※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

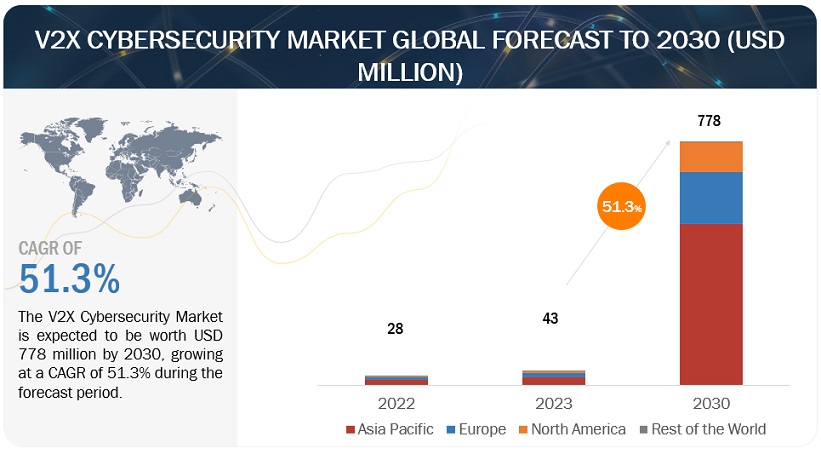

[276 Pages Report] The global V2X cybersecurity market was valued at USD 43 million in 2023 and is expected to reach USD 778 million by 2030 and grow at a CAGR of 51.3% over the forecast period. The growth of the V2X cybersecurity market is driven by a confluence of factors that underscore the increasing connectivity and digitalization in the automotive industry. As vehicles become more integrated with communication technologies, including V2V (Vehicle-to-Vehicle) and V2I (Vehicle-to-Infrastructure), the susceptibility to cyber threats rises, necessitating robust cybersecurity solutions. The escalating adoption of connected and autonomous vehicles and the proliferation of smart infrastructure amplifies the attack surface for malicious actors, and government regulations mandating stringent cybersecurity measures further fuel market demand. Additionally, the growing awareness among automotive manufacturers and stakeholders about the potential risks associated with V2X communication systems propels investments in advanced cybersecurity solutions, fostering the expansion of the V2X cybersecurity market.

Market Dynamics:

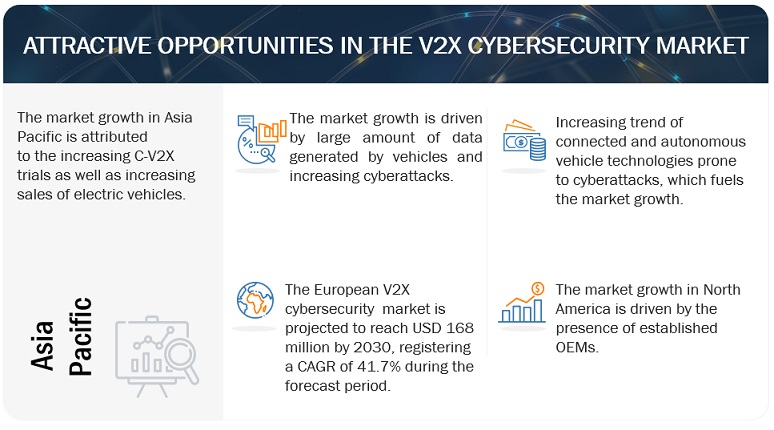

Driver: Large amount of data generated by vehicles and increasing cyberattacks

An advanced V2X communication system is integral to developing connected and autonomous vehicles. A V2X communication system uses several connectivity options, networks, sensors, and devices that produce a massive amount of data to be analyzed. The privacy of this data must be ensured to avoid misuse. Upon successfully breaching the system, hackers access comprehensive data encompassing the driver, infrastructure, cloud, and vehicle. Additionally, V2X facilitates the connection of vehicles to smartphones, increasing the risk of potential unauthorized access by hackers to users' private information, which is commonly stored on the cloud. Companies such as ESCRYPT GmbH, Qualcomm Incorporated, HARMAN International, and AUTOCRYPT Co., Ltd. have developed sophisticated V2X cybersecurity and encryption systems to prevent cyberattacks on V2X communications.

Cyberattacks in the automotive field have increased over the years. For instance, as per Upstream Security Ltd., the automotive industry is expected to lose a staggering USD 505 billion by 2024 to cyber-attacks. Hackers are now easily able to hack the vehicle remotely; approximately 97% of attacks are executed remotely, with 70% of such remote attacks occurring over long distances. Further, in 2022, there was a 380% increase in automotive API attacks, constituting 12% of the total incidents. This occurred despite OEMs implementing advanced IT cybersecurity protections. Thus, increasing cyberattacks would drive the V2X cybersecurity market.

Restrain: Complex ecosystem with multiple stakeholders

The automotive industry is now becoming the focus area for many non-automotive suppliers. As the value chain is fragmented among all types of industries, revenue distribution has become a tough task for stakeholders. Developing countermeasures in the V2X cybersecurity market is very difficult due to the lack of standardization of cybersecurity solutions. The cybersecurity solutions depend on the specifications given by OEMs. These solutions vary due to different platforms in the same vehicle model and differences in electronic architecture, connectivity, and software. As a result, V2X cybersecurity solution providers face integration risks in dealing with threats and vulnerabilities of a vehicle.

The inherited nature of buying all the components of V2X systems from various suppliers and assembling them into one system can make the overall system more vulnerable. Every supplier has its own platform of electronic components, software, platform, and connection modules, making it difficult for cybersecurity solution providers. Hence, regardless of the strength of individual components, poor integration of these components can lead to exposure to cyberattacks. Therefore, it is necessary to release standards for cybersecurity products and services throughout the value chain stakeholders to make vehicles with V2X systems less vulnerable to cyberattacks.

Opportunity: Increasing trend of connected and autonomous vehicle technologies prone to cyberattacks

Connected and autonomous vehicles are considered the future of automobiles, and V2X technology will play an important role in this evolution. Connected and autonomous vehicles rely on advanced V2X technologies and systems to collect and share real-time data. Autonomous vehicles are gaining an unprecedented amount of traction. Companies such as Mercedes Benz, BMW, Continental AG, and BYD invest heavily in their R&D capabilities to revolutionize traditional driving. For instance, in January 2024, BYD was granted a Level 3 Advanced Driver Assistance Systems (ADAS) testing license for China's high-speed roads, making it the first company in China to receive such a license. Continental and Aurora have also unveiled the world's first scalable Level 4 autonomous truck system.

Similarly, Google, NVIDIA, Uber, and Tesla are ramping up their investments to bring autonomous vehicles on the road, which would comply with all the statutory rules and regulations and make driving a seamless experience. For instance, in January 2024, Ansys and NVIDIA formed a partnership to enhance the development of autonomous vehicles. The growth of autonomous vehicles offers unparalleled opportunities to cloud providers, OEMs, and other stakeholders to collaborate and partner with automotive companies to leverage this growth. The agreement between Daimler AG, manufacturer of Mercedes-Benz, and Uber Technologies Inc. to develop self-service vehicles is another instance that suggests autonomous vehicles will be a reality soon. The advent of autonomous vehicles will increase cybersecurity threats and drive the V2X cybersecurity market in the automotive industry. Autonomous cars are still developing and are being tested on the roads in Texas, Arizona, California, Pennsylvania, Washington, and Michigan under specific test areas and driving conditions. According to automotive experts, these cars would soon become a mainstream reality. Companies such as NVIDIA, Qualcomm Incorporated, Autotalks, among others have started developing components and systems for autonomous vehicle development. For instance, NVIDIA has developed a software-based platform for the automotive industry, especially for transportation applications, which would help develop autonomous driving technologies on a large scale. These developments would offer several opportunities to cloud and cybersecurity service providers, including V2X cybersecurity solution providers, to partner with automotive companies to advance the driving revolution with robust vehicle security.

Challenges: Need for keeping up with continuous evolution in V2X ecosystem

V2X communication is continuously evolving due to the introduction of advanced technologies. For instance, the key issue with the performance of V2X is low latency and high reliability. IEEE 802.11p-based DSRC uses CSMA/CA (Carrier Sense Multiple Access protocols with Collision Avoidance) mechanisms to avoid collisions. DSRC is expected to offer high reliability, but its performance diminishes in a dense vehicle environment. LTE-V2X has more reliable latency and provides less interference, less than 100 ms. In a dense vehicle environment, a communication delay of less than 100 ms offered by LTE-V2X is insufficient, which could put the driver's life in danger. 5G-V2X is expected to overcome the shortcomings of DSRC and LTE-V2X. The 5G network will delay communication of less than 1 ms with a stability of 99.99%. The 5G-V2X will thus be able to support automated driving-oriented V2X services. Further, 6G brings forth notable enhancements, both in terms of speed and intelligence. With a remarkable speed advantage, being 100 times faster than 5G, it is heralded as the most intelligent and efficient cellular network. V2X cybersecurity solution providers must emphasize continuous R&D of security solutions to cope with these continuously changing technologies.

Hackers try to find new ways to breach the system irrespective of the changing V2X communication technologies and V2X security solutions. Thus, cybersecurity companies must track the loopholes and provide quick OTA updates to counter these attacks. Apart from cyberattacks, the security protocols and standards will keep changing, whether due to governments or automotive authorities. Therefore, V2X cybersecurity solution providers must be aware of them and keep updating the systems.

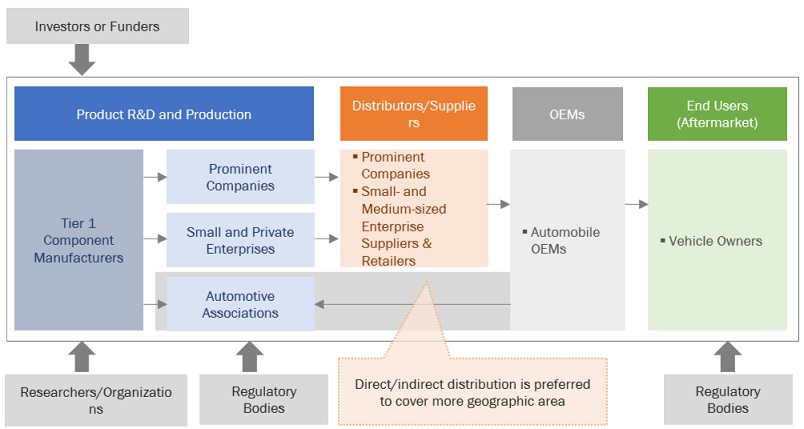

Market Ecosystem

Internal Combustion Engine (ICE) vehicle segment is estimated to hold a significant share of V2X cybersecurity market during the forecast period

Internal Combustion Engine (ICE) is currently the dominant technology in the global vehicle market. An ICE consists of a cylinder and piston mechanism that converts the chemical energy of gasoline fuel into mechanical energy to drive the vehicle. As far as ICE vehicles are concerned, the key functions of the V2X are the V2V and V2I. V2V helps increase vehicle safety, while V2I helps optimize traffic, which helps improve vehicle fuel economy. The steady demand for ICE vehicles is likely to increase the demand for automotive technology, systems, and components. This, in turn, will also increase the need for cybersecurity to secure these advanced technologies.

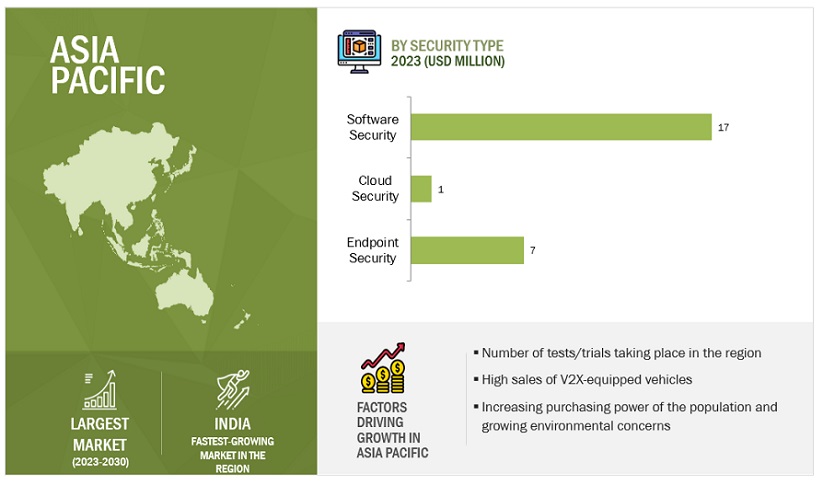

Software Security segment expected to be larger segment during the forecast period

Software security is crucial for V2X cybersecurity as it protects the integrity, confidentiality, and availability of communication between vehicles and their surroundings. Robust security measures prevent unauthorized access, data tampering, and malicious attacks, ensuring the safety and reliability of V2X systems in the rapidly evolving landscape of connected and autonomous vehicles. The increasing penetration of V2V and V2I technology is likely to support the revenue growth of the software security segment of the V2X cybersecurity market. V2V feature helps in enhancing the safety warning capabilities such as forward collision warning (FCW), blind spot warning (BSW), lane changing warning (LCW), and do-not-pass warning (DNPW). Some key safety applications that can be achieved only through V2V are intersection movement assist (IMA), left turn assist (LTA), and emergency electronic brake light. On the other hand, in V2I technology, the exchange of data takes place wirelessly between the road infrastructure and vehicles V2I is used in ITS (Intelligent Transport System) to capture traffic data generated by the vehicles and offer information from the infrastructure to the vehicles. The technologies used under V2I include intelligent traffic systems (ITS), emergency vehicle notification, passenger information systems, fleet and asset management, and parking management systems. Vehicle-to-infrastructure (V2I) is also important for parking management in smart cities. In this V2I technology, vehicles and parking lots are connected so that the vehicle owner/driver gets information on which/where parking spaces are available. This solution makes parking occupancy tracking easier for parking lot owners and operators. Hence, for having secured V2V and V2I communication, software security plays a vital role.

“Asia Pacific is estimated to be the largest market during the forecast period.”

The Asia Pacific region is poised to become the largest market for V2X cybersecurity by 2030, driven by substantial sales of V2X-equipped vehicles that set a precedent for other automotive OEMs to integrate this technology. This surge in adoption is expected to elevate the demand for cybersecurity solutions. Notably, Asia Pacific hosts key players in the V2X cybersecurity market, including Autotalks and AUTOCRYPT Co. Ltd. The region's increasing penetration of electric vehicles and connected car features is poised to boost the demand for V2X cybersecurity further. Countries such as China, Japan, and South Korea in Asia Pacific are anticipated to lead in 5G adoption, with the advancements in 5G enabling cellular connectivity and subsequently driving the adoption of V2X technology. This heightened adoption underscores the imperative need for cybersecurity to secure V2X communication, thereby fueling the growth of the Asia Pacific V2X cybersecurity market throughout the forecast period.

Key Market Players

The V2X cybersecurity market is dominated by major players, including ESCRYPT GmbH (Germany), Qualcomm Incorporated (US), Autotalks (Israel), AUTOCRYPT Co., Ltd. (Korea), and Continental AG (Germany). These companies offer V2X cybersecurity solutions and have strong distribution networks at the global level. These companies have adopted extensive expansion strategies and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the V2X cybersecurity market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Connectivity, Communication, Vehicle Type, Security Framework, Form, Propulsion, Security Type and Region. |

|

Geographies covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

ESCRYPT GmbH (Germany), Qualcomm Incorporated (US), Autotalks (Israel), AUTOCRYPT Co., Ltd. (Korea), and Continental AG (Germany). |

This research report categorizes the V2X cybersecurity market based on connectivity, communication, vehicle type, security framework, form, propulsion, security type and region.

Based on Connectivity:

- Cellular

- DSRC

Based on Communication:

- Vehicle-to-Vehicle (V2V)

- Vehicle-to-Infrastructure (V2I)

- Vehicle-to-Pedestrian (V2P)

- Vehicle-to-Grid (V2G)

Based on Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Based on Security Framework:

- PKI

- Embedded

Based on Form:

- In-Vehicle

- External Cloud Services

Based on Propulsion:

- Internal Combustion Engines

- Electric Vehicles

Based on Security Type:

- Endpoint Security

- Software Security

- Cloud Security

Based on the Region:

-

Asia Pacific (APAC)

- China

- India

- South Korea

- Japan

-

North America (NA)

- US

- Canada

- Mexico

-

Europe (EU)

- Germany

- France

- UK

- Italy

- Spain

-

Rest of the World (RoW)

- Brazil

- Argentina

Recent Developments

- In January 2024, AUTOCRYPT and Cohda Wireless have formalized a Memorandum of Understanding (MOU) during CES 2024, outlining their collaborative efforts to develop a security-integrated Vehicle-to-Everything (V2X) solution.

- In June 2023, Autotalks and Infineon Technologies AG have formed a collaborative partnership to develop advanced Vehicle-to-Everything (V2X) solutions. In this collaboration, Infineon will contribute its automotive-grade HyperRam 3.0 memory to be integrated into Autotalks' V2X reference designs, namely Tekton3 and Secton3.

- In May 2023, Qualcomm Incorporated declared that its subsidiary, Qualcomm Technologies, Inc., had entered into a definitive agreement to acquire Autotalks.

- In January 2022, AUTOCRYPT Co., Ltd. launched AutoCrypt SCMS Version 5.0, a Security Credential Management Security (SCMS) for Vehicle-to-Everything (V2X) communications and a crucial component of its AutoCrypt V2X security solution. The SCMS would be important for autonomous driving as it would sign and verify the messages transmitted through V2X communication to ensure safety and security.

Frequently Asked Questions (FAQ):

What is the current size of the global V2X cybersecurity market?

The global V2X cybersecurity market is projected to grow from USD 43 million in 2023 to USD 778 million by 2030, at a CAGR of 51.3%.

Who are the winners in the global V2X cybersecurity market?

The V2X cybersecurity market is dominated by major players including ESCRYPT GmbH (Germany), Qualcomm Technologies, Inc. (US), Autotalks (Israel), AUTOCRYPT Co., Ltd. (Korea), and Continental AG (Germany).

Which region will have the largest market for V2X cybersecurity?

The Asia Pacific region will the largest market for V2X cybersecurity due to commercialization of 5G technology and increasing trials pertaining to Cellular-V2X technology in the region.

Which country will have the significant demand for V2X cybersecurity in APAC region?

China will be the significant market for V2X cybersecurity due to strong government support towards Cellular-V2X technology.

What are the key market trends impacting the growth of the V2X cybersecurity market?

Virtual Security Operations Centre (VSOC), C-V2X, LTE-V2X, and 5G-V2X are the key market trends or technologies which will have major impact on the V2X cybersecurity market in the future. .