation Mode, Duration, End Use and Region.

|

Segment |

Subsegment |

|

By Solution |

|

|

By Range |

|

|

By Package Size |

|

|

By Type |

|

|

By Operation Mode |

|

|

By Duration |

|

|

By End Use |

|

|

By Region |

|

Recent Developments

- In March 2024, Alphabet, Inc. :- Wing Aviation LLC, a subsidiary of Alphabet, Inc., partnered with DoorDash (US) to expand drone delivery services in the US. Under this partnership, Wing Aviation will deliver Wendy’s meals in Christiansburg, Virginia, with the help of DoorDash.

- In February 2024, Zipline International, Inc. :- Zipline International Inc. partnered with the Government of Rwanda to create a new delivery service to promote economic development and wildlife conservation. Under this partnership with the Rwanda Development Board (RDB), Zipline will deliver products made by local artisans directly to guests at resorts and lodges.

- In August 2023, United Parcel Service of America, Inc. :- UPS Flight Forward Inc., a subsidiary of United Parcel Service of America, Inc., collaborated with CVS Health to deliver prescription medications to the front lawns of patients’ homes and retirement facilities. As part of this collaboration, both companies will develop drone-based medical delivery services that take advantage of the convenience, speed, and accuracy of UAVs.

Frequently Asked Questions (FAQs) Addressed by the Report:

Which are the major companies in the Drone Package Delivery market? What are their major strategies to strengthen their market presence?

Some of the key players in the Drone Package Delivery market are Alphabet Inc. (US), Zipline International, Inc. (US), United Parcel Service of America, Inc. (US), Wingcopter (Wingcopter) and Matternet, Inc. (US), and among others, are the key providers that secured Drone Package Delivery partnerships in the last few years.

What are the drivers and opportunities for the Drone Package Delivery market?

The Increasing demand for fast delivery services, Need for time-sensitive deliveries in healthcare sector, and Cost-efficiency of drones compared with ground delivery vehicles in Drone Package Delivery worldwide are some of the drivers for the Drone Package Delivery market.

Which region is expected to hold the largest share in the 2024?

The market in the North America region is projected to account the largest share in 2024, showcasing strong demand for Drone Package Delivery solutions in the region. The presence of various key players are driving the market growth.

What is the CAGR of the Drone Package Delivery Market?

The CAGR of the Drone Package Delivery Market is 37.4%.

Which segment shows the highest CAGR of the Drone Package Delivery Market?

The drone package delivery by Package Size- >5 kg to show the highest growth rate during the forecasted year for the Drone Package Delivery Market.