※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

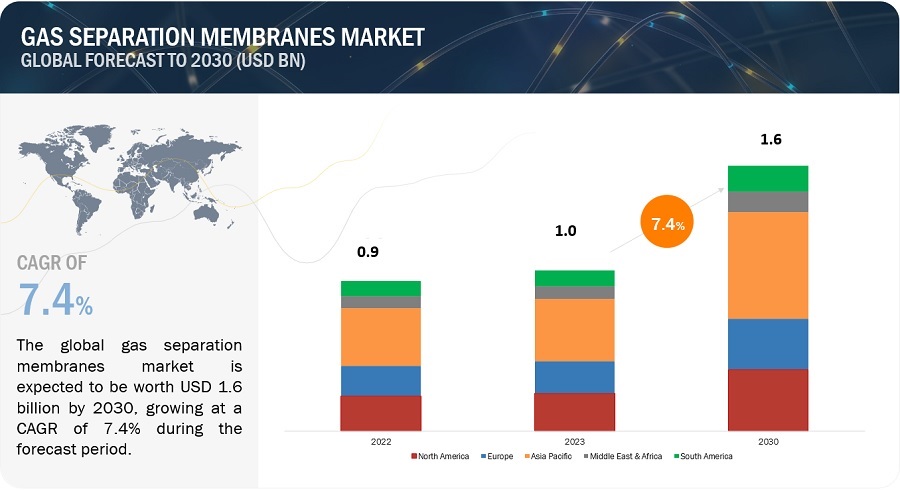

The global gas separation membrane market size is projected to reach USD 1.4 billion by 2028 from USD 1.0 billion in 2023, at a CAGR of 7.1% during the forecast period. The gas separation membrane market is projected to grow significantly in the coming years. Gas separation membranes offer a more energy-efficient alternative to traditional separation methods like cryogenic distillation or chemical absorption. As energy efficiency becomes a paramount concern, the demand for these membranes increases.

Global Gas Separation Membrane Market Trend

Gas Separation Membrane Market Dynamics

Driver: Environmental regulations and stringent emission standards

Environmental regulations are put in place by governments and regulatory bodies to protect the environment, human health, and public safety. These regulations aim to set standards, guidelines, and restrictions for various industries and activities to minimize their impact on the environment. Many industries are required to reduce the release of greenhouse gases (GHGs) and other pollutants, such as sulfur dioxide (SO2) and nitrogen oxides (NOx), into the atmosphere. Gas separation membranes are used for carbon capture and storage (CCS) applications, where they selectively separate and capture CO2 emissions from flue gases before they are released. This helps industries meet emission reduction targets and comply with environmental regulations. gas separation membranes enable industries to meet stricter environmental regulations while maintaining or even enhancing process efficiency. The selectivity and efficiency of these membranes allow for the separation of specific gases and contaminants, which reduces waste and energy consumption.

Restraint: Plasticization of polymeric membranes in high-temperature applications

Plasticization of polymer membranes in high-temperature applications refers to a phenomenon where the polymer material used in the membrane becomes more flexible and less selective at elevated temperatures. This can occur because the thermal energy disrupts the polymer's molecular structure, allowing gas molecules to diffuse through the membrane more easily. As a result, the membrane's selectivity for specific gases decreases, compromising its separation performance. This plasticization effect is a critical consideration when designing polymer-based gas separation membranes for high-temperature environments, such as in natural gas processing or industrial applications, as it can impact the membrane's long-term stability and efficiency. To mitigate plasticization, researchers often explore advanced polymer materials with higher glass transition temperatures or employ hybrid membranes with inorganic components to maintain membrane integrity and selectivity under extreme temperature conditions.

Opportunity: Rising demand for clean energy

The rising demand for clean energy is driven by concerns over climate change, environmental degradation, and air quality, societies around the world are increasingly embracing renewable energy sources like solar, wind, and hydroelectric power, alongside advancements in nuclear and energy storage technologies. This shift signifies a commitment to reducing greenhouse gas emissions, enhancing energy security, and fostering economic growth through sustainable practices. Governments, industries, and individuals are recognizing the potential of clean energy not only to mitigate the effects of climate change but also to create jobs, improve public health, and diversify energy portfolios, thus paving the way towards a more sustainable and resilient future.

Challenges: Upscaling and commercializing new membranes

Upscaling and commercializing new gas separation membranes pose significant challenges in the field. While researchers continually develop innovative membrane materials and designs with promising lab-scale results, transitioning these concepts to large-scale industrial applications is complex. The challenges include ensuring membrane durability and stability under real-world conditions, maintaining cost-effectiveness at scale, and addressing fouling and maintenance issues. Moreover, the variability in feedstock gases and operating conditions across different industries adds to the complexity. Commercialization requires substantial investment, collaboration between researchers and industry, and rigorous testing to meet stringent performance and regulatory standards.

Market Ecosystem

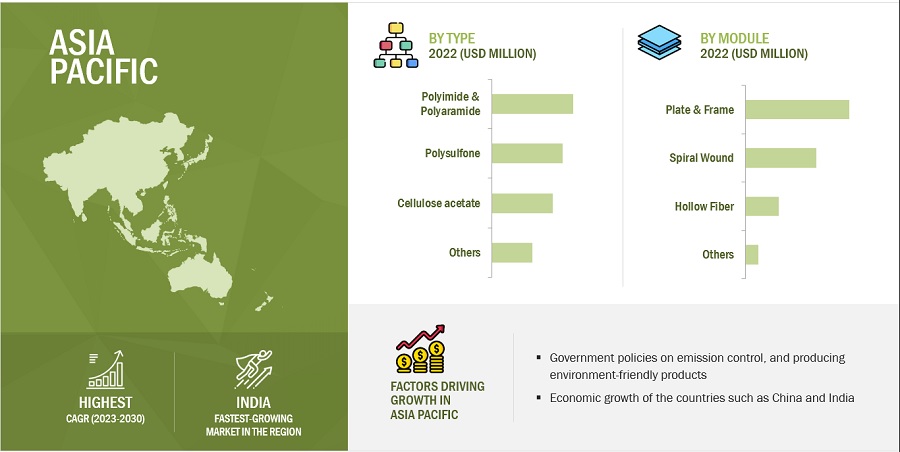

By material type, Polyimide & Polyaramide is the fastest growing in gas separation membrane market, in 2022.

Polyimide and polyaramide gas separation membranes are experiencing rapid growth in various industrial applications due to their exceptional chemical resistance, high thermal stability, and superior gas separation capabilities. These membranes are increasingly being employed in sectors such as petrochemical, natural gas processing, and hydrogen purification, as they enable efficient separation and purification of gases, contributing to improved environmental sustainability and energy efficiency. Their expanding adoption is driven by the need for more efficient and environmentally friendly gas separation processes, making polyimide and polyaramide membranes pivotal in addressing the evolving demands of various industries for cleaner and more sustainable solutions.

By module, plate and frame module is the largest in gas separation membrane market, in 2022.

The plate and frame module is emerging as the dominant technology for gas separation due to its versatility and efficiency. This innovative module design consists of a series of stacked plates and frames, offering a large surface area for effective gas separation processes such as membrane filtration and adsorption. Its compact footprint and scalable nature make it ideal for a wide range of applications, from industrial gas purification to greenhouse gas capture and natural gas processing. Furthermore, the plate and frame module's modular design allow for easy customization and integration into existing gas separation systems, making it a cost-effective and environmentally sustainable choice for addressing the growing demand for efficient gas separation technologies.

By application, vapor / vapor separation segment is fastest growing application in the gas separation membrane market, in 2022.

The vapor-vapor separation application is experiencing rapid growth in the field of gas separation, driven by its effectiveness in tackling various challenges in the industry. This technology, which involves separating different vapor components from a gas mixture, finds significant applications in industries like petrochemicals, natural gas processing, and environmental protection. Its growth can be attributed to its ability to achieve high-purity separations with reduced energy consumption compared to traditional methods. As industries increasingly prioritize environmental sustainability and stringent product quality standards, vapor-vapor separation emerges as a pivotal solution for achieving these objectives, resulting in its rapid adoption and expansion in the gas separation sector.

Asia Pacific is projected to be fastest growing amongst other regions in the gas separation membrane market, in terms of value.

The gas separation membrane industry in the Asia-Pacific region is experiencing remarkable growth and expansion. This growth can be attributed to several factors, including the region's booming industrial sectors, increased focus on environmental sustainability, and a rising demand for clean energy sources. Gas separation membranes, which are used for applications such as nitrogen generation, carbon capture, and natural gas processing, are gaining prominence due to their energy efficiency and cost-effectiveness. Additionally, government initiatives aimed at reducing greenhouse gas emissions are further propelling the adoption of gas separation membranes, making the Asia-Pacific market a hotspot for research, development, and deployment of these technologies.

Key Market Players

Some of the key players operating in the gas separation membrane market include Air Products and Chemicals, Inc. (US), Air Liquide (France), UBE Corporation. (Japan), Honeywell UOP (US), Fujifilm Manufacturing Europe B.V. (Netherlands), Schlumberger Limited (US), DIC Corporation (Japan), Parker-Hannifin Corporation (US), Membrane Technology and Research, Inc. (US), and Generon, Inc. (US). among others.

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2022 to strengthen their positions in the market. The new product launch is the key growth strategy adopted by these leading players to enhance regional presence and develop product portfolios to meet the growing demand for gas separation membrane from emerging economies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion), Volume (Million Square Meter) |

|

Segments |

Material Type, Module, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Air Products and Chemicals, Inc. (US), Air Liquide (France), UBE Corporation. (Japan), Honeywell UOP (US), Fujifilm Manufacturing Europe B.V. (Netherlands), Schlumberger Limited (US), DIC Corporation (Japan), Parker-Hannifin Corporation (US), Membrane Technology and Research, Inc. (US), and Generon, Inc. (US). among others. |

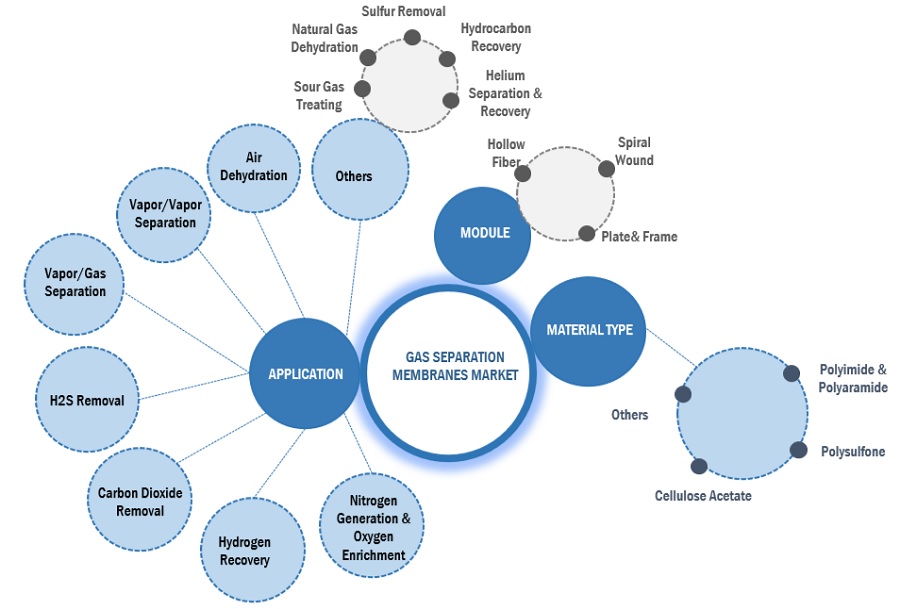

This report categorizes the global gas separation membranes market based on type, module, application, and region.

On the basis of material type, the gas separation membranes market has been segmented as follows:

- Polyimide & Polyaramide

- Polysulfone

- Cellulose acetate

- Others

On the basis of module, the gas separation membranes market has been segmented as follows:

- Spiral wound

- Hollow fiber

- Plate & Frame

- Others

On the basis of application, the gas separation membranes market has been segmented as follows:

- Nitrogen Generation & Oxygen Enrichment

- Hydrogen Recovery

- Carbon Dioxide Removal

- Vapor/Gas Separation

- Vapor/Vapor Separation

- Air Dehydration

- Others

On the basis of region, the gas separation membranes market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

The gas separation membranes market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In July 2021, Air Liquide has completed the construction of Canada's largest helium purification facility, which is anticipated to provide crucial support to North America Helium's operations in southwest Saskatchewan, Canada. This plant stands as the largest helium production facility in the country.

- In October 2021, Air Products has unveiled a fresh brand identity for its membrane business divisions, unifying them globally as "Air Products Membrane Solutions." This streamlined approach brings together the previous business units like Air Products PRISM Membranes, Air Products Norway, and Permea China Ltd. under a single banner, aiming to enhance the customer journey and promote collaboration and innovation.

- In November 2021, Honeywell has announced a partnership with SK Innovation and Energy, a Korean energy-refining company, to conduct a feasibility study regarding the retrofitting of SK's hydrogen plant with carbon capture capabilities. SK Innovation and Energy aims to investigate the capture and storage of 400,000 tons of carbon dioxide (CO2) from their current hydrogen production facilities. Honeywell UOP brings a range of technologies, including solvents, membranes, cryogenics, and pressure-swing adsorption (PSA) systems, which can be tailored to meet the specific needs of the project.

- In November 2020, Generon has successfully produced and supplied a purification system for Sulfur Hexafluoride (SF6) to FluoroMed. This system incorporates multiple stages of Generon membranes to effectively purify SF6 gas, ensuring it reaches a remarkable purity level of 99.9%.

- In January 2020, The National Energy Technology Laboratory has chosen MTR's PolarCap membrane process technology for a substantial phased trial to demonstrate post-combustion CO2 capture on a large scale.

Frequently Asked Questions (FAQ):

What is the current size of the global gas separation membrane market?

Global gas separation membrane market size is estimated to reach USD 1.4 billion by 2028 from USD 1.0 billion in 2023, at a CAGR of 7.1% during the forecast period.

Who are the winners in the global gas separation membrane market?

Companies such as include Air Products and Chemicals, Inc. (US), Air Liquide (France), UBE Corporation. (Japan), Honeywell UOP (US), Fujifilm Manufacturing Europe B.V. (Netherlands), Schlumberger Limited (US), DIC Corporation (Japan), Parker-Hannifin Corporation (US), Membrane Technology and Research, Inc. (US), and Generon, Inc. (US) among others. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Growing demand in nitrogen generation and syngas cleaning, Increasing demand for membranes in carbon dioxide separation processes technology, and Environmental regulations and stringent emission standards.

What are the various material types of gas separation membranes?

Polyimide & polaramide, Polysulfone, and Cellulose acetate are the major types of gas separation membranes.

What are the various module of gas separation membranes?

Spiral Wound, Hollow Fiber, Plate & Frame are the major modules of gas separation membrane. .