※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

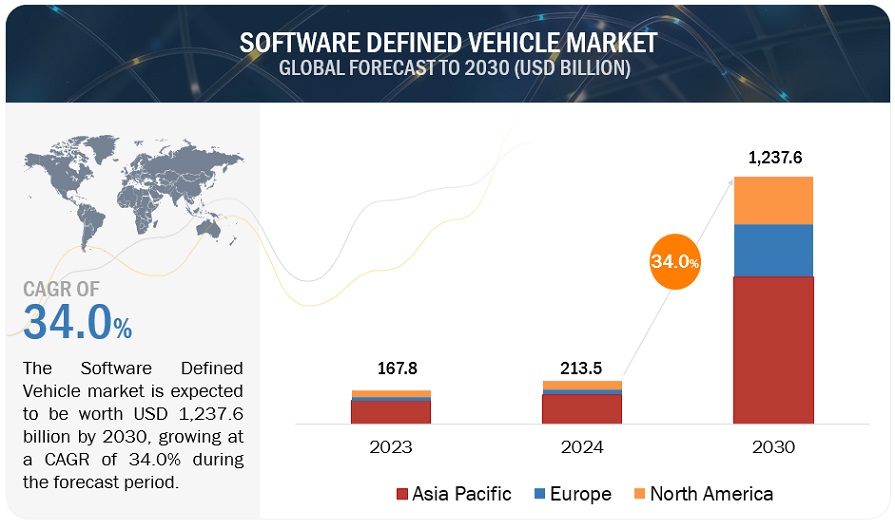

[238 Pages Report] The Software Defined Vehicle Market size is projected to grow from USD 213.5 billion in 2024 to USD 1,237.6 billion by 2030, at a CAGR of 34.0%. With the increase in the adoption of 5G technology in vehicles and autonomous driving experience, primarily in emerging markets, are expected to increase the demand for SDV solutions globally. Moreover, the increasing adoption of EVs and growing demand for driving experience and intelligent cockpits are also expected to create lucrative opportunities for the Software Defined Vehicle market globally in the coming years.

Software Defined Vehicle market Dynamics:

Driver: Reduced recall and manufacturing costs

In conventional vehicles there are limitations with respect to predefined hardware configurations. When the faults identified in hardware, it often needs extensive recall campaigns, leading to substantial costs and logistical challenges for manufacturers. However, with the introduction of SDVs, a lot of the functionality previously controlled by hardware components is now controlled by software and over-the-air updates. Because issues can frequently be fixed online, this change drastically lowers the requirement for actual recalls. For example, car owners don't have to visit service centers to get software faults or performance optimizations fixed quickly. This reduces operational costs for manufacturers by reducing the costs associated with physical recalls and servicing campaigns and improves customer satisfaction by limiting disruptions.

Restraint: Increase in risk of cyberattacks

The risk of cyberattacks is increased due to the integration of complex software systems and connection elements in modern cars, which leads to loopholes that hackers could attack. One of the primary concerns is the potential for remote hacking of SDVs. Vehicles are becoming more and more convenient targets for hackers looking to cause disruption with operations or steal confidential information since they depend more and more on software for essential features such as navigation, autonomous driving, and V2X communication. Software development shortcomings, insecure safety protocols, and inadequate encryption procedures can expose SDVs to unauthorized access and control.

Opportunity:SDV platform monetization

OEMs and technology providers generate new revenue streams by SDV platform monetization through innovative software and services. This shift from a hardware-centric to a software-centric business model boosts profitability and advances continuous customer engagement and loyalty. The monetization of SDV platforms can be achieved through various strategies. For instance, OEMs can offer premium features such as ADAS, enhanced navigation, and entertainment options on a pay-per-use or subscription basis. These features can be dynamically updated and customized to individual preferences. Additionally, data-Defined services such as predictive maintenance, remote diagnostics, and fleet management can offer valuable insights and operational efficiencies for both individual users and commercial fleet operators.

Challenge: Complex software updates and security patching

The updates and maintenance in conventional vehicles were primarily mechanical, involving physical parts and periodic service checks. However, nowadays vehicles are become increasingly software-Defined and the maintenance landscape has shifted toward continuous software updates and security patching. This shift brings about new complexities and challenges that manufacturers and service providers must address to ensure vehicle safety, functionality, and security. Managing software updates in SDVs involves coordinating an array of interconnected systems, each with its unique requirements and dependencies. The complexity is further increased by the need to perform these updates remotely, often while the vehicle is in use. Security patching in SDVs presents another layer of complexity. As vehicles become more connected, they become more vulnerable to cyber threats. Hackers can exploit vulnerabilities in the software to gain control of critical vehicle functions, posing serious safety risks. Hence, timely and effective security patching is crucial. Moreover, patching security flaws must be done so as not to disrupt the vehicle's functionality or the driver's experience. This requires a complex balance between rapid response to emerging threats and thorough testing to ensure patches do not cause potential hazards.

SOFTWARE DEFINED VEHICLE MARKET ECOSYSTEM

The ecosystem analysis highlights various players in the Software Defined Vehicle ecosystem, which OEMs, SDV providers, Tier 1 Hardware provider, Tier 2 players, and chip providers primarily represent. Prominent companies in this market include Tesla (US), Li Auto Inc. (China), NIO (China), ZEEKR (China), XPENG Inc. (China), Rivian (US), among others.

Domain Centralized Architecture is projected to witness significant growth rate in the global Software Defined Vehicle market during the forecast period.

Legacy OEM which are planning for a shift to software-based architectures, are transitioning to domain-centralized architecture as a transition towards zonal control architecture. In such vehicles, functions are grouped into domains such as powertrain, body, and ADAS, each controlled by a few powerful ECUs. This reduces the number of ECUs to around 20-40 per vehicle, streamlining operations and improving integration. However, vehicles are becoming more technologically advanced and software-focused, so they define function based on domains. Key legacy OEMs such as Mercedes-Benz (Germany), BMW (Germany), Ford (US), General Motors (US), Volkswagen AG (Germany), Renault Group (Germany), BYD (China), and Toyota (Japan) have shifted to this architecture with developments in their latest vehicle platforms. Mercedes-Benz has shifted to domain centralized architecture in its MB.OS integrated MB.EA, MB.Van, AMG.E platforms. For instance, BMW has shifted to this architecture with its new vehicle skateboards through its CLAR New Class platform. Other examples include STLA Small to Frame platforms and the MEB platforms of Stellantis and Volkswagen, respectively, which come with domain centralized architecture.

Leading manufacturers such as Tesla (US), Li Auto Inc. (China), NIO (China), ZEEKR (China), XPENG Inc. (China), and Rivian (US), are integrating SDV technology into their vehicles. Companies such as Stellantis, BMW, Volkswagen, and BYD are transitioning towards SDVs to offer software Defined passenger cars.

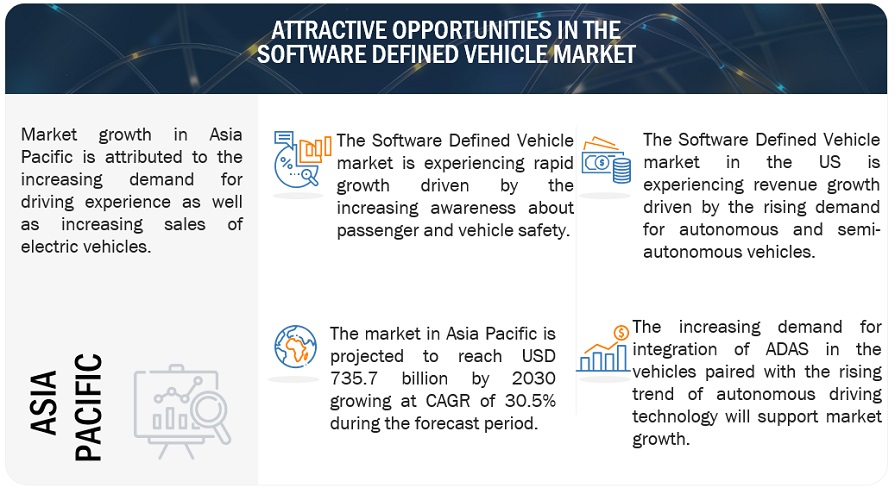

“The Asia Pacific Software Defined Vehicle market is projected to hold the largest share by 2030.”

Asia Pacific is estimated to be the largest market for SDVs by 2030. In this region, leading countries such as China, Japan, India, and South Korea are expected to develop autonomous driving technology in the coming years. Leading OEMs in this region, such as Toyota, BYD, and Hyundai, have utilized the advantages of R&D in autonomous technology and collaborated with various technology enablers such as SAMSUNG, among others to enhance their SDV capabilities. China is expected to be the most significant factor in the Asia Pacific Software Defined Vehicle market growth in terms of value & volume. China leads the region in terms of value and volume for Software Defined Vehicle market, which can also be attributed to the increased demand for EVs and increased sales of vehicles equipped with SDV technology. For example, ZEEKR 001, XPENG P5, XPENG P7, ZEEKR X, and BYD Seal H6 are some of the models in China equipped with SDVs.

Key Market Players

The global Software Defined Vehicle market is dominated by major players such as Tesla (US), Li Auto Inc. (China), NIO (China), Rivian (US), XPENG Inc. (China), and ZEEKR (China) and among others. These companies have strengthened distribution networks at a global level and offer a wide range of SDVs such as XPENG P5, Rivian R1T, Tesla Model Y, among others. The key strategies these companies adopt to sustain their market position are collaborations, new product developments, acquisitions, etc.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2030 |

|

Forecast units |

Volume (Thousand Units) & Value (USD Billion) |

|

Segments Covered |

SDV Type, Vehicle Type, E/E Architecture, and Region |

|

Geographies covered |

Asia Pacific, North America, and Europe. |

|

Companies Covered |

Tesla (US), Li Auto Inc. (China), NIO (China), Rivian (US), ZEEKR (China), XPENG Inc. (China) |

This research report categorizes the SDV market based on SDV type, vehicle type, E/E Architecture, and region.

Software Defined Vehicle Market, By SDV Type

- Semi-SDV

- SDV

Software Defined Vehicle Market, By E/E Architecture

- Distributed Architecture

- Domain Centralised Architecture

- Zonal Control Architecture

Software Defined Vehicle Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

Software Defined Vehicle Market, By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Spain

-

Asia Pacific

- China

- Japan

- South Korea

Recent Developments

- In June 2024, XPENG Inc. partnered with NVIDIA Corporation for the adoption of the NVIDIA DRIVE Thor platform for its next-generation EVs. This platform will power XPENG's XNGP AI-assisted driving system, enhancing intelligent driving capabilities. XPENG launched the G6 Coupe SUV, G9 SUV, and P7 Sedan equipped with NVIDIA DRIVE Orin, boasts continuously upgraded AI capabilities through over-the-air updates.

- In June 2024, XPENG Inc. launched its all-new G6 electric mid-size SUV, positioning it as a strong contender against established rivals like the Tesla Model Y in the Australian market. It is designed on XPENG's SEPA 2.0 platform. The vehicle also features bidirectional charging (V2X) with V2L support up to 3.3 kW AC, making it versatile for energy transfer to external devices. This SUV accelerates from 0 to 100 km/h in 6.9 seconds and reaches a top speed of 200 km/h, powered by a rear-wheel drive system generating 190 kW (258 PS) of total power and 440 Nm of torque. Its battery architecture operates at 800 V, and it supports up to 11 kW AC charging.

- In June 2024, Rivian launched the second generation of the R1 lineup i.e., R1S and R1T models with software-defined technology. These vehicles feature a streamlined electrical architecture, reducing ECUs from 17 to 7 and significantly cutting down wiring. The new Rivian Autonomy Platform, powered by advanced sensors and AI, enhances driving assistance capabilities. In-vehicle connectivity includes digital car keys via Apple Wallet and Google Pixel, a rich entertainment system with streaming video and Apple Music integration, and an interactive user interface powered by Unreal Engine.

- In April 2024, Li Auto launched Li L6, which is a five-seat premium family SUV, available in Pro and Max trims. Li L6 offers a spacious, high-tech interior, advanced safety features, and robust performance with an extended range of 1,390 kilometers. The Li L6 combines luxury with advanced technology, featuring a four-screen interactive system powered by the Qualcomm Snapdragon 8295P chip for a seamless infotainment experience. The Li L6 Pro includes the Li AD Pro autonomous driving system, using a Horizon Robotics Journey 5 chip for enhanced computing power, while the Li L6 Max boasts the Li AD Max system with dual Orin-X chips for superior autonomous driving capabilities.

- In April 2024, ZEEKR launched ZEEKR MIX, the first model built on the sustainable experience architecture (SEA)-M platform. All SEA-M-based vehicles will meet global five-star safety standards and qualify for IIHS Top Safety Pick. The ZEEKR MIX, the fifth model from ZEEKR and the first on the SEA-M platform, has a length of 4.7 meters, a 3-meter wheelbase length, and a ground clearance of 39 centimeters.

- In March 2024, Panasonic Holdings Corporation and Mazda Motor Corporation partnered and installed full-display meters for the CX-70 model of Mazda Motor Corporation. The CX-70 integrates a large 12.3-inch display, showcasing graphics of the vehicle conditions, such as speed and warnings. It adapts in real-time to offer drivers timely and pertinent information, enhancing their safety and driving experience.

Frequently Asked Questions (FAQ):

What is the current size of the Software Defined Vehicle market?

The Software Defined Vehicle market is estimated to be USD 213.5 billion in 2024 and is projected to reach USD 1,237.6 billion by 2030.

Who are the winners in the global Software Defined Vehicle market?

The Software Defined Vehicle market is dominated by global players such as Tesla (US), Li Auto Inc. (China), NIO (China), Rivian (US), and XPENG Inc. (China) among others. These companies develop new products, adopt expansion strategies, and undertake collaborations, partnerships, and mergers & acquisitions to gain traction in the Software Defined Vehicle market.

What are the new market trends impacting the growth of the Software Defined Vehicle market?

Increasing demand for ADAS digital cockpits in vehicles and the adoption of 5G technology are major trends affecting this market.

Which region is expected to be the largest market during the forecast period?

Asia Pacific is expected to be the largest market in the Software Defined Vehicle market due to increased demand for SDVs and increased sales of vehicles equipped with autonomous technology, especially in China.

What is the total CAGR expected to be recorded for the Software Defined Vehicle market during 2024-2030?

The CAGR is expected to record a CAGR of 34.0% from 2024-2030. .