※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

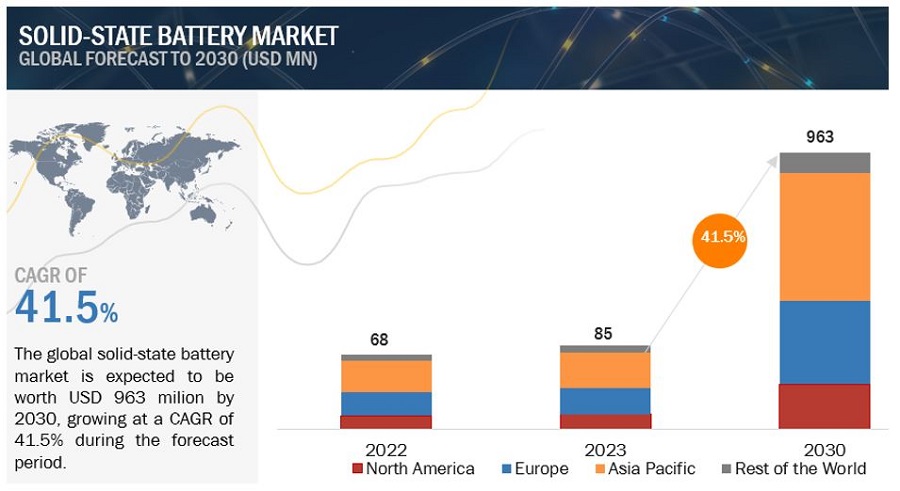

[208 Pages Report] The global solid-state battery market size is expected to grow from USD 85 million in 2023 to USD 963 million by 2030, at a CAGR of 41.5% from 2023 to 2030. The demand for wearable devices is continuously increasing in the consumer electronics and healthcare sectors along with the industrial sector. Moreover, the advent of mobile healthcare devices and wireless healthcare monitoring systems has transformed the global healthcare sector. The market for wearable electronics is continuously flourishing with new product launches and developments. These devices require small and compact form factor batteries such as solid-state batteries, and hence, the demand for solid-state batteries is expected to increase in wearable devices.

Solid-State Battery Market Forecast to 2030

Market Dynamics

DRIVERS: Rising demand for miniaturized and compact electronic devices

The ongoing miniaturization of devices such as mobile phones, watches, and medical devices is contributing to the demand for miniaturized electronic components. This miniaturization trend is driving the demand for small and compact solid-state batteries. These batteries offer high energy density, longer lifespan, and are safer than traditional lithium-ion batteries. All these advantages make them an ideal choice for powering small and lightweight devices such as IoT devices, smartphones, wearable devices, and IoT devices.

RESTRAINTS: Complexity of manufacturing processes

There are some issues related to the manufacturing process of solid-state batteries, which makes the process complex. The first one is to develop a solid electrolyte that can be both ionically conductive as well as stable. Moreover, the interface between solid electrolytes and electrodes should be very carefully designed to avoid performance degradation. Another issue is the requirement for specialized equipment and processes to manufacture these batteries. These factors could impact the market growth in a negative manner.

OPPORTUNITIES: Increasing investments in research and development of solid-state batteries

Continuous research and development efforts by market players to develop cost-efficient and advanced solid-state batteries are expected to drive the growth of this market in the near future. These efforts are mainly focused on decreasing production costs, improving stability, and increasing awareness about the benefits of these batteries over conventional lithium-ion batteries. Main efforts are being taken in the field of electrolyte material research to make it safe and stable.

CHALLENGES: High cost of solid-state batteries

Solid-state batteries are presently more expensive than the conventional lithium-ion batteries used in consumer electronics and electric vehicles. Some of the key reasons for the higher costs include expensive raw materials, complex manufacturing processes, and lower production volume at this point in time. The high cost is currently limiting the mass adoption of these batteries in many applications, but market players are continuously working on bringing down the development and production costs.

Solid-State Battery Market Ecosystem

Prominent companies in this market include Blue Solutions (France), QuantumScape Corporation (US), ProLogium Technology Co, Ltd. (Taiwan), and Hitachi Zosen Corporation (Japan). These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Most of the companies in this market are still in the research and development and prototyping phases, with some offering commercial batteries for specific applications.

The market for above 500 mAh is projected to grow with substantial CAGR during the forecast period

Solid-state batteries with a capacity of above 500 mAh are designed for products and devices with high energy requirements and long battery shelf life. The target audience for these batteries includes electric vehicles and energy harvesting, among others. The use cases require high power sources to improve their functionalities and complement the designs of products. These high-power batteries can last longer on a single charge, which makes them ideal for electric vehicles. However, these batteries are currently in the development stage and are expected to be commercialized within three to five years by a few key market players. Growth in the electric vehicles market is expected to fuel the market for solid-state batteries with a capacity range of above 500 mAh in the coming years.

The market for secondary batteries is projected to grow with an impressive CAGR during the forecast period.

Secondary batteries are most suitable for electric vehicles as the complete mechanism of electric vehicles depends on the charging capacity of the battery. Secondary solid-state batteries, having high energy density and charging capabilities, have a huge potential to be employed in electric vehicles. Also, the use of wearable devices and medical devices, such as smartwatches and fitness bands, has increased in recent years, which is expected to drive the market for rechargeable solid-state batteries. Consumer electronic devices also require rechargeable power sources, thus creating an opportunity for market growth.

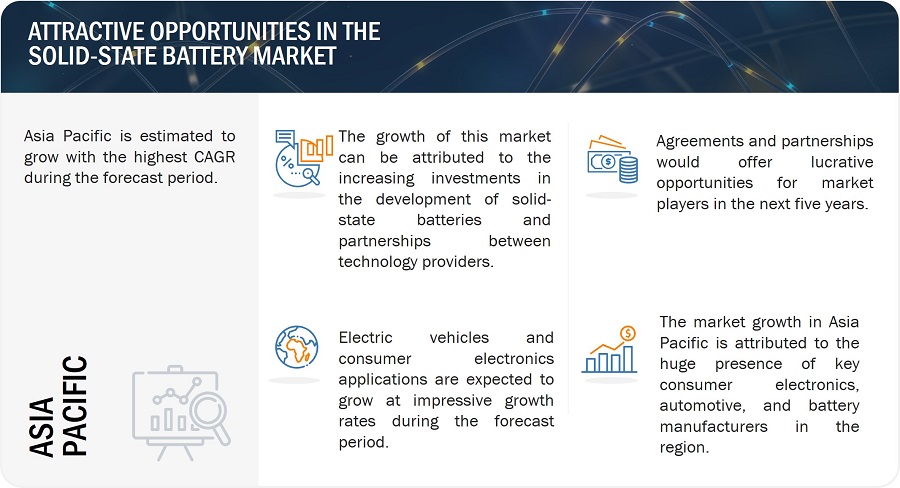

The market in Asia Pacific is projected to grow with the highest CAGR from 2023 to 2030.

Solid-State Battery Market by Region

The market in Asia Pacific has been segmented into China, Japan, India, South Korea, and the Rest of Asia Pacific. The presence of not only developing economies that are witnessing high economic growth but also a number of consumer electronics and wearable devices manufacturers, such as Panasonic Holdings Corporation (Japan), Sony Corporation (Japan, Samsung (South Korea), and LG Electronics Inc. (South Korea), and the increasing demand for IoT and consumer electronics in countries such as Japan, China, and South Korea are expected to boost the growth of the region significantly and pose huge potential for the solid-state battery market.

China, being a global manufacturing hub, holds immense potential for the growth of the solid-state battery market. The expansion in industrial manufacturing and the presence of major wearable manufacturers are creating an opportunity for the growth of the solid-state battery market here. Technological innovation has led to the development of IoT-based medical devices and wireless medical devices.

Key Market Players

Blue Solutions (France), Ilika (UK), Solid Power (US), QuantumScape (US), ProLogium Technology Co., Ltd. (Taiwan), BrightVolt (US), Excellatron (US), Sakuu Corporation (US), and Hitachi Zosen Corporation (Japan), are among a few top players in the solid-state battery companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2030 |

|

Units |

Value (USD Million) |

|

Segments Covered |

Component, Type, Battery Type, Capacity, and Application |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Major Players: Blue Solutions (France), Ilika (UK), Solid Power (US), QuantumScape (US), ProLogium Technology Co., Ltd. (Taiwan), BrightVolt (US), Excellatron (US), Sakuu Corporation (US), Hitachi Zosen Corporation (Japan) and Others- (Total 22 players have been covered) |

Solid-State Battery Market Highlights

This research report categorizes the solid-state battery market by component, type, capacity, battery type, application, and region.

|

Segment |

Subsegment |

|

By Component: |

|

|

By Type: |

|

|

By Battery Type: |

|

|

By Capacity: |

|

|

By Application: |

|

|

By Region |

|

Recent Developments

- In July 2023, ProLogium Technology Co, Ltd. signed an agreement with MAHLE GmbH for the development of the first thermal management system for ProLogium’s next-generation solid-state batteries. This agreement will help in the commercialization of solid-state battery solutions that offer energy density, improved safety, and lifespan.

- In May 2023, Sakuu Corporation introduced Li-Metal Cypress Battery Cell Chemistry for manufacturing license. Further, this Li-Metal chemistry has the ability to deliver high-power density and high energy density, with a focus on safety.

- In December 2022, Solid Power announced its partnership with BMW Group. Under this partnership agreement, Solid Power, Inc. has granted the BMW Group an R&D license for Solid Power’s all-solid-state cell design and manufacturing know-how.

Frequently Asked Questions:

What is the total CAGR expected to be recorded for the solid-state battery market during 2023-2030?

The global solid-state battery market is expected to record a CAGR of 41.5% from 2023–2030.

What are the driving factors for the solid-state battery market?

The rising adoption of electric vehicles and the rapidly evolving energy harvesting sector are some of the driving factors for the solid-state battery market.

Which application will grow at a fast rate in the future?

The electric vehicle application is expected to grow at the highest CAGR during the forecast period. Solid-state batteries are designed primarily with solid electrolytes, which eliminates battery overheating in the EVs and is the major factor contributing to the segment's growth.

Which are the significant players operating in the solid-state battery market?

Blue Solutions (France), QuantumScape (US), ProLogium Technology Co, Ltd. (Taiwan), and BrightVolt (US) are among a few top players in the solid-state battery market.

Which region will grow at a fast rate in the future?

The solid-state battery market in Asia Pacific is expected to grow at the highest CAGR during the forecast period.