※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

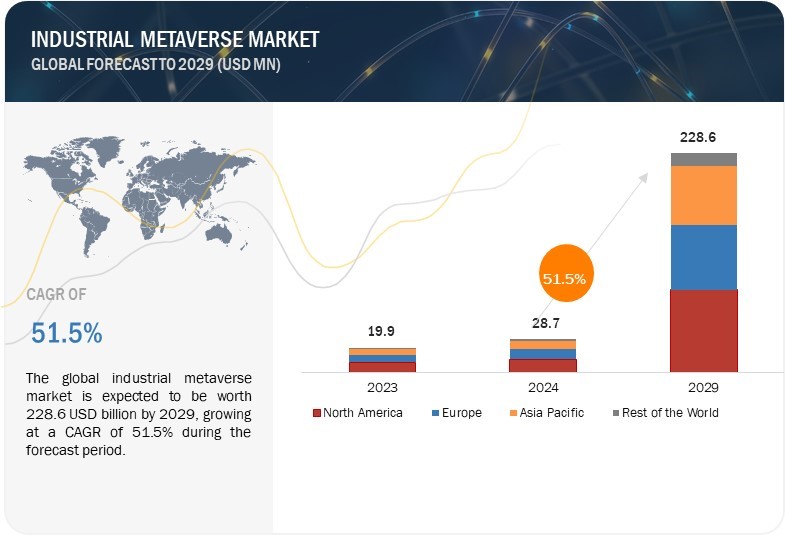

[384 Pages Report] The global industrial metaverse market size is estimated to be USD 28.7 billion in 2024 and is projected to reach USD 228.6 billion by 2029, at a CAGR of 51.5% during the forecast period. Some of the major factors contributing to the growth of the industrial metaverse market include the rising adoption of digital twins, advancement in core technologies such as AR, VR, AI, and IoT, rising demand for efficiency and optimization in industrial sector,and addressing skill gaps and workforce challenges through industrial metaverse.

Industrial Metaverse Market Forecast to 2029

Market Dynamics:

Driver: Rising demand for efficiency and optimization in industrial sector

The industrial sector is constantly under pressure to do more tasks in less time which reflects into a continuous pursuit of efficiency and optimization in all aspects of industrial manufacturing. Industrial metaverse helps in optimizing operations. Using industrial metaverse, engineers working on a virtual factory floor can monitor production lines in real-time, identify problems within the production machines, and make required changes. Adoption of digital twin technology is increasing due to such situations. These virtual replicas of real-world machines and processes enable the data-driven decision making as real-time data from sensors on machines and production lines provides insights into performance. This data is then analyzed to identify areas for improvement and optimize production processes. It offers predictive maintenance by continuously monitoring equipment health, the industrial metaverse can predict potential failures before they happen. This results in minimizing downtime and associated costs. Furthermore, it provides improved resource allocation by understanding production challenges and resource utilization, and thus, manufacturers can allocate resources more effectively enabling smoother operations.

Restraint: High Installation and Maintenance Costs of High-End Metaverse Components

The significant expenses associated with deploying and maintaining advanced technologies within industrial environments is one of the important restraining factors for the industrial metaverse market. These costs can hinder the adoption and growth of industrial metaverse solutions, which rely on cutting-edge technologies such as VR, AR, edge computing, AI, and blockchain.

The industrial metaverse relies on advanced hardware like VR headsets, haptic gloves, edge computing solutions, blockchain technology, and high-performance computing systems. These cutting-edge technologies are expensive to develop, manufacture, and purchase. To fully utilize the industrial metaverse, companies need robust network connectivity, secure data storage solutions, and specialized software platforms. Establishing such facilities and maintaining the required infrastructure is costly, especially for SMEs that are trying to optimize their operations to achieve better results. Also, implementing industrial metaverse requires skilled personnel having strong expertise in VR/AR technologies, blockchain, edge computing, data management, and cybersecurity. To find such industry experts and retaining the talent pool is challenging and expensive.

Opportunity: Continuous Developments In 5G/6G

The rapid advancements in 5G and the arrival of 6G technology present a transformative opportunity for the industrial metaverse market as it depends on seamless connectivity and real-time data exchange.

5G has significantly lower latency as compared to its previous generations such as 4G cellular networks. This results in efficient real-time data transmission, which is crucial for the industrial metaverse where split-second delays can disrupt operations. 6G provides Ultra-reliable and Low-Latency Communication (URLLC) in which it aims to achieve even lower latency and higher reliability than 5G, pushing the boundaries of real-time data exchange. This could enable complex applications like remote robotic surgery within the industrial metaverse with higher precision and responsiveness.

Challenge: Opposition From Incumbents Towards Blockchain Technology

Opposition from prominent financial and governmental regulations towards blockchain technology is a major challenge for the industrial metaverse market. The challenge is rooted in the potential disruption that blockchain technology can bring to traditional business models, processes, and power structures. This resistance can stem from a lack of understanding of blockchain technology or concerns about the potential impact on their market share and revenue. As blockchain represents a significant shift from traditional data management methods, incumbents might be hesitant to embrace this change due to the complexity of integrating blockchain into their existing infrastructure.

Blockchain technology decentralizes data and transactions, which leads to a loss of control for traditional power structures. This can be particularly challenging for companies that rely heavily on centralized systems and may be hesitant to give up their control.

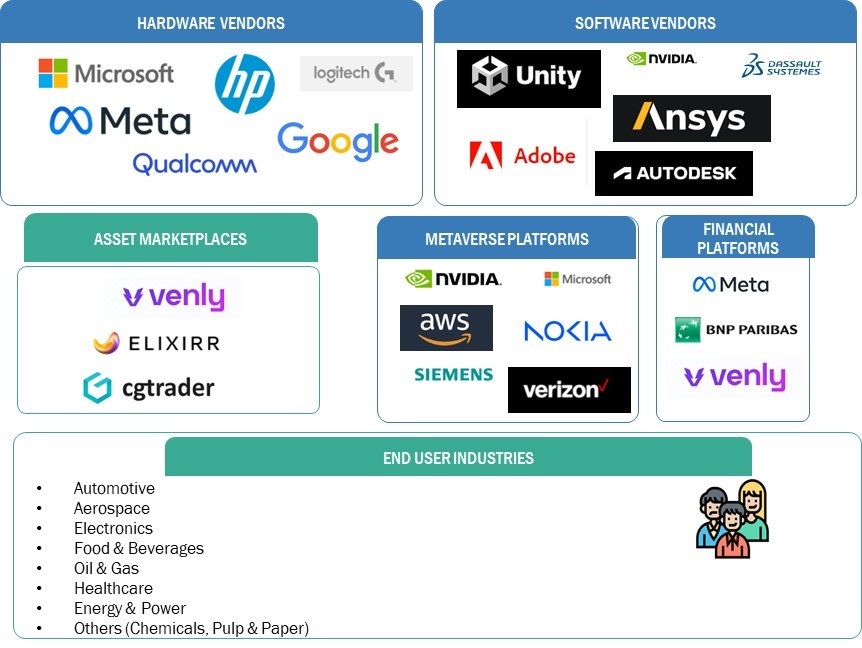

Industrial Metaverse Market Ecosystem:

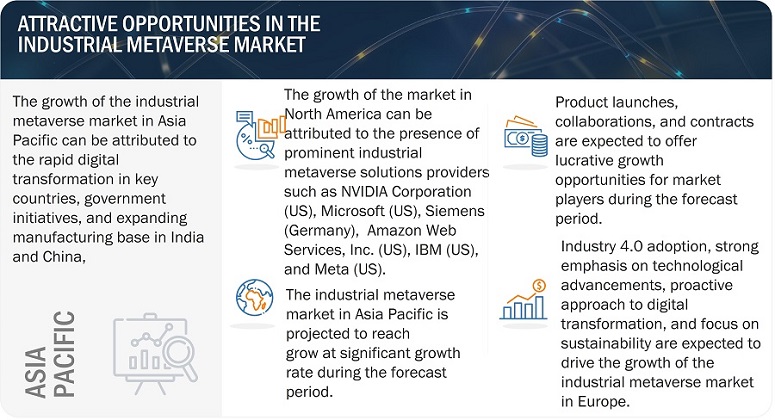

The prominent players in the industrial metaverse market are NVIDIA Corporation (US), Microsoft (US), Siemens (Germany), Amazon Web Services, Inc. (US), IBM (US), Meta (US), HTC Corporation (Taiwan), ABB (Switzerland), PTC (US), Dassault Systèmes (France), GE Vernova (US), Intel Corporation (US), AVEVA Group Limited (UK), Alphabet, Inc. (US), and Nokia (Finland). These companies not only boast a comprehensive product portfolio but also have a strong geographic footprint.

Digital twin technology segment to hold a prominent share of the industrial metaverse market during the forecast period.

A digital twin is a digital copy or virtual replica of a physical object, system or a process. It serves as a digital replica that accurately captures the essential characteristics and behaviors of the real-world entity. By using advanced technologies like sensors, data analytics, and simulations, digital twin gathers real-time data from their physical counterparts. This data is used to maintain an up-to-date digital representation that replicates the behavior of the actual entity such as a production machine or an automation system in an oil & gas industry. Digital twin provide valuable insights and drive operational improvements, helping businesses to understand performance, identify enhancement opportunities, and test strategies before real-world implementation. They are used across various industries, such as manufacturing, healthcare, transportation, energy & power, and food & beverages. The digital twin technology is used in industrial metaverse for applications such as predictive maintenance, business optimization, performance monitoring, inventory management, and product design & development.

Automotive end user segment to grow at a prominent CAGR during the forecasting period.

The automotive industry has been at the forefront of adopting digital twin technology, as it applies it across various systems and processes throughout the entire lifecycle of automotive products and services. The implementation aims to streamline and enhance complex processes that typically span 4-6 years from design to launch of a new automobile model. Modern vehicles that are equipped with numerous sensors for continuous critical-system monitoring, underscore the importance of the design phase. This phase influences an automobile manufacturer's long-term sustainability and profitability, as even minor design errors can severely impact brand value and financial performance. The integration of digital twins in the automotive design phase is poised to be transformative, enabling companies to identify and resolve potential issues early in the process, thereby fostering more efficient and cost-effective product development.

Asia Pacific to hold significant market share during the forecast period.

The market in Asia Pacific has been segmented into China, Japan, South Korea, India, and the Rest of Asia Pacific. Factors such as Rapid Digital Transformation in key countries, government initiatives, Expanding Manufacturing Base in India and China, growing adoption of AI and edge computing technologies are expected to be drivers for the growth of the industrial metaverse market in the Asia Pacific region. With a substantial consumer base eager to explore emerging technologies, expos and conferences are anticipated to drive the growth of China's AR and VR technology. China is poised to lead the Asia Pacific region in the adoption of mobile-based AR and VR devices, driven by its large mobile user base and high population density, with widespread mobile internet access serving as a key growth driver. Furthermore, Japan's most dynamic sectors include financial services, healthcare, advanced manufacturing, and retail, bolstered by significant advancements in healthcare that contribute to the highest life expectancy globally. The increasing integration of advanced technologies within the healthcare sector is expected to further drive the adoption of AR and VR technologies in Japan. Also, South Korea leads the way in 5G network development, with key industry players including SK Telecom, Samsung, KT Corporation, and LG Corporation headquartered in the country. To accelerate the adoption of this technology across diverse sectors, the South Korean government has initiated the allocation of private 5G frequencies.

Industrial Metaverse Market by Region

Key Market Players

NVIDIA Corporation (US), Microsoft (US), Siemens (Germany), Amazon Web Services, Inc. (US), IBM (US), Meta (US), HTC Corporation (Taiwan), ABB (Switzerland), PTC (US), Dassault Systèmes (France), Intel Corporation (US), Alphabet, Inc.(US), and Nokia (Finland) are among the major players in the industrial metaverse companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

By Technology, End User, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies Covered |

The major players include NVIDIA Corporation (US), Microsoft (US), Siemens (Germany), Amazon Web Services, Inc. (US), IBM (US), Meta (US), HTC Corporation (Taiwan), ABB (Switzerland), PTC (US), Dassault Systèmes (France), GE Vernova (US), Intel Corporation (US), AVEVA Group Limited (UK), Alphabet, Inc. (US), and Nokia (Finland). |

Industrial Metaverse Market Highlights

This research report categorizes the industrial metaverse market by technology, end user, and region available at the regional and global level

|

Segment |

Subsegment |

|

Based on Technology: |

|

|

Based on End User: |

|

|

Based on the Region: |

|

Recent Developments

- In May 2023, NVIDIA Corporation (US) released a new class of large-memory AI supercomputer called NVIDIA DGX supercomputer powered by NVIDIA GH200 Grace Hopper Superchips and the NVIDIA NVLink Switch System, created to enable the development of giant, next-generation models for generative AI language applications, recommender systems, and data analytics workloads.

- In February 2022, NVIDIA Corporation partnered with Jaguar Land Rover, the iconic maker of modern luxury vehicles, to manufacture software-defined future cars. Jaguar Land Rover was expected to develop vehicles on a full-stack NVIDIA DRIVE Hyperion 8 platform, delivering multiple active safety, automated driving, and parking systems.

- In November 2021, Siemens (Germany) launched Industrial Edge Ecosystem, a vendor-independent and digital, cross-manufacturer app store. It is an IT platform that enables the scalable development of IT technologies and apps in the production environment.

- In December 2020, ABB (Switzerland) and CORYS (France) have signed a Memorandum of Understanding for digital collaboration. This collaboration aimed to advance digital twin modeling and simulation technology within the energy and process industries. Both companies are dedicated to delivering cutting-edge digital twin technology to help customers reduce capital and operational costs and mitigate risks. Utilizing ABB Ability 800xA Simulator, ABB provides comprehensive digital replicas of plant control systems. When integrated with CORYS’ dynamic high-fidelity Indiss Plus process modeling simulator, customers receive a complete digital twin solution. This solution facilitates training, enables operators to validate and test control strategies and production processes, and manage changes throughout the lifecycle of operations.

- In November 2020, Resulting from a collaborative effort involving Microsoft (US), HP Development Company, L.P. (US), and Valve (US), and, this virtual reality headset represents a significant breakthrough. It offers an enhanced level of immersion, comfort, and compatibility. Boasting top-tier visual quality, spatial audio, motion tracking, and ergonomic design, the HP Reverb G2 establishes a fresh benchmark in both enthusiast and commercial virtual reality experiences.

Key Questions Addressed by the Report:

Who are the key players in the industrial metaverse market? What are the major growth strategies they have taken to strengthen their position in the market?

Key players of industrial metaverse market include NVIDIA Corporation (US), Microsoft (US), Siemens (Germany), Amazon Web Services, Inc. (US), IBM (US), and Meta (US). These companies offer a wide portfolio for industrial metaverse with global presence across various countries to meet the requirements of customers. Strategies such as acquisitions, product launches, collaborations, agreements and contracts were adopted by these companies to withstand the competitive landscape of this market.

What are the new opportunities for emerging players in the industrial metaverse value chain?

In the value chain of industrial metaverses, emerging players have various new prospects to explore. These include opportunities such as the developing products and solutions catering to technologies such as digital twin, AR & VR, AI, edge computing, and private 5G technology. Companies are developing advanced hardware, and software solutions catering to varius end user industries such as automotive, electronics, oil & gas, healthcare, aerospace, food & beverages, and others. These players can collaborate and develop innovative solutions for the industrial metaverse market.

Which end-user of the industrial metaverse market is expected to be a prominent for the market's growth in the next five years?

During the projected timeframe, the automotive industry is expected to be a prominent industry that is expected to drive the industrial metaverse market growth. Need for optimization and enhancement of time-consuming processes in vehicle manufacturing to boost adoption of the industrial metaverse solutions.

Which region to offer lucrative growth for the industrial metaverse market by 2029?

During the projected period, the Asia Pacific is expected to offer lucrative opportunities in the industrial metaverse market.

Which technology of the industrial metaverse market is expected to drive the market's growth in the next five years?

The digital twin technology segment is expected to grow at a prominent rate during the forecast period. The growth of this market segment can be attributed to the increasing demand for predictive maintenance and inventory optimization in industries to drive segment growth.