※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

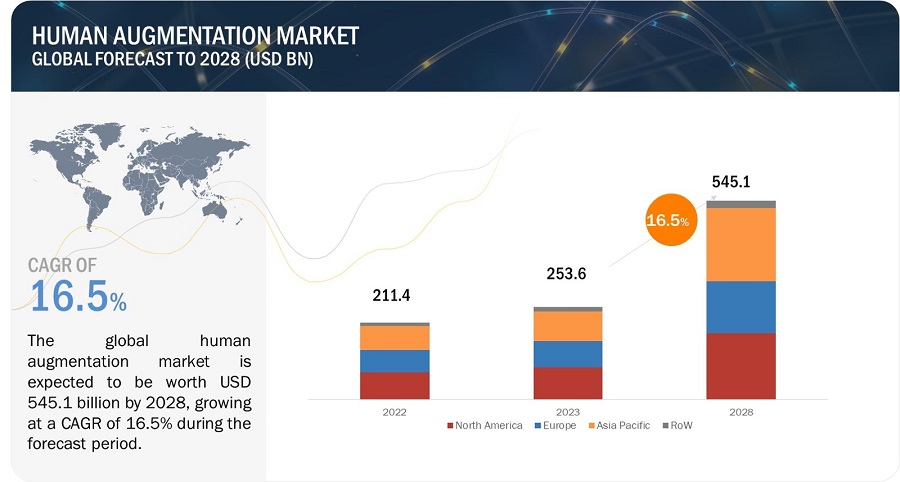

[294 Pages Report] The global human augmentation market is expected to be valued at USD 253.6 billion in 2023 and is projected to reach USD 545.1 billion by 2028; it is expected to grow at a CAGR of 16.5% from 2023 to 2028. Product launches, acquisitions, partnerships, collaborations, agreements, and expansions are the major growth strategies adopted by the market players. These strategies have enabled them to efficiently fulfill the growing demand for human augmentation from different end-user industries and expand their global footprint by offering their products in all the major regions.

Human Augmentation Market Forecast to 2028

Human augmentation market dynamics

Driver: Growth in virtual reality (VR) and augmented reality (AR) technologies

The growth in Virtual Reality (VR) and Augmented Reality (AR) technologies is a significant driver for the human augmentation market, as these immersive technologies enhance training, simulation, and real-time data visualization, allowing users to interact with digital information and objects in ways that augment their skills and experiences, whether in fields like healthcare, education, or workplace training, thereby expanding the applications and adoption of human augmentation technologies.

Restraint: High cost of technology

One significant restraint in the human augmentation market is the high cost associated with developing and implementing these advanced technologies. The research, development, and manufacturing of human augmentation solutions involve cutting-edge materials, intricate engineering, and sophisticated software. These factors result in high initial capital investments, making the technology expensive for both developers and end-users. The cost of research and clinical trials to ensure safety and efficacy also adds to the overall expense.

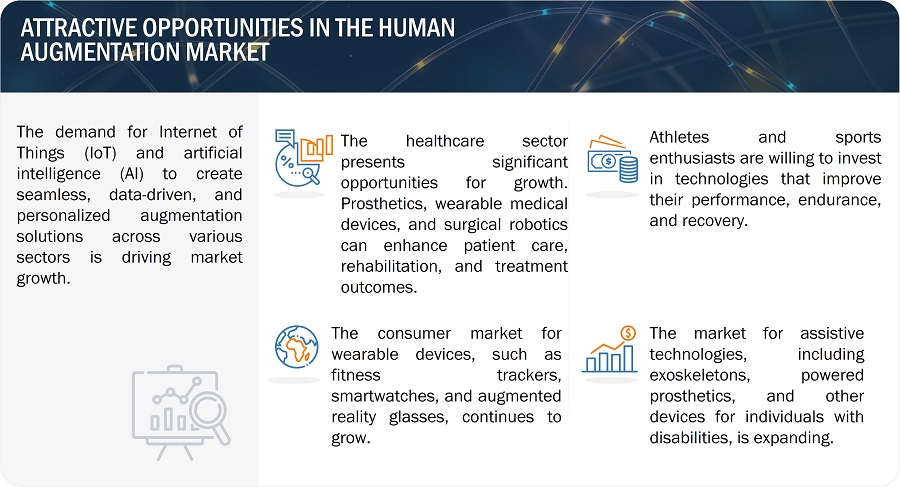

Opportunity: Growing adoption of technologies in military and defense

The growing adoption of advanced technologies in the aerospace and defense sectors presents a significant opportunity for the human augmentation market. In these fields, technological advancements are often a matter of life and death, making the integration of human augmentation technologies crucial. Exoskeletons, wearable devices, augmented reality (AR), and cognitive enhancements are being employed to enhance the physical and cognitive capabilities of soldiers, pilots, and ground personnel. These technologies improve soldier performance, reduce the physical strain of lifting heavy equipment, and provide critical information through heads-up displays.

Challenge: Safety and liability issues

The human augmentation market presents a significant challenge in addressing safety and liability issues associated with the adoption of these technologies. As human augmentation technologies become more integrated into various aspects of life, including healthcare, the workplace, and everyday activities, ensuring the safety of users and establishing clear liability frameworks becomes crucial. There's a risk of unforeseen health complications, such as allergic reactions to implanted devices or cyberattacks targeting wearable technologies.

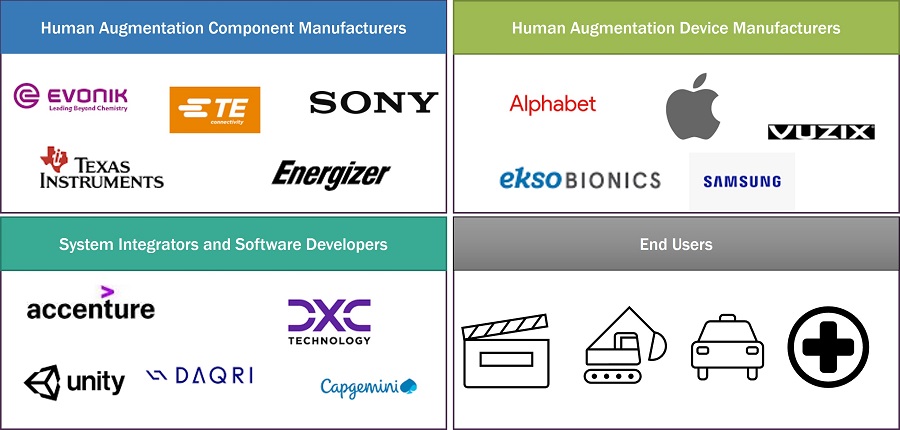

Human Augmentation Market Ecosystem

The human augmentation market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Samsung from South Korea, Alphabet Incorporation from US, Apple Inc. from US, Meta from US, Microsoft from US.

Based on product type, the biometric systems market for human augmentation to hold second highest market share during the forecast period

With increasing concerns about security in various sectors, such as finance, healthcare, and government, the demand for robust authentication and identification methods is growing. Biometric systems offer highly secure and reliable ways to verify and validate individual identities. Ongoing advancements in biometric technology, including facial recognition, fingerprint scanning, and iris recognition, have made these systems more accurate, accessible, and cost-effective, increasing their adoption in various industries.

Based on functionality, the non body-worn market for human augmentation to hold second highest market share during the forecast period

Non-body-worn devices, such as brain-computer interfaces (BCIs) and neural implants, offer the potential to enhance cognitive and physical performance without the need for external wearables. BCIs enable direct communication between the brain and external devices, allowing for improved control and interaction. Regulatory bodies in healthcare are increasingly approving and regulating the use of non-body-worn medical devices, providing a supportive environment for their development and adoption.

Based on end-user, the medical end-user market for human augmentation to hold second highest market share during the forecast period

The medical field is constantly innovating, and human augmentation technologies play a vital role in improving healthcare outcomes. Medical augmentations include wearable health devices, robotic surgery systems, and neural implants, which enhance patient care and treatment. Remote patient monitoring and telemedicine are on the rise. Wearable medical devices allow healthcare providers to monitor patients' vital signs and health conditions remotely, leading to better care and early interventions.

Human augmentation market in Asia Pacific to hold the second highest market share during the forecast period

The Asia Pacific region, including countries like China, Japan, and South Korea, is known for its rapid technological advancements. These nations invest heavily in research and development, fostering innovation in human augmentation technologies. Asia Pacific countries are experiencing an increased demand for healthcare services. This has led to the development of medical augmentations, wearable medical devices, and surgical robotics, all of which contribute to the growth of the human augmentation market.

Human Augmentation Market by Region

Key Market Players

The human augmentation companies is dominated by players such Samsung (South Korea), Alphabet Incorporation (US), Apple Inc. (US), Meta (US), Microsoft (US), and others

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

By Product Type, By Technology, By Functionality, and By End-User |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Samsung (South Korea), Alphabet Incorporation (US), Apple Inc. (US), Meta (US), Microsoft (US), Sony Group Corporation (Japan), Ekso Bionics (US), Vuzix (US), Garmin Ltd. (US), Fossil Group Inc. (US), B-Temia (Canada), Casio Computers Co., Ltd. (Japan), ReWalk Robotics (US), Cyberdyne Inc. (Japan). (Total 29 players are profiled) |

Human Augmentation Market Highlights

The study categorizes the human augmentation market based on the following segments:

|

Segment |

Subsegment |

|

By Product Type |

|

|

By Technology |

|

|

By Functionality |

|

|

By End-user |

|

|

By Region |

|

Recent Developments

- In September 2023, Apple Watch Series 9 also has a new 4-core Neural Engine that can process machine learning tasks up to twice as fast, when compared with Apple Watch Series 8. The power efficiency of the S9 SiP allows Apple Watch Series 9 to maintain all-day 18-hour battery life.

- In September 2023, Fitbit launched Charge 6 fitness tracker. It has most accurate heart rate on a fitness tracker and the ability to connect to compatible gym equipment.

- In July 2023, Garmin the launch of two powerful and feature-rich outdoor smartwatch series: the fenix 7 Pro and epix Pro Series. These next-generation smartwatches are designed to meet the demands of athletes, adventurers, and fitness enthusiasts, providing them with the ultimate performance and tracking capabilities.

- In June 2023, Samsung launched its next generation Galaxy Watch6 series. Galaxy Watch6 series now offers in-depth analysis of Sleep Score Factors — total sleep time, sleep cycle, awake time, plus physical and mental recovery to help users understand the quality of sleep received each night.

- In April 2023, Casio launched the smartwatch. The smartwatch has a built-in optical sensor which can be used to track your heart rate, and you can also track your blood oxygen levels with the gadget. An accelerometer tracks your steps though the wearables do not have GPS; linking the watch to your smartphone enables you to track your distance, and route travelled while walking or running.

- In February 2023, Sony launched the VR glasses. These are virtual reality glasses that were released in 2023. They have the highest pixel density display among commercial OLED panels. PlayStation VR2 can be used with the PlayStation 5 console.

- In October 2022, Fossil launched the Gen 6 Wellness edition smartwatch powered by Google’s updated Wear OS 3 platform. The Fossil Gen 6 Wellness edition features Snapdragon Wear 4100+, fast charging, and Bluetooth connectivity above 5.0.

- In August 2022, Vuzix introduced Blade 2 smart glasses, its third generation Blade model. Configured primarily for commercial use, Vuzix Blade 2 smart glasses pack a power efficient high performance Qualcomm processor that now runs Android 11 in support of a large variety of enterprise-focused apps.

Frequently Asked Questions:

What are the major driving factors and opportunities in the human augmentation market?

Some of the major driving factors for the growth of this market include Growth in virtual reality (VR) and augmented reality (AR) technologies, Advancements in medical technology, Increasing adoption of wearable devices, Growing adoption of advanced technologies in sports. Moreover, Growing adoption of technologies in military and defense, Adoption of remote work and telemedicine, Wide range of applications in gaming and entertainment industries are some of the key opportunities for the human augmentation market.

Which region is expected to hold the highest market share?

North America, particularly the United States, is a hub for technological innovation. Ongoing advancements in fields like robotics, artificial intelligence, biotechnology, and materials science are driving the development of advanced human augmentation technologies. The United States and Canada, as leading North American countries, have seen economic growth and significant investment in research and development of human augmentation technologies.

Who are the leading players in the global human augmentation market?

Companies such as as Samsung (South Korea), Alphabet Incorporation (US), Apple Inc. (US), Meta (US), Microsoft (US) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

Technological advancements in the human augmentation market are rapidly transforming the landscape. Breakthroughs in artificial intelligence, robotics, biotechnology, and materials science are enabling the development of highly sophisticated and integrated augmentation solutions. For instance, Brain-computer interfaces are becoming more precise, allowing for seamless communication between the brain and external devices. Wearable technologies are getting smarter, offering real-time health monitoring and augmented reality experiences. As these technologies continue to evolve, they hold the promise of improving human capabilities, enhancing healthcare, and revolutionizing various industries, from manufacturing to entertainment.

What is the impact of global recession on the market?

The Human Augmentation industry is expected to face challenges in 2023, primarily due to the economic recession and the rising tide of inflation. Its growth is intricately tied to the production and sale of various semiconductor components, including sensors, microelectronics, and batteries, which are the fundamental building blocks of human augmentation technologies. As inflation and interest rates climb while unemployment rates increase, the demand for human augmentation solutions from both consumers and enterprises is likely to diminish, thereby affecting production and global investments. The recession will result in reduced capital expenditures (CAPEX) across end-user industries such as consumer, medical, commercial, and industrial sectors that rely on human augmentation solutions.