※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

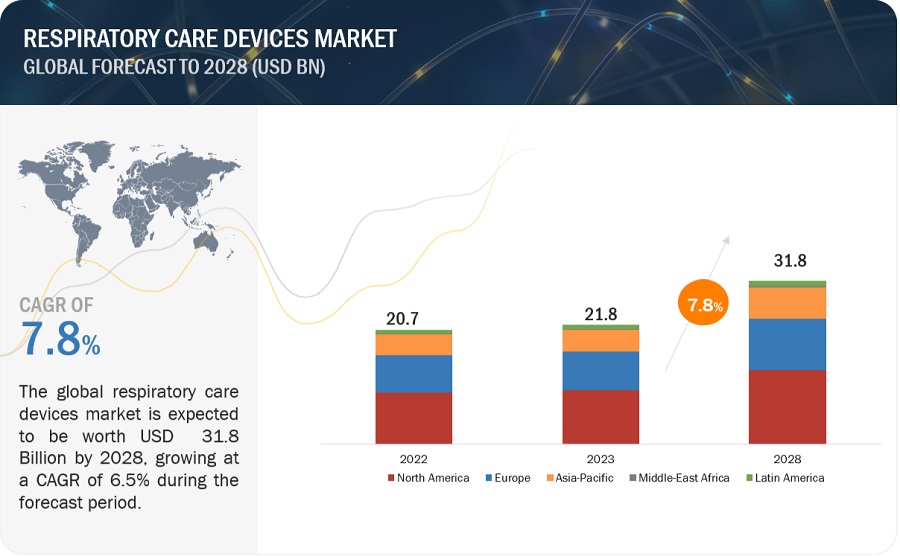

The global respiratory care devices market in terms of revenue was estimated to be worth $21.8 billion in 2023 and is poised to reach $31.8 billion by 2028, growing at a CAGR of 7.8% from 2023 to 2028. Growth in this market is largely driven by the growth in the number of patients suffering from respiratory disorders, such as COPD and asthma, increase in overweight and obese population, and rising number of preterm births. Globally, the number of preterm births has increased over the past 20 years. Pregnancy at an inappropriate age, generally over 40 years and below 20 years, increases the risk of preterm delivery. Reasons for preterm births include maternal health problems, including diabetes, high blood pressure, and massive usage of infertility treatments. Also, women belonging to specific ethnic groups are genetically prone to preterm births. For instance, the African-American and Hispanic populations in the US have a high risk of preterm births. Smoking and obesity during the pregnancy period further increase the probability of preterm births.

Attractive Opportunities in Respiratory Care Devices Market

Respiratory Care Devices Market Dynamics

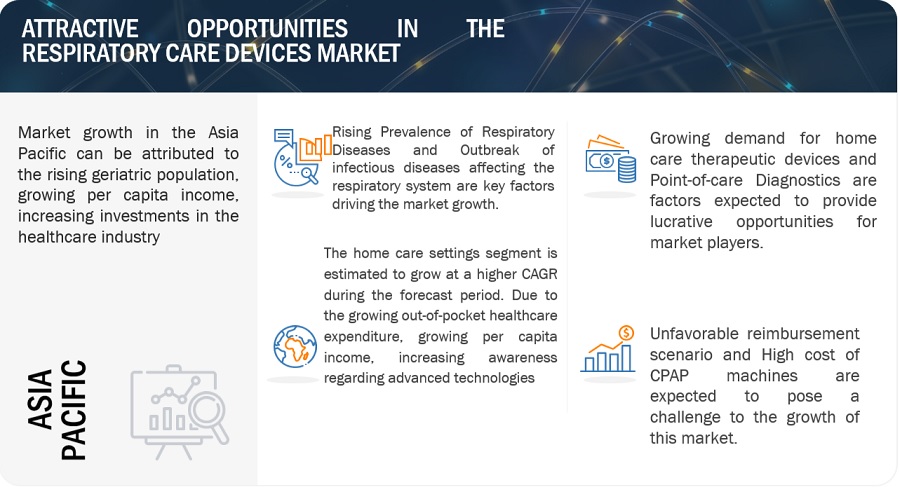

Driver: Rising Prevalence of Respiratory Diseases

Some of the major causes of COPD are long-term asthma and prolonged exposure to tobacco smoke, indoor & outdoor air pollution, and occupational fumes & dust. Other comorbid chronic conditions, including cardiovascular disease, musculoskeletal impairment, and diabetes mellitus, are related to COPD. These conditions may also impact the health status of patients, as well as interfere with COPD management. According to the WHO, in 2019, about 262 million people were suffering, and 0.5 million people died from asthma. In asthma, morbidity and mortality still remain important issues, and disease normalization is not achieved by any treatment. By 2025, it is expected that 100 million more asthmatic patients will increase globally. In the US, the condition affects 1 in every 12 people, and in Europe, there are nearly 10 million people over 45 years of age living with asthma. It is estimated that up to 1,000 people die as a result of asthma every day.

Restraint: Unfavorable reimbursement scenario

Many patients rely on reimbursements to receive treatment. The diagnostic industry, as a whole, and respiratory care diagnostics, in particular, is presently facing the challenge of a lack of reimbursements for various diagnostic tests. The Centers for Medicare & Medicaid Services (CMS) have released the 2020 Medicare Physician Fee Schedule on November 1st. As per the CMS, the final payment rates for home sleep tests are aligned with the changes initiated by the CMS. Medicare national payment rates for CPT 95800 (sleep study, heart rate, oxygen saturation, and simultaneous recording; respiratory analysis, by airflow or peripheral arterial tone; and sleep time) almost remained the same, with a 2% decline as compared to the previous year. Medicare payment amounts for CPT 95806 (unattended, simultaneous recording of sleep study, oxygen saturation, respiratory airflow, heart rate and respiratory effort, and thoracoabdominal movement) continue with a 15% decrease in global service payment from the previous year. The difference between the two codes is that CPT 95800 may include the use of Peripheral Arterial Tone technology and the requirement for the measurement of sleep time by the devices.

Opportunity: Point-of-care Diagnostics

Point-of-care (POC) testing is performed at or near the site of patient care. Improvements in the level of accuracy of tests and the increasing number of diagnostic tests for different conditions are the major factors that are providing a niche market opportunity for POC devices in respiratory diagnostics.

Increased self-testing by patients is a major factor driving the growth of the POC respiratory disease diagnostics market. Technological advancements, which are leading to devise miniaturization and enabling microfabrication processes, are expected to support the trend of POC testing and the management of respiratory diseases in the coming years. Government bodies of both developed and developing countries have recognized that POC technology provides an ideal prospect for the expansion of public healthcare networks and addressing the unmet medical needs of patients. In addition, the decreasing number of skilled technicians in the centralized system is increasing the preference for POC testing.

Challenges: Lack of patient compliance

Lack of patient compliance to CPAP therapy is a crucial factor challenging the growth of the market. Treatment compliance has always been an issue with respiratory and sleeping-related disease patients, mainly due to various issues such as lack of affordability and comfort. Patients are also not willing to bear treatment costs due to very weak reimbursements in geographies like Asia (India and China) and RoW. Non-compliance is found to be more rampant among CPAP users. Studies show that around 30% to 50% of patients experience difficulties in continuing CPAP treatments due to its claustrophobic nature. Another survey discovered that about half of CPAP patients stopped using their device within 1–3 weeks of use, with discomfort from the masks or airflow being the major reason for non-compliance with treatment.

Reimbursement Scenario

|

Respiratory Care Device |

Description |

Example |

Reimbursement Scenario |

|

Continuous Positive Airway Pressure (CPAP) Device |

A device used to treat sleep apnea by delivering a continuous stream of air pressure to keep airways open during sleep. |

ResMed AirSense 10 |

Typically covered by Medicare and private insurance. Reimbursement varies based on the payer's fee schedule and the patient's coverage. Patients may need to meet deductible and copayment requirements. |

|

Ventilators |

Mechanical devices that support breathing by delivering controlled amounts of air and oxygen to patients who cannot breathe adequately on their own. |

Philips Respironics Trilogy 100 |

Covered by Medicare and private insurance. Reimbursement varies based on the type of ventilator, settings, and duration of use. May require prior authorization. |

|

Nebulizers |

Devices that convert liquid medication into a fine mist for inhalation, often used for respiratory conditions like asthma or COPD. |

Omron MicroAir |

Covered by Medicare and private insurance. Reimbursement may include the cost of the nebulizer, medication, and necessary supplies. Specific reimbursement rates depend on the insurance plan. |

RESPIRATORY CARE DEVICES MARKET ECOSYSTEM

Leading players in this market include well-established and financially stable service providers of respiratory care devices. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in this market include Koninklijke Philips N.V. (Netherlands), General Electric Healthcare (US), ResMed Inc. (US), Fisher & Paykel Healthcare Corporation Limited (New Zealand), and Medtronic plc (Ireland).

The ICU ventilators segment accounted for the larger share of the respiratory care devices industry.

By type, the respiratory care devices market is segmented into ICU ventilators and portable/transportable ventilators. The ICU ventilators segment accounted for the larger share of the ventilators market in 2022. Factors such as the rising number of intensive care beds equipped with ventilators, increasing ICU admission and re-admissions in developed countries, and the favorable reimbursement scenario are supporting the growth of the ICU ventilators segment. Due to the susceptibility of geriatric individuals to develop severe health problems, the volume of patients being treated in critical care units is increasing, which in turn is driving the demand for intensive care beds.

The COPD segment of the respiratory care devices industry is estimated to grow at a higher CAGR during the forecast period.

Based on disease indication, the respiratory care devices market is segmented into chronic obstructive pulmonary disease (COPD), asthma, sleep apnea, infectious diseases, and other disease indications The COPD segment is estimated to grow at a higher CAGR during the forecast period. One of the major causes of COPD is tobacco smoking. According to the US Centers for Disease Control and Prevention (CDC), as many as 8 in 10 COPD-related deaths are due to smoking. Additionally, rising indoor and outdoor air pollution levels, exposure to dust and chemicals are other factors driving the prevalence of COPD.

The home care settings segment of the respiratory care devices industry is expected to grow at the highest CAGR during the forecast period.

The respiratory care devices market is segmented into home care settings, hospitals, ambulatory care centers and other end users based on end users. Home care is the fastest-growing segment for respiratory care devices, mainly due to their convenience to patients. Sleep apnea therapeutics is one of the key markets for home care respiratory devices. The growing use of positive airway pressure devices for sleep apnea therapy is the primary contributor to the growth of this market segment.

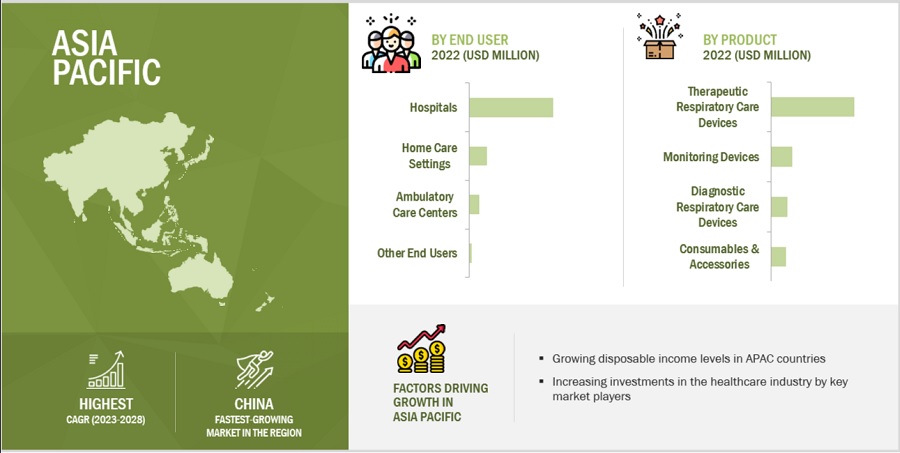

APAC is estimated to be the fastest-growing regional market for respiratory care devices industry.

The global respiratory care devices market is segmented into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for respiratory care devices. The APAC market is becoming a medical tourism hub and is considered one of the fastest-growing medical procedures and devices markets. Low infrastructure and treatment costs and the availability of highly educated physicians have driven medical tourists to APAC countries, particularly India and China

The respiratory care devices market is dominated by a few globally established players such as Koninklijke Philips N.V. (Netherlands), General Electric Healthcare (US), ResMed Inc. (US), Fisher & Paykel Healthcare Corporation Limited (New Zealand), and Medtronic plc (Ireland). Major players adopt growth strategies to expand their geographical presence and garner higher shares in the global market.

Scope of the Respiratory Care Devices Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$21.8 billion |

|

Estimated Value by 2028 |

$31.8 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 7.8% |

|

Market Driver |

Rising Prevalence of Respiratory Diseases |

|

Market Opportunity |

Point-of-care Diagnostics |

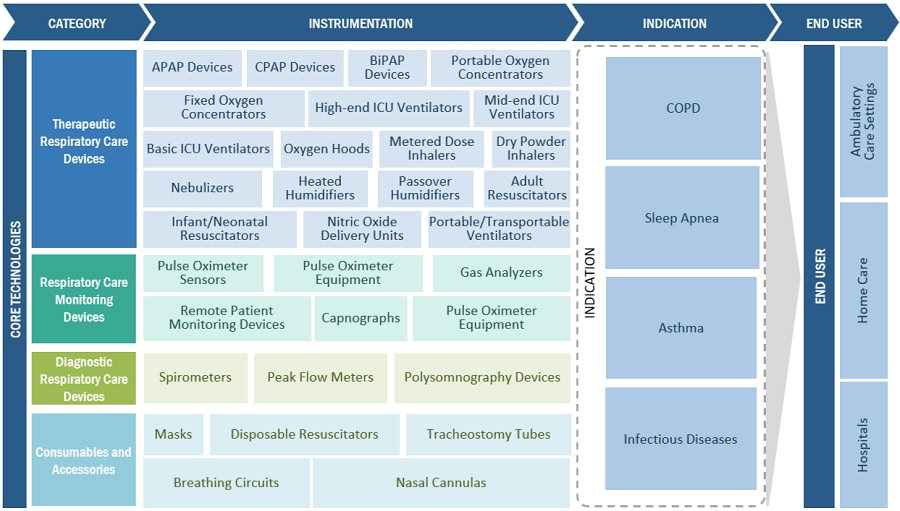

The study categorizes the respiratory care devices market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Therapeutic Respiratory Care Devices

- PAP Devices

- CPAP Devices

- APAP Devices

- BiPAP Devices

- Ventilators

- ICU Ventilators

- High-end Ventilators

- Mid-end Ventilators

- Basic Ventilators

- Portable/transportable Ventilators

- Nebulizers

- Jet Nebulizers

- Mesh Nebulizers

- Ultrasonic Nebulizers

- Humidifiers

- Heated Humidifiers

- Passover Humidifiers

- Oxygen Concentrators

- Fixed Oxygen Concentrators

- Portable Oxygen Concentrators

- Inhalers

- Metered-dose Inhalers (MDIs)

- Dry Powder Inhalers (DPIs)

- Reusable Resuscitators

- Nitric Oxide Delivery Units

- Oxygen Hoods

- Monitoring Devices

- Pulse Oximeters

- Pulse Oximeter Sensors

- Pulse Oximeter Equipment

- Capnographs

- Gas Analyzers

- Diagnostic Respiratory Care Devices

- Spirometers

- Polysomnography Devices (PSG Devices)

- Peak Flow Meters

- Other Diagnostic Devices

- Consumables & Accessories

- Masks

- Reusable Masks

- Disposable Masks

- Disposable Resuscitators

- Tracheostomy Tubes

- Breathing Circuits

- Nasal Cannulae

- Other Consumables & Accessories

By Disease Indication

- Chronic Obstructive Pulmonary Disease (COPD)

- Sleep Apnea

- Asthma

- Infectious Diseases

- Other Disease Indications

By End User

- Hospitals

- Home Care Settings

- Ambulatory Care Centers (ACCs)

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global respiratory care devices market?

The global respiratory care devices market boasts a total revenue value of $31.8 billion by 2028.

What is the estimated growth rate (CAGR) of the global respiratory care devices market?

The global respiratory care devices market has an estimated compound annual growth rate (CAGR) of 7.8% and a revenue size in the region of $21.8 billion in 2023.