※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

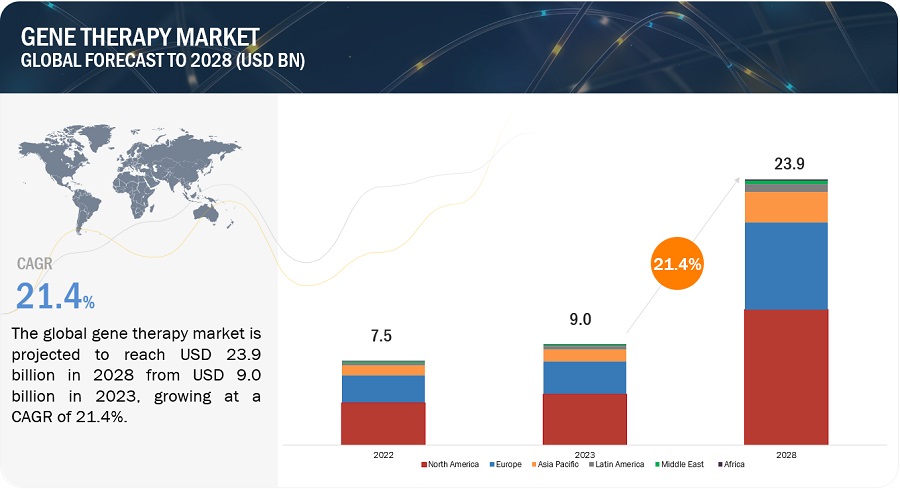

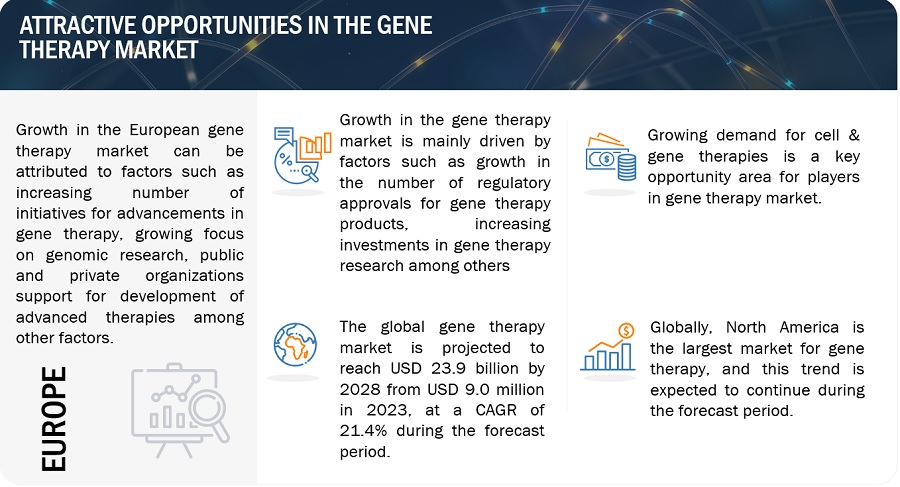

The global gene therapy market in terms of revenue was estimated to be worth $9.0 billion in 2023 and is poised to reach $23.9 billion by 2028, growing at a CAGR of 21.4% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in the market is mainly due to the growing number of approvals from regulatory bodies. Additionally, factors such as growing clinical research initiatives in the genomics field, and a rising focus on advanced targeted therapies are supporting the growth of this market. However, gene therapy products are highly priced which is expected to restrain market growth to a certain extent.

Attractive Opportunities in the Gene Therapy market

Gene Therapy Market Dynamics

Driver: Increasing regulatory approvals for gene therapy products

Gene therapy products undergo rigorous regulatory scrutiny before approval. They act at the genetic level in order to generate therapeutic effects which are relatively effective and long term than traditional medicines. The number of approvals received for gene therapy products has been observed to increase due to this major advantage offered by these products. The US FDA has approved more than 10 products between 2021 and 2023. Additionally, there are significant number of products in the clinical pipeline expected to receive final approval during the forecast period. Thus, this is a major factor driving the growth of the market during the forecast period.

Restraint: High costs of gene therapy products

Research and development efforts are extensive for development of advanced therapies such as gene therapy. Thus, they demand a significant investment in terms of time and money. The costs include laboratory research, preclinical testing, clinical trials, and regulatory approval. Additionally, gene therapy products use of vectors which need to be produced and separately engineered as per requirement. This increases the complexity of the overall manufacturing process. The manufacturing processes are required to be highly controlled and adherence to stringent quality standards is required, adding to production costs. Besides, gene therapies are highly targeted therapies and are not produced in bulk. All these factors add to high costs of gene therapy products restraining its adoption especially in developing regions across the globe.

Opportunity: Growing demand for cell and gene therapies

The research and development initiatives in the area of cell and gene therapies has been growing. This is due to the fact that's cell and gene therapies hold significant potential to address several issues for especially neurology indications for which yet an effective treatment is unavailable. This is as an area of opportunity for pharmaceutical and biotechnology companies to invest into development and commercialization of novel cell and gene therapies. Besides, cell and gene therapies produce a targeted therapeutic effect. Due to this they have been largely adopted with a view to reduce further repeated costs of treatment. Thus, growing demand for cell and gene therapies owing to the benefits that they offer is a significant opportunity area for the gene therapy market.

Challenge: Short shelf life and supply chain challenges

Gene therapies are typically fragile and can lose their efficacy over time, necessitating strict control over storage and transportation conditions. The gene therapy product development involves significant use of viral vectors. Currently, majority of the available gene therapy products employ viral vectors. Viral vectors are biological products that have a limited shelf life. They require vigilant storage and handling to maintain their efficacy. The shelf life of cell & gene therapy products varies widely. The short shelf life of viral vectors limits their availability and increases their costs. Viral vectors with short shelf life require production in small batches making the overall process expensive and slow. Additionally, unlike traditional biological therapies that require temperature control, cell & gene therapy products (as well as some biological samples) require ultra-cold temperatures, ranging from –4°C and –20°C to –80°C, –120°C, –150°C, and beyond. This poses a challenge to build a more efficient supply chain for these products. However, addressing this challenge through building in-house capabilities is expected to reduce the overall manufacturing cost of these products.

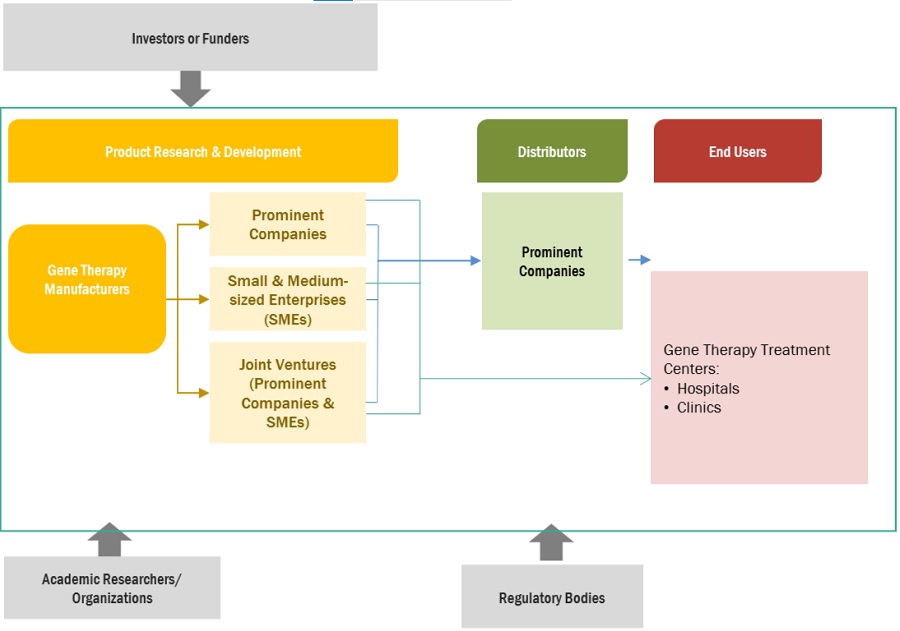

Gene Therapy Market Ecosystem

Prominent companies in the market includes companies operating in the market for several years and posess diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in the global market include Novartis AG (Switzerland), Biogen Inc. (US), Gilead Sciences, Inc. (US), Bristol-Myers Squibb (US), Alnylam Pharmaceuticals, Inc. (US), and Sarepta Therapeutics, Inc. (US) among others.

The gene silencing therapy accounted for the largest share of the type segment in overall gene therapy industry in 2023.

On the basis of type, the gene therapy market is segmented into gene silencing, cell replacement, gene augmentation, and other therapies. In 2022, the gene silencing segment accounted for the largest share of the market owing to a major factor including presence of large number of gene therapy products using gene silencing mechanism. Additionally, gene silencing has been observed to an effective mechanism, especially against neurological conditions including neuromuscular diseases among others.

The neurology segment dominated the therapeutic area segment in overall gene therapy industry in 2023.

On the basis of therapeutic areas, the gene therapy market is segmented into neurology, oncology, hepatology, and other therapeutic areas. Neurology accounted for the largest share of the market owing to factors such as increasing number of gene therapy products against this therapy area along with the growing focus of research and development on neurological indications, especially neuromuscular disorders among others.

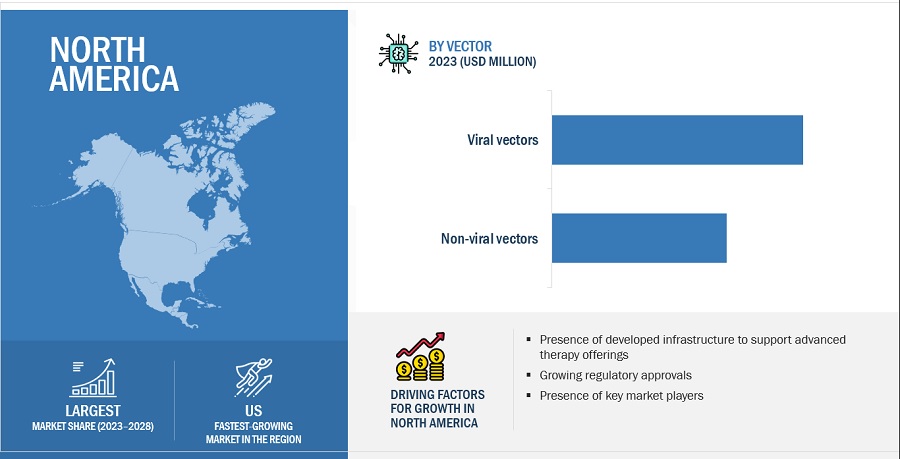

North America was the largest market for overall gene therapy industry in 2022 and also during the forecast period.

Geographically, the gene therapy market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East and Africa. The market was dominated by North America in 2022 and this dominance is anticipated to continue throughout the forecast period between 2023 and 2028. The market for gene therapy is expanding in the region as a result of factors like availability of advanced technologies including diagnostics required for identifying eligibility of patients to take gene therapy, presence of highly advanced infrastructure in hospitals among others.

The prominent players in the gene therapy market are Novartis AG (Switzerland), Biogen Inc. (US), Gilead Sciences, Inc. (US), Bristol-Myers Squibb (US), Alnylam Pharmaceuticals, Inc. (US), and Sarepta Therapeutics, Inc. (US) among others.

Scope of the Gene Therapy Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$9.0 billion |

|

Estimated Value by 2028 |

$23.9 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 21.4% |

|

Market Driver |

Increasing regulatory approvals for gene therapy products |

|

Market Opportunity |

Growing demand for cell and gene therapies |

This report categorizes the gene therapy market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- Gene silencing

- Cell replacement

- Gene augmentation

- Other therapies

By Vector

- Viral vectors

- Non-Viral vectors

By Therapeutic area

- Neurology

- Oncology

- Hepatology

- Other therapeutic areas

By Delivery method

- In Vivo

- Ex Vivo

By Route of administration

- Intravenous

- Other routes of administration

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Rest of Latin America

- Middle East

- Africa

Recent Developments of Gene Therapy Industry

- In May 2022, Novartis AG (Switzerland) received US FDA approval for KYMRIAH (Tisagenlecleucel) for a third indication, including relapsed or refractory (r/r) follicular lymphoma (FL) after two or more lines of systemic therapy.

- In May 2022, Biogen Inc. (US) partnered with Scribe Therapeutics (US) to develop a new neurological disease target in gene therapy using the company’s CRISPR technology. The deal size for this partnership was ~USD 15 million.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global gene therapy market?

The global gene therapy market boasts a total revenue value of $23.9 billion by 2028.

What is the estimated growth rate (CAGR) of the global gene therapy market?

The global gene therapy market has an estimated compound annual growth rate (CAGR) of 21.4% and a revenue size in the region of $9.0 billion in 2023.