※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

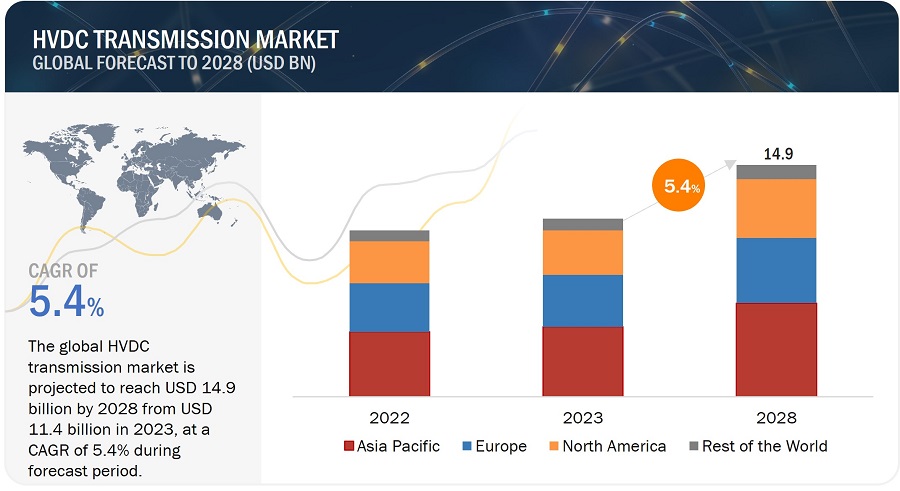

[240 Pages Report] The HVDC transmission market is projected to reach USD 14.9 billion by 2028 from USD 11.4 billion in 2023, at a CAGR of 5.4% from 2023 to 2028. A growing number of VSC-based HVDC projects, increasing adoption of renewable energy globally, growing demand for reliable power supplies, and favorable government policies and initiatives for HVDC transmission are the major factors driving the market growth. Furthermore, the constantly increasing technological advancements related to converter station components and the growing need for electricity exchange globally with the help of seamless interconnection of power grids are also expected to boost the market growth during the forecast period.

HVDC Transmission Market Forecast to 2028

HVDC Transmission Market Dynamics

Driver: Shift towards renewable energy

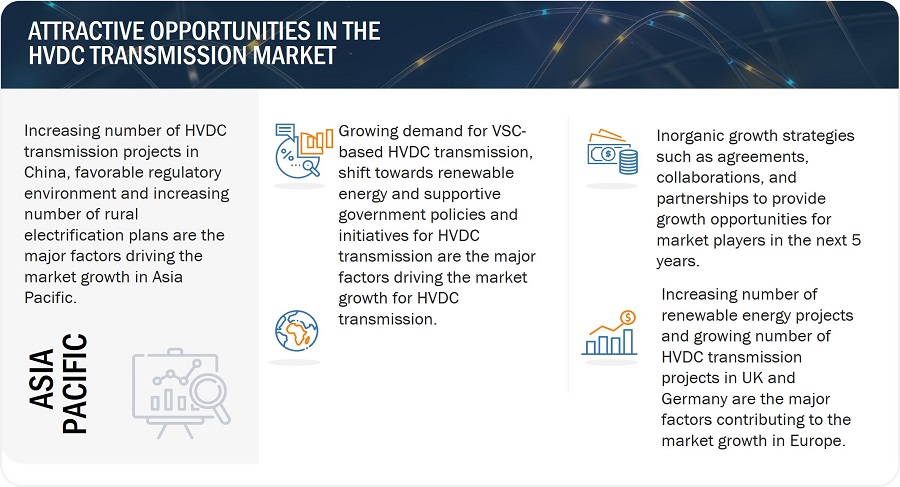

The global shift towards renewable energy sources, such as wind and solar power, is a significant driver for the growth of the HVDC transmission market. As countries and regions increasingly embrace clean energy solutions to reduce carbon emissions and combat climate change, there is a growing need to efficiently integrate renewable energy into existing power grids. HVDC transmission systems provide an optimal solution for this requirement. They enable the long-distance transmission of electricity from renewable energy sources to population centers and industrial hubs, minimizing energy loss during transmission. Additionally, HVDC technology supports grid stability, making it easier to manage the intermittent of renewable sources. As the world continues to transition towards greener energy, the demand for HVDC transmission systems is expected to rise, further driving market growth.

Restraint: Reduced demand due to distributed and off-grid power generation

Reduced demand for HVDC transmission systems can be attributed to the increasing adoption of distributed and off-grid power generation. These decentralized energy sources, such as rooftop solar panels and small-scale wind turbines, enable consumers to generate their electricity locally. As a result, there is less reliance on long-distance electricity transmission. Additionally, advancements in energy storage systems allow for better management of locally generated power, reducing the need for extensive grid infrastructure.

Opportunity: Technological advancements related to HVDC transmission

Technological advancements are extensively providing opportunities for market players within the HVDC transmission market. In recent years, there have been a significant number of technological advancements associated with converter technologies, grid management systems, efficiency gains, digitalization, and innovations in underwater HVDC transmission and circuit breaker technology. Converter technologies, particularly Voltage Source Converter (VSC) technology, have evolved significantly. VSC-based HVDC systems offer improved control, reliability, and efficiency, making them ideal for renewable energy integration and grid modernization. Furthermore, grid management systems have undergone significant advancements, offering real-time monitoring, predictive maintenance, and advanced fault detection. These enhancements boost grid reliability and system performance.

Challenge: Lack of standardization and interoperability

The lack of standardization and interoperability in HVDC transmission is a significant challenge that hampers its widespread adoption and operational efficiency. This issue arises from the absence of uniform technical standards and communication protocols across the industry, making it challenging to integrate HVDC systems and components from different manufacturers seamlessly. A primary consequence of this lack of standardization is compatibility issues and communication breakdowns between non-standardized HVDC components. As HVDC systems are complex and involve various components like converters, transformers, and control systems, the absence of standardization complicates their integration into a cohesive system.

HVDC Transmission Market Ecosystem

The prominent players in the HVDC transmission market are Hitachi (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), General Electric (US), and Prysmian Group (Italy). These companies use inorganic growth strategies to expand themselves globally by providing advanced components related to HVDC transmission.

Converter stations to dominate the HVDC transmission market during the forecast period.

The growing electricity demand globally and the subsequent increase in the need to transmit power has led to increased adoption of HVDC transmission as it facilitates transmission with lower losses over longer distances. The growing number of VSC-based HVDC transmission projects globally has driven the demand for insulated-gate bipolar transistor (IGBT) valves and circuit breakers used in converter stations. Furthermore, the growing need for improved and efficient power transmission and connection of asynchronous grids is expected to create a surge in demand for HVDC converter stations.

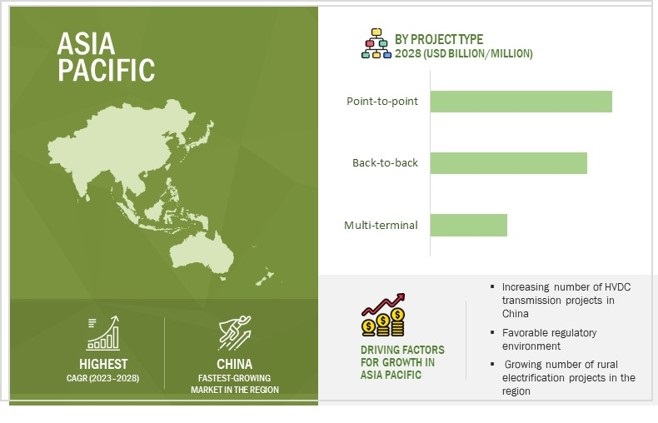

Point-to-point projects to lead the HVDC transmission market during the forecast period.

Point-to-point transmissions are generally used if high power is needed to be transmitted between two converter stations. Point-to-point transmission is highly suitable for transmitting power over long distances, and in recent years, there has been a significant increase in the adoption of bipolar configurations in point-to-point transmissions in the Asia Pacific due to their reliability in carrying high power loads. Furthermore, the increasing focus of European countries on using renewable energy and the subsequent need for efficient energy transmission would further drive the market growth for point-to-point transmissions.

Asia Pacific held the largest share of the HVDC transmission market in 2022.

Asia Pacific accounted for the largest share of the HVDC transmission market in 2022. An increasing number of HVDC transmission projects in countries such as China and India, a favorable regulatory environment for the development and sales of HVDC components, and an increasing number of rural electrification projects in the region are some of the major factors driving the market growth in the Asia Pacific. Moreover, the constantly increasing population, rapid urbanization, and the subsequently increasing demand for electricity in the region are also major factors driving the market growth. Furthermore, the presence of established market players in the region, such as Hitachi (Japan) and Mitsubishi Electric Corporation (Japan), is also expected to provide increased opportunities for the adoption of HVDC transmission in the region.

HVDC Transmission Market by Region

Key Market Players

The major players in the HVDC transmission companies include Hitachi (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), General Electric (US), and Prysmian Group (Italy). These companies have used inorganic growth strategies such as agreements, collaborations, acquisitions, partnerships, and joint ventures to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Component, Project Type, Technology, Application, and Region |

|

Geographies covered |

Americas, Europe, Asia Pacific, and Rest of the World (RoW) |

|

Companies covered |

The major players in the HVDC transmission market are Hitachi (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), General Electric (US), Prysmian Group (Italy), Toshiba Corporation (Japan), NKT A/S (Denmark), Nexans (France), LS Electric Co., Ltd. (South Korea), and NR Electric Co., Ltd. (China). |

HVDC Transmission Market Highlights

The study segments the HVDC transmission market based on component, project type, technology, application, and region at the regional and global level.

|

Segment |

Subsegment |

|

By Component |

|

|

By Project Type |

|

|

By Technology |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In March 2023, Hitachi (Japan) secured a contract to upgrade the Al Fadhili converter station in Saudi Arabia. The station, established in 2009, plays a crucial role in connecting the power grids of multiple Middle Eastern countries.

- In March 2023, Siemens Energy (Germany), in partnership with Italy's FATA (Danieli group) (Italy), secured a contract from Terna (Italy) to supply four converter stations for the "Tyrrhenian Link" project, a 970 km long HVDC power link connecting mainland Italy, Sicily, and Sardinia. This project facilitates flexible electricity exchange between these regions, enhances renewable energy utilization grid stability, and supports the phasing out of coal-fired power plants on the islands to reduce CO2 emissions.

- In February 2023, Mitsubishi Electric Corporation (Japan) acquired Scibreak AB (Sweden), a Swedish company specializing in direct current circuit breakers (DCCBs). This move aims to enhance their joint efforts in developing DCCB technologies for high-voltage direct current (HVDC) systems, aligning with the global expansion of renewable energy sources.

- In July 2022, General Electric (GE) (US) and KAPES (Dubai), a KEPCO-GE joint venture, secured a contract to enhance South Korea's electric grid with a 500-MW high voltage direct current (HVDC) link. The Shin-buying project, situated in Incheon near Seoul, aims to alleviate grid overload and strengthen the overall grid system.

- In June 2021, Siemens Energy (Germany) and Mitsubishi Electric Corporation (Japan) signed an MoU to explore the development of high-voltage switching solutions using clean air insulation to replace greenhouse gases. They will focus on a 245-kV circuit breaker as an initial step towards climate-neutral high-voltage switching solutions.

Frequently Asked Questions (FAQs):

What is the current size of the global HVDC transmission market?

The HVDC transmission market is projected to reach USD 14.9 billion by 2028 from USD 11.4 billion in 2023, at a CAGR of 5.4% from 2023 to 2028. The growing number of VSC-based HVDC projects and the shift towards renewable energy adoption globally are the major factors driving the market growth.

Who are the winners in the global HVDC transmission market?

Companies such as Hitachi (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), General Electric (US), and Prysmian Group (Italy) fall under the winner’s category.

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the HVDC transmission market during the forecast period. An increasing number of HVDC transmission projects in China and India, a favorable regulatory environment for the development and sales of HVDC components, and a growing number of rural electrification projects in the region are some of the major factors driving the market growth in the Asia Pacific.

What are the major drivers and opportunities related to the HVDC transmission market?

The increasing number of VSC-based projects globally, increasing adoption of renewable energy, growing demand for reliable power supplies, favorable government initiatives, constant technological advancements, and the growing need for interconnectivity of power grids are some of the major drivers and opportunities impacting the HVDC transmission market.

What are the major strategies adopted by market players?

The key players have adopted agreements, collaborations, partnerships, acquisitions, and joint ventures to strengthen their position in the HVDC transmission market.