※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

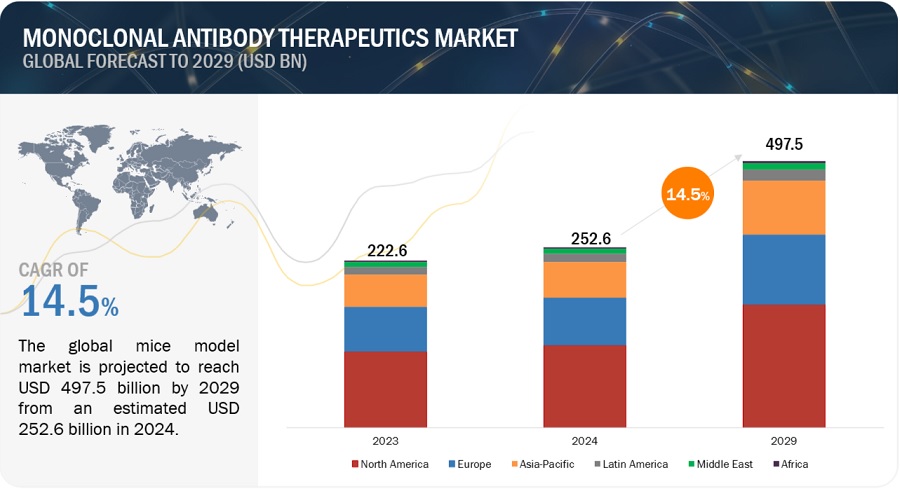

The size of global monoclonal antibody therapeutics market in terms of revenue was estimated to be worth $252.6 billion in 2024 and is poised to reach $497.5 billion by 2029, growing at a CAGR of 14.5% from 2024 to 2029. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

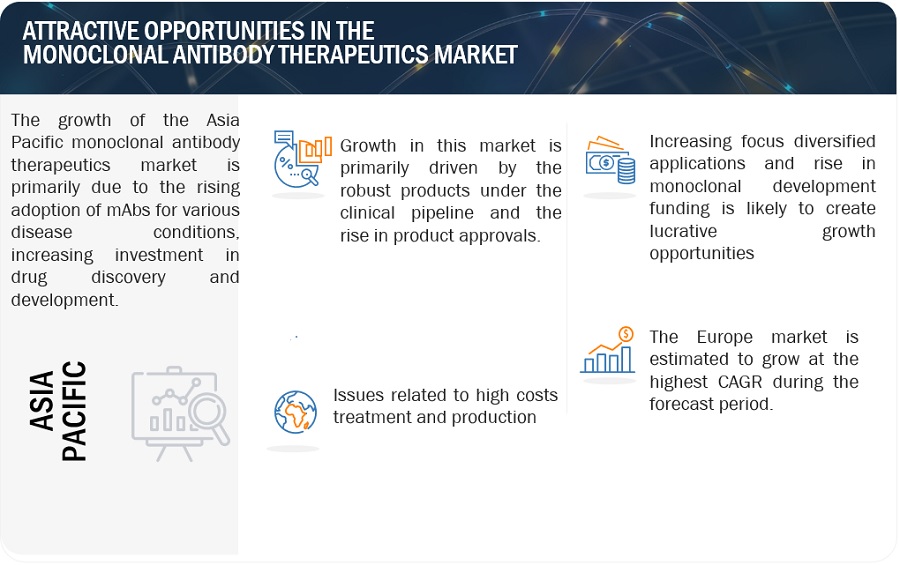

Driving factors of the market, including clinical trials, encompass increasing prevalence of complex diseases, advancements in biotechnology facilitating targeted treatments, regulatory support expediting approval processes, and robust investments in research and development. Clinical trials play a pivotal role in validating efficacy, safety, and commercial viability, driving market growth.

Monoclonal Antibody Therapeutics Market- Global Forecast to 2029

Attractive Opportunities in the Monoclonal Antibody Therapeutics Market

Global Monoclonal Antibody Therapeutics Market Dynamics

DRIVER: Advancements in Biotechnology and Genetic Engineering

Advancements in biotechnology and genetic engineering are pivotal in propelling the growth of the market. Techniques such as recombinant DNA technology enable the production of monoclonal antibodies with enhanced efficacy, reduced immunogenicity, and improved pharmacokinetics. Moreover, innovations in cell culture systems and protein engineering facilitate the development of novel therapeutic candidates, expanding the treatment landscape for various diseases, including cancer, autoimmune disorders, and infectious diseases, driving market expansion and innovation.

RESTRAINT: Cost Burden on patients

The cost burden on patients presents a significant restraint to the growth of the market. These treatments often come with high price tags due to complex manufacturing processes and extensive research and development costs. As a result, accessibility and affordability issues arise, limiting patient access and hindering market expansion. Efforts to address pricing concerns, such as the introduction of biosimilars and reimbursement strategies, are crucial to mitigate this barrier and promote market growth.

OPPORTUNITY: Expansion into new therapeutic areas

Expansion into new therapeutic areas is creating growth opportunities for the market. With ongoing research and development efforts, monoclonal antibodies are being explored for a wider range of diseases beyond their traditional applications, including neurological disorders, infectious diseases, and rare genetic conditions. This diversification of indications broadens the market scope, attracting investment and fostering innovation, ultimately driving growth and advancing the role of monoclonal antibodies in modern healthcare.

CHALLENGE: Data interpretation challenges

The high cost of monoclonal antibody (mAb) development poses significant challenges for the growth of the market. From research and preclinical studies to clinical trials and manufacturing, the process entails substantial expenses. These costs are often passed on to patients, limiting accessibility and affordability. Addressing this challenge requires innovative financing models, collaborative efforts among stakeholders, and optimization of manufacturing processes to reduce production expenses and improve market sustainability.

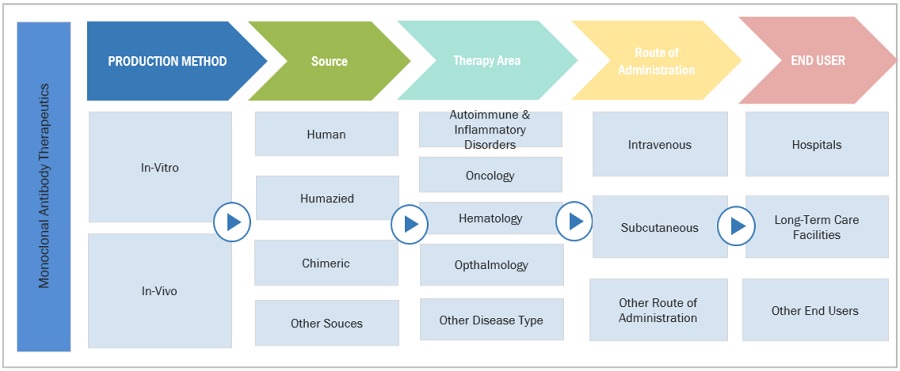

Global Monoclonal antibody therapeutics Industry Ecosystem Analysis

The monoclonal antibody therapeutics market ecosystem comprises production method, source, therapy area, route of administration, regulatory authorities, and end users, such as hospitals, long-term care facilities and other end users.

In-Vitro segment held a dominant share in production method segment in the monoclonal antibody therapeutics industry

On the basis production method, the monoclonal antibody therapeutics market is segmented into in-vitro and in-vivo. In 2023, in-vitro segment accounted for the largest share of the global market. Driving factors of the in-vitro production method monoclonal antibody-therapeutics market include scalability, cost-effectiveness, and reduced batch-to-batch variability.

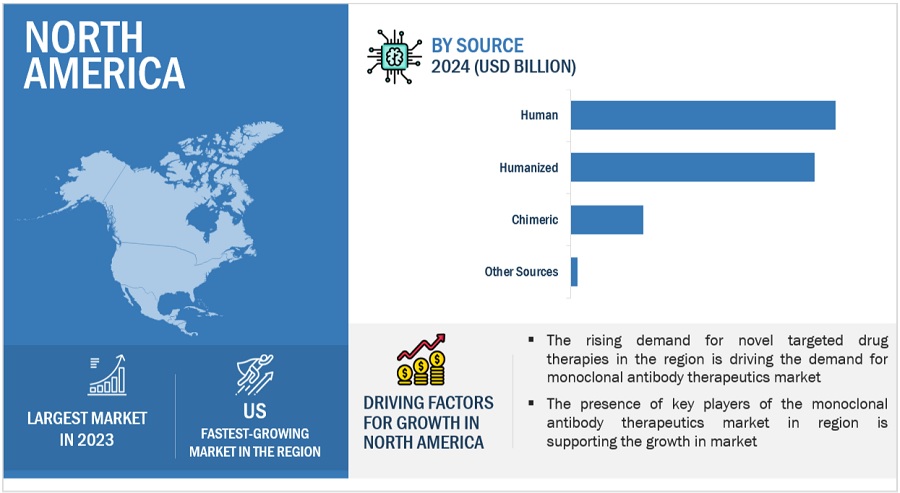

Human segment held a dominant share in source segment in the monoclonal antibody therapeutics industry

On the basis of sources, the monoclonal antibody therapeutics market is segmented into human, humanized, chimeric and other sources. In 2023, human source segment dominated market and humanized segment is likely to grow at significant CAGR during the forecast period of 2024-2029. Driving factors of the human source monoclonal antibody-therapeutics market include enhanced efficacy, reduced immunogenicity, and improved safety profiles. Examples: Monoclonal antibodies derived from humanized or fully human sources like adalimumab (Humira) and pembrolizumab (Keytruda).

Oncology is likely to grow at significant CAGR in the monoclonal antibody therapeutics industry

On the basis therapy area, the monoclonal antibody therapeutics market is segmented into autoimmune & inflammatory disorders, oncology, hematology, opthalmology and other therapy areas. Autoimmune & inflammatory diseases dominated the global market in 2023. Driving factors of onocology as a therapy area in the market include high incidence rates, increasing awareness, and demand for targeted treatments.

The hospitals segment of the monoclonal antibody therapeutics industry is expected to register fastest growth during the forecast period.

Based on the hospitals, monoclonal antibody therapeutics market has been segmented into hospitals, long-term care facilities, and other end users. In 2023, the hospitals segment accounted for the largest share in global market. Driving factors of the hospitals end user segment in the market include advanced infrastructure, access to specialized care, and higher patient volumes.

North America accounted for the largest share of the monoclonal antibody therapeutics industry in 2023

Geographically, the monoclonal antibody therapeutics market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. North America's dominance in the global market is driven by robust research and development infrastructure, high healthcare expenditure, supportive regulatory frameworks like the FDA, and a large patient pool. Major companies like Genentech, Amgen, and Pfizer contribute to this dominance.

Key players in the global monoclonal antibody therapeutics market include F. Hoffmann-La Roche Ltd (Switzerland), Abbvie Inc. (US), Johnson & Johnson Services, Inc. (US), Merck & Co., Inc. (US), Bristol Myers Squibb Company (US), AstraZeneca (UK), Sanofi (France), Novartis AG (Switzerland), Amgen Inc. (US), Takeda Pharmaceutical Company Limited (Japan), GSK plc. (UK), Eli Lilly and Company (US), Regeneron Pharmaceuticals Inc. (US), Biogen (US), UCB S.A. (Belgium), Boehringer Ingelheim International GmbH (Germany), Y-mAbs Therapeutics Inc. (US), Teva Pharmaceutical Industries Ltd. (Israel) and among others.

Scope of the Monoclonal Antibody Therapeutics Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2024 |

$252.6 billion |

|

Projected Revenue Size by 2029 |

$497.5 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 14.5% |

|

Market Driver |

Advancements in Biotechnology and Genetic Engineering |

|

Market Opportunity |

Expansion into new therapeutic areas |

This report categorizes the monoclonal antibody therapeutics market to forecast revenue and analyze trends in each of the following submarkets:

By Production Method

- In-Vitro

- In-Vivo

By Sources

- Human

- Humanized

- Chimeric

- Other Sources

By Route of Administration

- Intravenous

- Subcutaneous

- Other Route of Administration

By Therapy Area

- Autoimmune & Inflammatory Disorders

- Oncology

- Hematology

- Ophthalmology

- Other Therapy Areas

By End User

- Hospitals

- Long-term Care Facilities

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Turkey

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Indonesia

- Malaysia

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Rest of Latin America (RoLATAM)

-

Middle East & Africa

-

Middle East

-

GCC Countries

- Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- Rest of GCC Countries

- Rest of Middle East (RoME)

-

GCC Countries

-

Middle East

- Africa

Recent Developments of Monoclonal Antibody Therapeutics Industry:

- In January 2024, UCB Inc., received U.S. FDA approval for RYSTIGGO (rozanolixizumab-noli) or the treatment of generalized myasthenia gravis (gMG) in adult patients who are anti-acetylcholine receptor (AchR) or anti-muscle-specific tyrosine kinase (MuSK) antibody positive.

- In August 2023, Regeneron Pharmaceuticals, Inc. received U.S. FDA approval Veopoz (pozelimab-bbfg) for the treatment of adult and pediatric patients 1 year of age and older with CHAPLE disease, also known as CD55-deficient protein-losing enteropathy.

- In August 2023, Pfizer received U.S. FDA accelerated approval for ELREXFIO (elranatamab-bcmm) for the treatment of adult patients with relapsed or refractory multiple myeloma (RRMM) who have received at least four prior lines of therapy.

- In August 2023, Janssen Pharmaceutical Companies of Johnson & Johnson received U.S. FDA accelerated approval for TALVEY (talquetamab-tgvs), a first-in-class bispecific antibody for the treatment of adult patients with relapsed or refractory multiple myeloma who have received at least four prior lines of therapy,

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global monoclonal antibody therapeutics market?

The global monoclonal antibody therapeutics market boasts a total revenue value of $497.5 billion by 2029.

What is the estimated growth rate (CAGR) of the global monoclonal antibody therapeutics market?

The global monoclonal antibody therapeutics market has an estimated compound annual growth rate (CAGR) of 14.5% and a revenue size in the region of $252.6 billion in 2024. .