※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

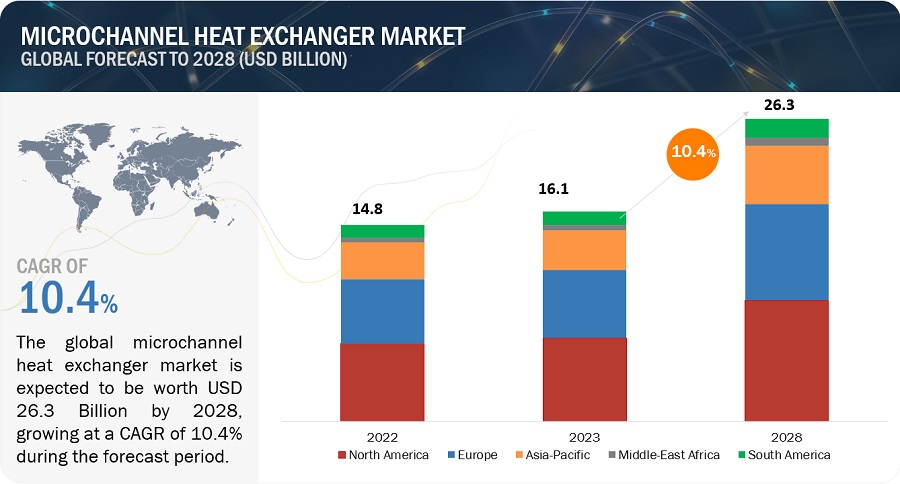

The global microchannel heat exchanger market size is estimated to be USD 16.1 billion in 2023 and projected to reach USD 26.3 billion in 2028, at a CAGR of 10.4%. Microchannel heat exchangers are compact devices that utilize multiple small channels to facilitate heat exchange between fluids. Typically made of materials, such as metal or ceramic, they optimize thermal efficiency, reduce size, and enhance performance in various applications such as HVAC, automotive, and industrial processes, making them crucial for efficient heat transfer in a compact and lightweight design.

Opportunities in the Microchannel Heat Exchanger Market

Recession impact

During a recession, the microchannel heat exchanger market may experience a range of impacts. Reduced industrial activities and capital expenditure could lead to a decline in demand from sectors like manufacturing and construction, affecting overall market growth. Industries may postpone or scale back projects, impacting the purchase of heat exchange equipment. Additionally, disruptions in the supply chain and financial constraints may hinder production and investment in innovative technologies. However, the market might see some resilience in sectors like HVAC, where the need for energy-efficient solutions persists. Cost-conscious approaches may drive the adoption of microchannel heat exchangers for their compact design and enhanced efficiency, providing opportunities for market recovery as economic conditions improve. Adaptability to changing market dynamics and cost-effectiveness will be crucial for companies navigating the challenges posed by a recession.

Microchannel Heat Exchanger Market Dynamics

Driver: Energy efficient regulations and stringent emission standards

Governments and environmental regulatory bodies globally are increasingly prioritizing sustainability and seeking avenues to mitigate the impact of industrial processes on the environment. In response to this imperative, the microchannel heat exchanger market is witnessing a shift, driven by a compelling need for energy-efficient solutions that simultaneously adhere to rigorous emission standards. The rising awareness of climate change and the commitment to reduce carbon footprints have propelled the implementation of stringent regulations aimed at curbing energy wastage and minimizing harmful emissions. Microchannel heat exchangers, with their compact designs and enhanced heat transfer capabilities, have emerged as a key technology to address these challenges. These heat exchangers facilitate more efficient heat exchange processes, optimizing energy utilization across various applications. The efficient and cost-effective CO2 mitigation options offered by energy efficiency align seamlessly with the principal goals of the Net Zero Emissions by 2050 (NZE) Scenario. In the context of global energy intensity, which experiences an impressive average annual decline of around 4% in the NZE Scenario, compared to the 1.7% observed over the past decade, the emphasis on cleaner and more efficient technologies becomes increasingly pronounced. States play a pivotal role in advancing energy efficiency through the active updating and expansion of Energy Efficiency Resource Standards (EERS), thereby establishing long-term efficiency goals for utilities. According to the US Department of Energy, 50.0% of the energy is utilized for operating residential and commercial infrastructure, and most of the energy is used by HVACR systems and appliances in the US. Systems such as chillers, heat pumps, and other similar HVAC systems can achieve energy efficiency up to 4.0% by using MCHE. MCHE requires 30.0% less refrigerant than traditional fin & tube heat exchangers.

Manufacturers in the microchannel heat exchanger market are compelled to innovate and engineer solutions that not only meet but exceed the prescribed energy efficiency benchmarks and emission thresholds. This push towards eco-friendly technologies has fostered a climate of innovation, driving research and development initiatives within the industry. Companies are investing in the creation of advanced microchannel heat exchanger designs that not only enhance performance but also contribute significantly to sustainability goals. The market response to these regulatory imperatives has been a proliferation of progressive microchannel heat exchanger technologies, designed to offer superior thermal performance while ensuring compliance with stringent emission standards. As a result, the industry is experiencing a paradigmatic shift towards cleaner, greener, and more energy-efficient solutions, positioning microchannel heat exchangers as a cornerstone in the global pursuit of sustainable industrial practices.

Restrain: Expensive manufacturing of microchannel heat exchangers

The adoption of microchannel heat exchangers, despite their significant thermal advantages, encounters a formidable restraint rooted in their expensive manufacturing processes. These heat exchangers, characterized by intricate designs and small channel networks, require specialized manufacturing techniques, advanced machinery, and skilled labor, contributing to elevated production costs. The complexity of the manufacturing process poses a challenge, limiting their integration in applications where cost-effectiveness is a crucial factor. The cost constraint is particularly pronounced in industries such as residential HVAC, where minimizing upfront expenses is a priority. The intricate nature of microchannel structures demands precision and attention to detail, making the manufacturing process inherently more expensive than that of conventional alternatives. In sectors with slim profit margins or stringent budget considerations, the higher costs associated with microchannel heat exchangers can act as a deterrent, impeding their widespread adoption. Moreover, the use of specialized materials, such as corrosion-resistant alloys, adds to the overall expenses. These materials are necessary to ensure the durability of microchannel heat exchangers, especially in corrosive environments. The challenge extends beyond the manufacturing phase, influencing the entire lifecycle of microchannel heat exchangers. Maintenance and repair costs are also elevated due to the complex design, necessitating specialized expertise.

Opportunity: Integrating microchannel heat exchangers in renewable energy systems

The integration of microchannel heat exchangers into solar thermal systems presents a promising avenue for enhancing the efficiency of heat transfer processes, ultimately advancing the harnessing and utilization of solar energy. In the context of renewable energy, solar thermal applications stand out as a key frontier where microchannel heat exchangers can play a pivotal role. Solar thermal systems rely on the efficient conversion of sunlight into heat, which is subsequently utilized for various applications such as electricity generation, heating, or desalination. The success of these systems hinges on the ability to capture and transfer solar heat with maximum efficiency, and this is precisely where microchannel heat exchangers come into play as a compelling opportunity.

Microchannel heat exchangers excel in optimizing heat transfer due to their intricate design, characterized by a network of small channels that facilitate rapid and controlled thermal exchange. In solar thermal applications, this design can significantly enhance the absorption and transfer of solar energy, thereby maximizing the overall efficiency of the system. The compact nature of microchannel heat exchangers also aligns with the space considerations often associated with solar installations, offering a solution that is both efficient and adaptable to various system configurations. Efficient heat transfer is crucial in solar thermal systems, where the goal is to capture and utilize solar radiation effectively. By integrating microchannel heat exchangers into these systems, manufacturers and researchers have the opportunity to elevate the performance of solar technologies, making them more competitive and viable alternatives to conventional energy sources.

Challenge: High pressure drops due to smaller flow passages in microchannel heat exchangers

Pressure drop poses a significant challenge in the microchannel heat exchanger market due to the inherent design characteristics of smaller flow passages. Microchannel heat exchangers, known for their compact structure and enhanced heat transfer capabilities, often experience higher pressure drops compared to conventional counterparts. The reduced size of channels, while advantageous for efficient heat exchange, can lead to increased fluid friction, necessitating higher pumping power to maintain desired flow rates. This challenge becomes pronounced in applications where energy efficiency is vital, as the elevated pressure drops can compromise overall system efficiency. The need for additional pumping power not only escalates operational costs but may also limit the applicability of microchannel heat exchangers in scenarios where power consumption is a critical consideration. Effectively managing pressure drop emerges as a crucial undertaking for stakeholders in the microchannel heat exchanger market. Balancing the benefits of compact design with the challenges of increased pressure drops requires innovative engineering solutions to optimize performance and broaden the range of applications, ensuring that microchannel heat exchangers remain competitive in diverse industries where energy efficiency is a pivotal concern.

Microchannel Heat Exchanger Market: Ecosystem

Ceramic based segment is the second-fastest growing type in the microchannel heat exchanger market during the forecast period.

The ceramic based segment is the second-fastest growing in the microchannel heat exchanger market due to the unique properties of ceramics, including high thermal resistance and corrosion resistance. These attributes make ceramic microchannel heat exchangers suitable for demanding applications where durability and resistance to extreme conditions are essential, driving their increased adoption and contributing to their rapid growth in the market.

The condensers segment is the second fastest growing component in the microchannel heat exchanger market during the forecast period.

The condensers segment experiences the second fastest growth in the microchannel heat exchanger market due to their pivotal role in various applications, especially in HVAC and refrigeration systems. The demand for efficient cooling solutions drives the adoption of microchannel condensers, which offer a compact design, enhanced heat transfer efficiency, and improved overall performance. As industries prioritize energy efficiency and sustainability, the versatility and effectiveness of microchannel condensers contribute to their accelerated growth, securing their position as the second fastest-growing segment in the dynamic landscape of the microchannel heat exchanger market.

The single coils segment is the second-fastest growing fluid-mechanism type in the microchannel heat exchanger market during the forecast period.

The single coils segment is the second fastest-growing fluid-mechanism type in the microchannel heat exchanger market due to its simplicity, cost-effectiveness, and efficiency. Single coil designs streamline fluid flow, providing effective heat transfer. Their uncomplicated configuration reduces manufacturing complexities and enhances reliability. As industries seek straightforward and efficient solutions, the versatility of single coil fluid mechanisms makes them well-suited for various applications.

Commercial refrigeration is the second-fastest growing end-use industry in the microchannel heat exchanger market during the forecast period.

The commercial refrigeration industry is the second fastest-growing end-use industry in the microchannel heat exchanger market due to escalating demand for efficient cooling solutions. Microchannel heat exchangers offer compact designs and improved heat transfer efficiency, meeting the specific requirements of commercial refrigeration systems. As businesses focus on energy-efficient and space-saving technologies, the adoption of microchannel heat exchangers in commercial refrigeration applications expands rapidly. Their ability to enhance overall system performance while addressing sustainability concerns positions microchannel heat exchangers as a key technology in the commercial refrigeration industry, contributing to their significant growth.

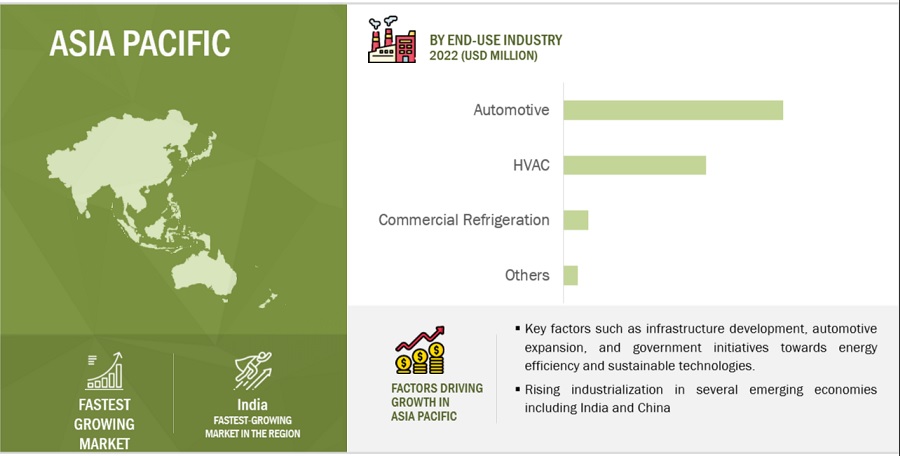

Asia Pacific is the fastest growing in the microchannel heat exchanger market, in terms of value.

Asia Pacific stands as the fastest-growing region in the microchannel heat exchanger market due to rapid industrialization, infrastructural development, and increasing adoption of advanced technologies. The region's expanding automotive and HVAC sectors, coupled with government initiatives promoting energy efficiency, drive the demand for microchannel heat exchangers. As manufacturing and construction activities surge, the need for compact and efficient thermal management solutions rises.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

Key Market Players

Sanhua (Spain), Modine Manufacturing Company (U.S.), Danfoss (Denmark), Hydro (Norway), and Kaltra (Germany). These players have established a strong foothold in the market by adopting strategies, such expansions, joint ventures, and mergers & acquisitions.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2020–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Million Units) and Value (USD Million/Billion) |

|

Segments |

By Material Type, Component, Fluid-mechanism, Type, End-use Industry, and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Sanhua (Spain), Modine Manufacturing Company (U.S.), Danfoss (Denmark), Hydro (Norway), and Kaltra (Germany). |

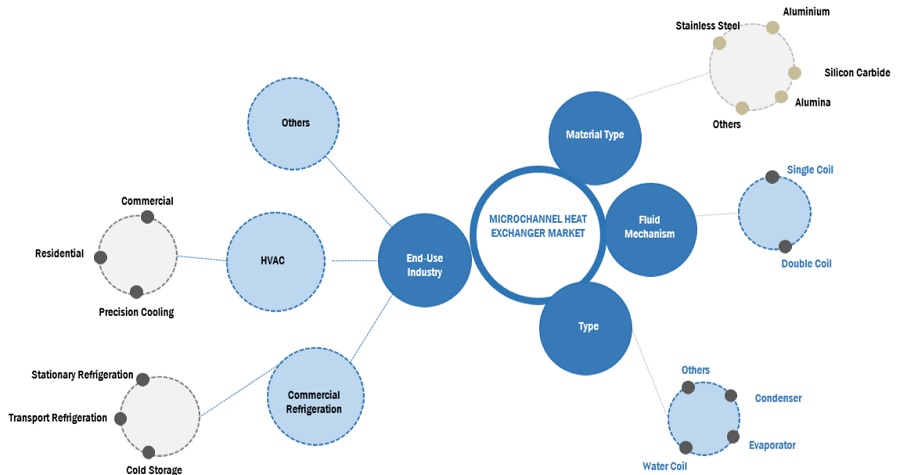

This research report categorizes the microchannel heat exchanger market based on material type, type, component, fluid-mechanism, end-use industry, and region.

By material type:

- Metal based

- Ceramic based

By components:

- Condenser

- Evaporator

- Water coil

- Others

By fluid-mechanism:

- Single coil

- Dual coil

- Multi-coil

By type:

- MCHX

- Round tube plate fin

By end-use industry:

- Automotive

- HVAC

- Commercial refrigeration

- Others

By region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2020, Sanhua introduced its new OPTIFlow microchannel heat exchanger. It's designed with a special feature that makes it 13% better at transferring heat. This makes it a great choice for commercial use.

- In August 2023, Modine, a prominent player in the HVAC sector, partnered with TMS Johnson to support educational administrators and facility supervisors in delivering optimal indoor air quality solutions. Together, they offer a comprehensive selection of HVAC products tailored specifically for schools.

- In December 2021, Kaltra has expanded its production capacity in response to a significant increase in microchannel heat exchanger (MCHE) sales. Additional machinery, including core builders, fin mills, ultrasonic cleaning machines, extruders, and test equipment, has been invested in to boost production capacity by 20%.

Frequently Asked Questions (FAQ):

What is the current size of the global microchannel heat exchanger market?

Global microchannel heat exchanger market size is estimated to reach USD 26.3 billion by 2028 from USD 16.1 billion in 2023, at a CAGR of 10.4% during the forecast period.

Who are the winners in the global microchannel heat exchanger market?

Sanhua, Modine Manufacturing Company, Danfoss, Hydro, and Kaltra fall under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use expansions, joint ventures, and mergers & acquisitions as important growth tactics.

What is the recession on microchannel heat exchanger manufacturers?

Companies may focus more on cost-cutting measures and short-term survival strategies rather than long-term investments. Recessions might bring about shifts in consumer preferences and market demands.

What are some of the drivers in the market?

Energy efficient regulations and stringent emission standards .