※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

Green Hydrogen Market

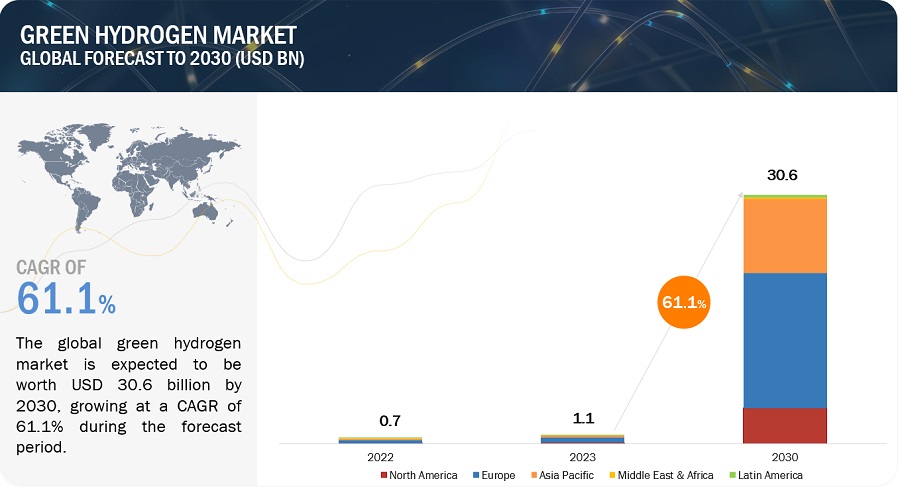

The green hydrogen market was valued at USD 1.1 billion in 2023 and is projected to reach USD 30.6 billion by 2030, growing at 61.1% cagr from 2023 to 2030. The green hydrogen market is experiencing rapid growth, driven by global efforts to reduce carbon emissions and advancements in electrolysis and renewables. Government support through policies and investments is also boosting growth. Its versatility and scalability make green hydrogen a key player in the transition to sustainable energy. The market is even being propelled by its increasing use in fuel cell electric vehicles (FCEVs) and high-energy-intensive industries like steel and ammonia production, further driving demand and market expansion.

Attractive Opportunities in the Green Hydrogen Market

Green Hydrogen Market Dynamics

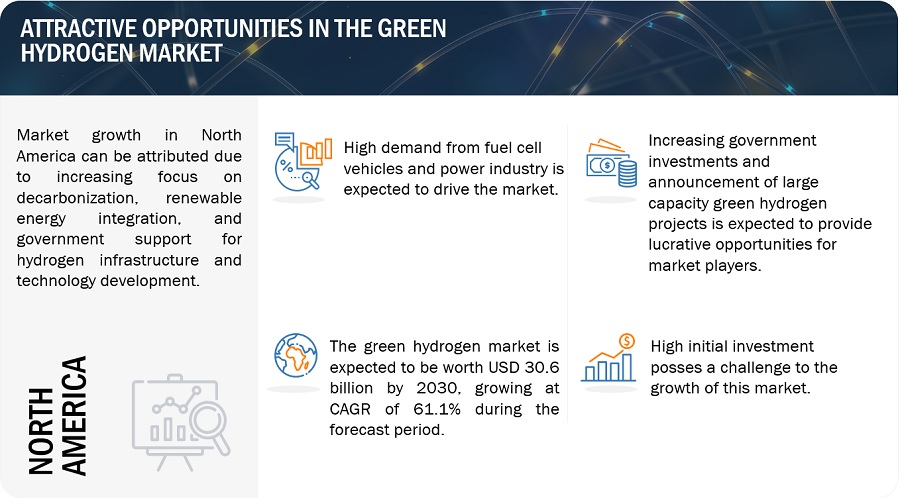

Driver: High demand from FCEVs and power industry

Hydrogen's versatility has expanded beyond its traditional role in fuel cells for electric vehicles, now encompassing the production of alternative fuels like ammonia, methanol, and synthetic liquids. These energy carriers are gaining prominence and are poised to drive future demand. In developing economies, green hydrogen presents a pathway to a low-carbon future, offering a nearly carbon-free fuel option for marine transportation, hydrogen fuel cells in electric vehicles (EVs), and industrial backup power. The diverse array of applications positions the green hydrogen sector as a lucrative venture with significant growth potential. The market for green hydrogen in vehicle fuel cells is rapidly evolving, providing the convenience of fossil fuels without the associated emissions.

Restraint: High cost of green hydrogen

The high cost of green hydrogen production is a restraint in the market. Current production methods, particularly electrolysis, are more expensive than conventional fossil fuel-based methods, making green hydrogen less competitive. This cost disparity is due to factors like high capital costs for electrolyzers, expensive renewable energy sources, and the lower efficiency of electrolysis. Additionally, the infrastructure for green hydrogen production, distribution, and storage adds to the overall cost. Efforts to reduce costs include technological advancements and increasing the use of renewable energy sources. However, restraints remain, such as high initial production costs, infrastructure limitations for transportation and storage, and the higher cost of fuel cells compared to fossil fuel technologies.

Opportunity: Increasing government investments

The increasing government investments in the green hydrogen market present a significant opportunity for industry growth. Many emerging countries, particularly in Asia and the European Union, along with some American and Middle Eastern countries, are actively developing infrastructure for green hydrogen. This infrastructure development will enable manufacturers to expand their reach and capacity, ultimately leading to a reduction in the price of green hydrogen. The global green hydrogen market is expected to grow significantly in the coming years, driven by the need to decarbonize energy systems and reduce greenhouse gas emissions. The India-Middle East-Europe Economic Corridor (IMEC) includes a hydrogen pipeline to facilitate exports to the EU, as per a memorandum of understanding signed by the governments of the US, India, Saudi Arabia, UAE, France, Germany, and Italy.

Challenge: High initial investments

The primary obstacle for green hydrogen manufacturers is the substantial initial investment needed to establish production facilities and manage transportation costs. The establishment of renewable energy power plants and the implementation of efficient electrolysis technology are key challenges. These tasks require significant research and development expenditures to develop viable technologies. The fixed costs associated with solar and wind power plants remain relatively high compared to traditional non-renewable energy sources, adding to the overall initial investment for hydrogen plants. Additionally, post-production, the development of transportation infrastructure is essential for the efficient and cost-effective transport of hydrogen, further elevating the overall cost of establishing green hydrogen plants.

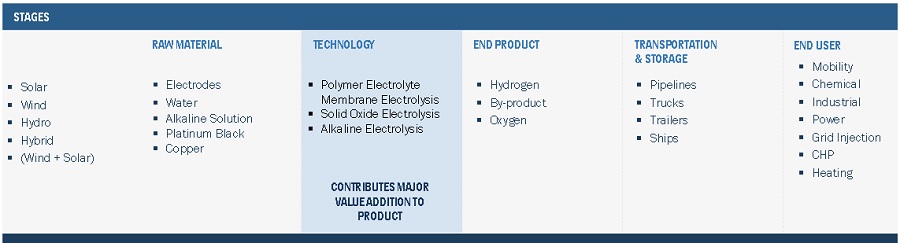

Green Hydrogen Market Ecosystem

Prominent companies in the market include well-established and financially stable manufacturers of green hydrogen market. This companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks

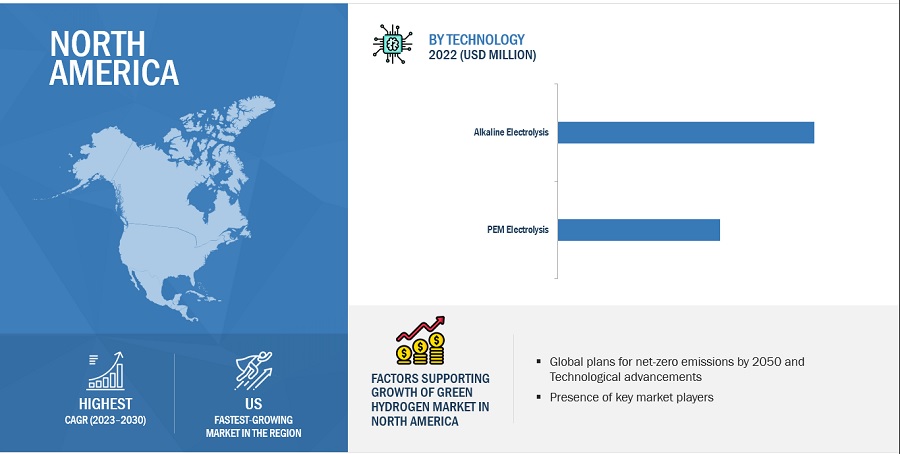

"PEM Electrolysis is accounted for the fastest growing segment during the forecast period."

Proton Exchange Membrane (PEM) electrolysis is emerging as the fastest-growing technology in the green hydrogen market, revolutionizing the production of clean hydrogen. This technology offers several advantages over traditional alkaline electrolysis, making it increasingly attractive to industries and governments seeking sustainable energy solutions. As governments around the world commit to reducing carbon emissions and transitioning to a sustainable energy future, PEM electrolysis is poised to play a crucial role in driving the growth of the green hydrogen market.

"Power is accounted for the second-fastest growing segment, in terms of value during the forecast period."

The power industry is accounted for second fastest growing end-use, in terms of value in the green hydrogen market, driven by its ability to store excess renewable energy and serve as a clean fuel for power generation. Green hydrogen's production from renewable sources like solar and wind power aligns with the industry's shift towards sustainable energy solutions. Government initiatives promoting renewable energy and carbon emission reduction further bolster the adoption of green hydrogen in the power sector. This trend underscores a broader transition towards cleaner and more sustainable energy sources, positioning green hydrogen as a crucial player in the global energy landscape.

"North America region is estimated to account for the fastest growing, in terms of value and volume during the forecast period."

North America is the fastest growing region, in terms of value and volume in global green hydrogen market in the forecast period. It has a significant number of manufacturers that are actively participating in development activities, especially in expansions. The region has presence of major green hydrogen manufacturers, such as Air Products & Chemical Inc. (US), Bloom Energy (US), Cummins Inc. (US), Plug Power Inc. (US), and IVYS Energy Solution (Canada). North America is a fastest growing region for the green hydrogen market. The growing manufacturing facilities in North America provides a high potential for market growth in the coming years.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

Green Hydrogen Market Players

Major companies in the green hydrogen market include Siemens Energy AG (Germany), Linde PLC (Ireland), Toshiba Energy Systems & Solutions Corporation (Japan), Air Liquide (France), Nel ASA (Norway), Air Products and Chemicals, Inc. (USA), Wind to Gas Energy GmbH & Co. KGV (Germany), H&R Olwerke Schindler GmbH (Germany), and Cummins Inc. (USA) and among others. A total of 33 players have been covered. These players have adopted agreements, product launches, joint ventures, investments, acquisitions, mergers, and expansions as the major strategies to consolidate their position in the market.

Green Hydrogen Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019–2030 |

|

Base year |

2022 |

|

Forecast period |

2023–2030 |

|

Units considered |

Value (USD Million/Billion), Volume (Kiloton) |

|

Segments |

Technology, Renewable Source, End-use Industry and Region |

|

Regions |

North America, Europe, APAC, Middle East & Africa, and Latin America |

|

Companies |

Siemens Energy AG (Germany), Toshiba Energy Systems & Solutions Corporation (Japan), Nel ASA (Norway), Linde (Ireland), Cummins Inc. (US), H&R Ölwerke Schindler GmbH (Germany), Wind to Gas Energy GmbH & Co. KG (Germany), Guangdong Nation-Synergy Hydrogen Power Technology Co., Ltd. (China), Air Liquide (France), and Air Products and Chemicals, Inc. (US). |

This research report categorizes the green hydrogen market based on technology, renewable source, end-use industry, and region.

Based on technology, the green hydrogen market has been segmented as follows:

- Alkaline Electrolysis

- PEM Electrolysis

Based on renewable source, the green hydrogen market has been segmented as follows:

- Wind Energy

- Solar Energy

- Others (geothermal, hydropower, and hybrid of wind & solar)

Based on end-use industry, the green hydrogen market has been segmented as follows:

- Mobility

- Chemical

- Power

- Grid Injection

- Industrial

- Others (CHP+Domestic Heat)

Based on region, the green hydrogen market has been segmented as follows:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- Latin America

Recent Developments

- In June 2022, Siemens Energy and Air Liquide S.A. had signed a joint venture to manufacture industrial-scale large quantities renewable hydrogen electrolyzers. This collaboration aims to facilitate the development of a sustainable hydrogen economy in Europe. The joint venture will promote the growth of a European ecosystem for hydrogen technology and electrolysis. Projected capacity of three gigatons per year by 2025.

- In May 2022, Air Liquide S.A., Toyota Motor, and CaetarioBus have announced a collaboration to advance integrated hydrogen solutions. They will focus on the deployment of hydrogen-powered vehicle fleets, aiming to accelerate the adoption of hydrogen mobility for both light- and heavy-duty vehicles and infrastructure development.

- In April 2022, WPD and Lhyfe have signed a collaboration to produce renewable green hydrogen on a large scale at the Storgrundet offshore wind farm in the Soderhamn municipality of Sweden.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the green hydrogen market?

Global efforts to reduce carbon emissions, technological advancements, government support, and increasing use in fuel cell electric vehicles (FCEVs) and power industries to drive green hydrogen has driven the market.

Which is the fastest-growing region-level market for green hydrogen?

Europe is the fastest-growing green hydrogen market due to the presence of major green hydrogen manufacturers.

What are the challenges in the green hydrogen market?

Challenges in the green hydrogen market is high initial investments.

Which energy based green hydrogen holds the largest market share?

Wind energy based green hydrogen, in terms of value and volume hold the largest share due to lower energy cost.

Who are the major manufacturers?

Major manufacturers in the green hydrogen market include Siemens Energy AG (Germany), Linde (Ireland), Toshiba Energy Systems & Solutions Corporation (Japan), and Air Liquide (France).

What are the major end use industry for green hydrogen?

Chemical, power, mobility, grid injection, and industrial are the major end-use industries of market green hydrogen.

What is the biggest restraint in the green hydrogen market?

The biggest restraint is high cost of green hydrogen. .