※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

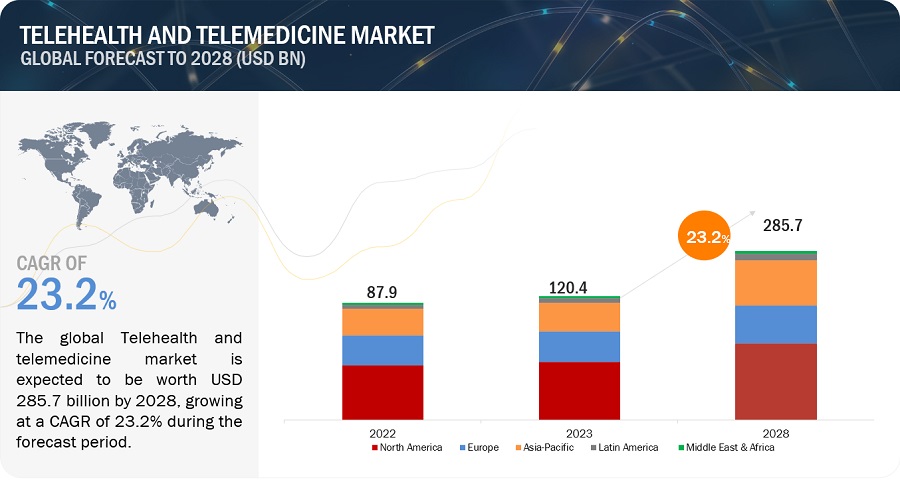

The global telehealth & telemedicine market in terms of revenue was estimated to be worth $120.4 billion in 2023 and is poised to reach $285.7 billion by 2028, growing at a CAGR of 23.2% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. This growth is attributed to several factors, including the rising demand for mental health services, advanced technologies, and cost-effective medical solutions. Additionally, the market is driven by the increasing need for enhanced healthcare services, boosted efficiency, and the integration of novel technologies like chatbots. Demand for telehealth is further accelerated by the rising need for radiological services, orthopedic care, and government initiatives promoting advanced healthcare infrastructure. The market is propelled by the growing preference for online consultations, the expansion of diagnostic laboratories, and governmental investments in telecommunication solutions to connect patients with healthcare experts online.

Telehealth and telemedicine Market Dynamics

Driver: Increasing Adoption Of Digital Health And Telehealth to drive the market

The healthcare landscape is witnessing a significant shift with the increasing adoption of digital health and telehealth solutions. This trend is primarily driven by technological advancements that have transformed the way healthcare services are delivered. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and data analytics enhances the capabilities of telehealth platforms. AI-powered chatbots provide real-time assistance to patients, while remote monitoring tools and Internet of Things (IoT) devices enable healthcare providers to gather and analyze patient data. This not only facilitates personalized healthcare but also allows for proactive management of health conditions.

Shortage of medical professionals and increasing demand for healthcare services to drive the market.

A critical challenge facing the healthcare industry is the shortage of medical professionals, coupled with a growing demand for healthcare services. Traditional healthcare delivery models struggle to cope with this imbalance, creating a need for innovative solutions. Digital health and telehealth emerge as crucial tools in addressing this challenge. Virtual consultations and remote healthcare services not only bridge the gap caused by the shortage of medical professionals but also enhance overall healthcare accessibility. By leveraging technology, healthcare providers can optimize resources, streamline administrative processes, and ensure that patients receive timely and efficient care. This shift towards digital health solutions aligns with the broader goal of making healthcare more patient-centric and accessible.

Restraint: Variations in Regulations Across Regions

The challenge of variations in regulations across regions in the telehealth sector is intricately linked to the diverse nature of healthcare policies and reimbursement models worldwide. Each country, and sometimes even different regions within a country, may formulate and implement distinct policies concerning the reimbursement of telehealth services. This lack of uniformity results in a complex operational environment for telehealth service providers, as they must navigate through disparate reimbursement mechanisms, each with its own set of rules and procedures. The complexity arises from the fact that telehealth providers often operate across borders or in regions with different regulatory frameworks. Consequently, understanding and complying with the nuanced reimbursement policies of each jurisdiction become a significant financial challenge. This scenario necessitates concerted efforts and collaboration among various stakeholders, including healthcare providers, policymakers, and payers.

To address this restraint, the telehealth industry requires a collective and collaborative approach to establish standardized reimbursement models. These models should be designed collaboratively with input from all stakeholders and should aim to incentivize the widespread adoption of telehealth services. By fostering collaboration among healthcare stakeholders, policymakers, and payers, the industry can work towards creating a more uniform and predictable reimbursement landscape. The development of standardized reimbursement models is crucial not only for the sustainable growth of telehealth providers but also for fostering greater trust and confidence among healthcare professionals, patients, and investors. Establishing a cohesive and standardized approach to reimbursement will contribute to the long-term viability and success of telehealth as an integral component of modern healthcare delivery. This collaborative effort is essential to overcome the challenges posed by regulatory variations and ensure the continued expansion and acceptance of telehealth services on a global scale.

Opportunity: High utility in combating infectious diseases and use of technologies such as blockchain and AI

The opportunity in the telehealth and telemedicine market lies in its high utility in combating infectious diseases, especially in the context of global health crises. The ongoing advancements in technologies, such as blockchain and artificial intelligence (AI), present a significant avenue for enhancing the capabilities of telehealth solutions.In the realm of infectious diseases, telehealth plays a crucial role in providing timely and efficient healthcare services. The ability to remotely diagnose, monitor, and treat individuals can be instrumental in managing the spread of infectious diseases, ensuring timely interventions, and reducing the burden on traditional healthcare systems. Telehealth platforms facilitate remote consultations, real-time monitoring of patients' health parameters, and the delivery of essential healthcare services without the need for physical presence, thereby minimizing the risk of transmission.

The integration of cutting-edge technologies like blockchain and AI further amplifies the potential of telehealth. Blockchain, with its decentralized and secure nature, enhances data integrity and privacy, addressing critical concerns in healthcare information exchange. This is particularly valuable in telehealth applications where sensitive patient data is transmitted and stored.Artificial intelligence contributes to telehealth by enabling more accurate diagnostics, personalized treatment plans, and predictive analytics. AI algorithms can analyze vast amounts of healthcare data, assisting healthcare professionals in making informed decisions and improving patient outcomes. Additionally, AI-driven chatbots and virtual assistants enhance the patient experience by providing timely information, appointment scheduling, and continuous support.

As the world faces ongoing and emerging infectious threats, the combination of telehealth solutions with advanced technologies creates a compelling opportunity to revolutionize healthcare delivery. Leveraging the high utility of telehealth in infectious disease management, coupled with the transformative capabilities of blockchain and AI, holds the potential to reshape the healthcare landscape, making it more resilient, responsive, and accessible. This convergence presents an optimistic outlook for the telehealth industry, positioning it as a key player in global health preparedness and response efforts.

Challenge: Issues related to hygiene and cleanliness, behavioral barriers, healthcare affordability, and lack of awareness.

The landscape of telehealth and telemedicine presents a myriad of challenges that necessitate strategic solutions for sustainable growth. One significant obstacle is the challenge of ensuring hygiene and cleanliness standards in virtual healthcare interactions, particularly when traditional physical examinations are not possible. This hurdle demands the development of standardized protocols and the integration of remote monitoring devices to maintain cleanliness without compromising the accuracy of assessments. Additionally, behavioral barriers to the widespread adoption of telehealth services must be addressed through extensive education and awareness campaigns, emphasizing the efficacy, convenience, and safety of virtual care. Healthcare affordability stands as a critical challenge, requiring strategic pricing models, government subsidies, and collaboration with insurance providers to make telehealth financially accessible. Lastly, the lack of awareness, particularly in underserved communities, necessitates robust public awareness campaigns, community outreach programs, and collaborations with local healthcare providers. By holistically addressing these challenges, the telehealth industry can pave the way for a more inclusive, efficient, and widely adopted healthcare paradigm.

Telehealth & Telemedicine Market Ecosystem

The telehealth and telemedicine market ecosystem comprises entities responsible for the end-to-end workflow of telehealth services. The major stakeholders present in this market include telecommunications companies, CT tools and electronics manufacturers, platforms, service and medical device providers, pharmaceutical companies, healthcare providers, payers, patients/customers, pharmacies and health retailers, senior living/post-acute/hospice centers, startups, and governments and regulatory bodies. The demand continues to grow and expand, especially after the outbreak of the COVID-19 pandemic. Solution and service providers continue to enhance and mature their offerings to add value.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

Note: Research and Development is restricted to softwares only.

The telehealth & telemedicine industry, is projected to grow at a CAGR of 23.2% between 2023 and 2028.

The telehealth & telemedicine market is projected to reach USD 285.7 billion by 2028 from USD 87.9 billion in 2023, at a CAGR of 23.2% during the forecast period. The rising aging population, increased chronic conditions, rising awareness and government initiatives will provide lucrative opportunities to the market during the forecast period.

Software and services segment accounted for a substantial share of the telehealth & telemedicine industry, by Component in 2022.

The software segment of the telehealth & telemedicine market is poised to experience a favorable CAGR in the forecast period, propelled by the increasing demand for cost-effective and easily accessible healthcare services, streamlined workflow management, and enhanced quality care. The surge in healthcare expenses, coupled with the escalating requirement for real-time and accurate population health monitoring, is fostering the uptake of software solutions. Additionally, healthcare institutions in developed countries are transitioning to value-based care models to enhance patient outcomes. The segment's growth is further accelerated by various global initiatives undertaken by key industry players.

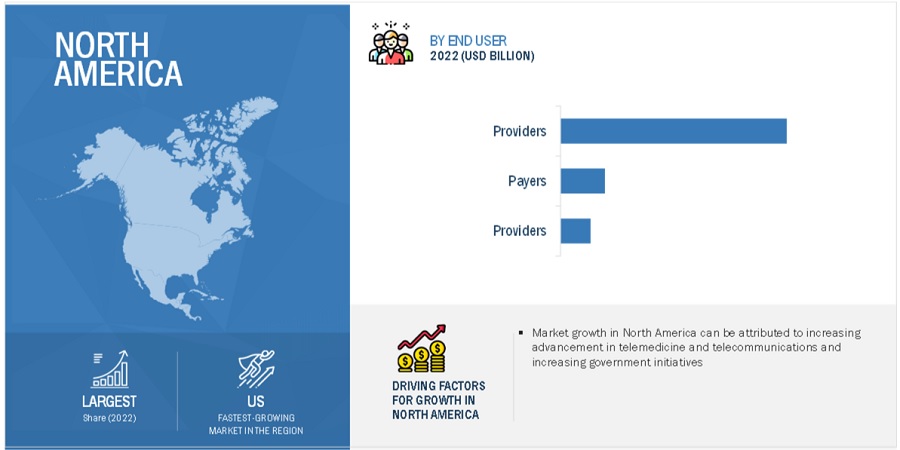

Providers segment accounted for a considerable share in the telehealth & telemedicine industry, by end user in 2022

The provider segment of the telehealth & telemedicine market dominated with the largest revenue share of 32.9% in 2022, primarily attributed to the growing acceptance of telehealth, teleconsultation, and telemedicine within the healthcare professional community, aiming to alleviate the strain on healthcare facilities. Additionally, the heightened convenience provided by these solutions enables healthcare providers to access patient health records swiftly, facilitate real-time quality reporting, enhance data management, make informed decisions, and embrace eHealth solutions, thereby fostering an increased adoption of these services among healthcare providers.

Web bases delivery mode accounted for the largest share in telehealth & telemedicine industry by Delivery mode in 2022

The web-based delivery mode segment of the telehealth & telemedicine market secured the largest share, constituting XX% of the total revenue in 2022. Factors contributing to its dominance include the rise of virtual care and web-based telehealth applications, fostering direct patient access to healthcare services. Increased internet penetration and smartphone industry innovations further propel the growth of web-based delivery, with its cost-effectiveness and user-friendly interface enhancing adoption rates.

On the other hand, the cloud-based delivery segment is poised for the fastest growth, driven by escalating adoption among healthcare providers and patients, alongside the introduction of technologically advanced solutions. The appeal lies in seamless data storage, easy accessibility, high bandwidth, and enhanced security, especially amid growing concerns over data breaches in web-based and on-premise telehealth platforms. Cloud-based applications address critical needs like patient monitoring and teleconsultation in rural and remote areas, emphasizing the demand for immediate medical assistance.

North America dominated the telehealth & telemedicine industry in 2022

In 2022, North America asserted its dominance in the telehealth & telemedicine market, securing 40.8% of the total revenue. The region's robust growth is attributed to substantial healthcare IT expenditures, coupled with a high penetration of internet and smartphone users. Future prospects are promising, fueled by the increasing burden of chronic conditions and a heightened awareness of digital health and virtual care platforms among both healthcare providers and patients. The region's favorable conditions, including the presence of key industry players and the emergence of startups, are poised to further drive the adoption of telehealth platforms.

Prominent players in the telehealth and telemedicine market include Koninklijke Philips, N.V (Netherlands), Medtronic plc (Ireland), GE Healthcare (US), Oracle (US), Siemens Healthcare GmbH (Germany), Cisco Systems (US), Asahi Kasei Corporation (Japan), Iron Bow Technologies (US), American Well (US), Teladoc Health, Inc. (US), AMC Health (US), TeleSpecialists(US), Doctor On Demand by Included Health, Inc. (US), MDLIVE (US), GlobalMedia Group, LLC (US), Medvivo Group Ltd. (UK), Medweb(US), VSee (US), Imedi Plus (China), Zipnosis (US), ACL Digital (US), iCliniq (US), Boston Scientific Cardiac Diagnostics Inc. (US), Resideo Technologies Inc.(US).

Scope of the Telehealth & Telemedicine Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$120.4 billion |

|

Projected Revenue by 2028 |

$285.7 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 23.2% |

|

Market Driver |

Increasing Adoption Of Digital Health And Telehealth to drive the market |

|

Market Opportunity |

High utility in combating infectious diseases and use of technologies such as blockchain and AI |

The study categorizes the telehealth & telemedicine market to forecast revenue and analyze trends in each of the following submarkets:

By Component

-

Software and Service by Type

- Remote Patient Monitoring

- Real Time Interaction

- Store and Forward

-

Software and Service by Offering

- One-Time Purchase

- Subscription Based

- Pay-Per Use

-

Hardware

- Monitors

-

Medical Peripheral Devices

- Blood Pressure Monitors

- Blood Glucose Meter

- Weight Scales

- Pulse Oximeters

- Peak Flow Meters

- Ecg Monitors

- Other Medical Peripheral Devices

By Mode of Delivery

- Cloud based

- On Premise

By Application

- Telecare

- Activity Monitoring

- Remote Medication Management

- Teleconsultation

- Tele ICU

- Telepsychiatry

- Teledermatology

- other applications

By End User

-

Providers

- Hospitals & Clinics

- Long Term Care Centers & Assisted Living Centers

-

Payers

- Public

- Private

- Patients and consumers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- Italy

- Spain

- France

- RoE

-

Asia Pacific

- Japan

- China

- India

- Australia

- RoAPAC

- Latin America

- Middle East and Africa

Recent Developments of Telehealth & Telemedicine Industry

- In 2021, Medtronic forged a partnership with Statis Lab Inc., aiming to introduce a patient monitoring system in India.

- Koninklijke Philips unveiled new products, such as Patch, Maternal Pod, and Avalon CL Fetalin 2020 for remote patient monitoring across New Zealand, Europe, Singapore, the United States, and Australia.

- In 2020, BioTelemetry completed the acquisition of various healthcare services and products from Envolve, encompassing a coaching platform and remote patient monitoring. The strategic move concentrated on addressing healthcare needs in hypertension, mental health, diabetes, and chronic heart failure.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global telehealth & telemedicine market?

The global telehealth & telemedicine market boasts a total revenue value of $285.7 billion by 2028.

What is the estimated growth rate (CAGR) of the global telehealth & telemedicine market?

The global telehealth & telemedicine market has an estimated compound annual growth rate (CAGR) of 23.2% and a revenue size in the region of $120.4 billion in 2023.