※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

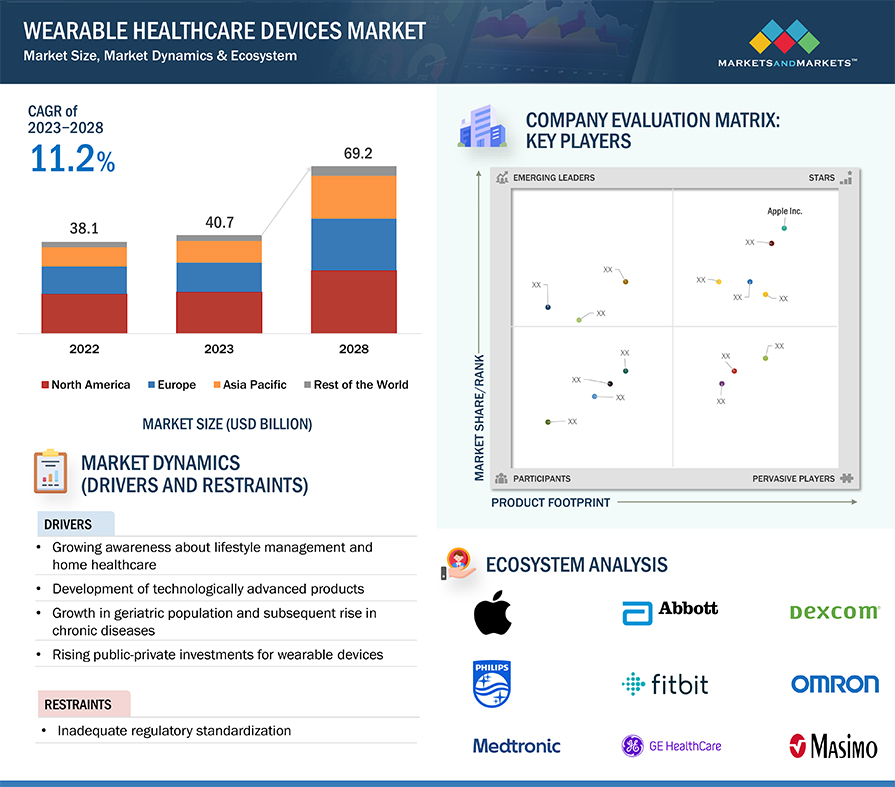

The global wearable healthcare devices market in terms of revenue was estimated to be worth $40.7 Billion in 2023 and is poised to reach $69.2 Billion by 2028, growing at a CAGR of 11.2% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth in the market is largely driven by the rising adoption of 3G and 4G networks for uninterrupted healthcare services, growing availability of smartphone-based healthcare devices, and growing preference for wireless connectivity among healthcare providers.

Attractive Opportunities in the Wearable Healthcare Devices Market

Wearable Healthcare Devices Market Dynamics

Driver: Growing awareness about lifestyle management and home healthcare

The growing awareness of fitness and the increasing desire for proactive health management have catalyzed a substantial uptick in the adoption of wearable healthcare devices. As individuals become more conscious of the significance of maintaining a healthy lifestyle, wearable devices equipped with fitness tracking capabilities have emerged as indispensable tools in this journey. These devices, ranging from smartwatches to trackers, enable users to monitor various aspects of their physical well-being. The synergy between a heightened awareness of fitness and the technological capabilities of wearables has not only empowered individuals to take charge of their health but has also fostered a shift toward preventive health measures. In line with this, wearable activity monitors have proven beneficial in maintaining consistency in exercise regimes (by efficiently tracking fitness goals and progress) among individuals focusing on leading a healthier lifestyle. Thus, these devices are witnessing significant adoption, as there is a growing focus on physical fitness among large sections of the population in a number of countries.

RESTRAINT: Issues related to accuracy & analysis of wearable-generated data

Wearable devices generate and collect a huge amount of data, including data considered protected health information (PHI) under the Health Insurance Portability and Accountability Act (HIPAA). It is important that the data received be standardized and ready to be integrated into clinical trial platforms; data collected in an uncontrolled research environment should be converted into meaningful outcomes by laying structured guidance/procedures to be clinical trial compliant.

Another important concern, given the large volume of data generated, is consumer privacy and ownership. In many cases, it is unclear who the data belongs to (the consumer or the company) and how it can be used, shared, or sold. With cybersecurity attacks on the rise, there is also a possibility that this data may be stolen or exposed. Furthermore, the lack of information or testing about the accuracy of data collected by wearables is a key consideration. Fraud is also possible and easily accomplished if companies do not achieve sufficient protection.

OPPORTUNITY: Rising adoption of AI and 5G

The utilization of high-speed 5G networks is instrumental in swiftly and dependably transporting extensive data files containing medical imagery, thereby enhancing both access to healthcare and the quality of care. Despite the limited current use of augmented reality (AR), virtual reality (VR), and spatial computing in healthcare, the advent of 5G holds the potential to further empower doctors in delivering innovative and less-invasive treatments. With lower latency and increased capacity, 5G facilitates healthcare systems in extending remote monitoring services to a larger number of patients. This enables healthcare providers to access real-time data, allowing them to deliver more effective and timely care.

CHALLENGE: Limited battery life

Battery life is an essential criterion for wearable devices, which are required to function continuously to monitor and track users’ health information. Considering this requirement, limited battery life poses a major challenge for the manufacturers of wearable devices.

Longer-lasting batteries tend to be larger and heavier, impacting the efficiency of wearable devices that are ideally lightweight and compact. To address this challenge, various research projects are actively working on the development of advanced batteries with extended life, including aluminum graphite batteries, flexible batteries, and solid-state batteries.

Wearable Healthcare Devices Ecosystem/Market Map

Smartphones segment accounted for the largest share of the wearable healthcare devices industry in 2022, by product.

The wearable healthcare devices market is categorized into trackers, smartwatches, patches, and smart clothing, based on the product. The smartphones segment emerged as the dominant force in the market in 2022. The market dominance of well-established brands fosters consumer trust and contributes to widespread adoption. Moreover, the all-in-one nature of smartwatches, serving as both a health monitoring tool and a fashion statement, sets them apart from specialized trackers, monitors, smart clothing, or patches.

Consumer-grade wearable healthcare devices segment accounted for the largest share in the wearable healthcare devices industry in 2022, by grade.

The global wearable healthcare devices market is categorized into consumer-grade and clinical-grade wearable healthcare devices. The consumer-grade wearable healthcare devices segment accounted for the largest share of the market in 2022. The large share of this segment is attributed to the growing trend of self-monitoring and increasing availability of consumer-grade wearable healthcare devices.

General health and fitness segment accounted for the largest share in the wearable healthcare devices industry in 2022, by application.

Segmented by application, the wearable healthcare devices market encompasses general health and fitness, remote patient monitoring, and home healthcare applications. In 2022, the market's predominant share was taken by the general health and fitness segment. This can be chiefly attributed to the growing emphasis on physical fitness and lifestyle management , and the growing trend of tracking health progress in real time. Also, general health and fitness monitoring wearables appeal to a broad consumer base, including individuals without specific medical conditions. This broad market appeal contributes to the large market share of wearables designed for general health monitoring.

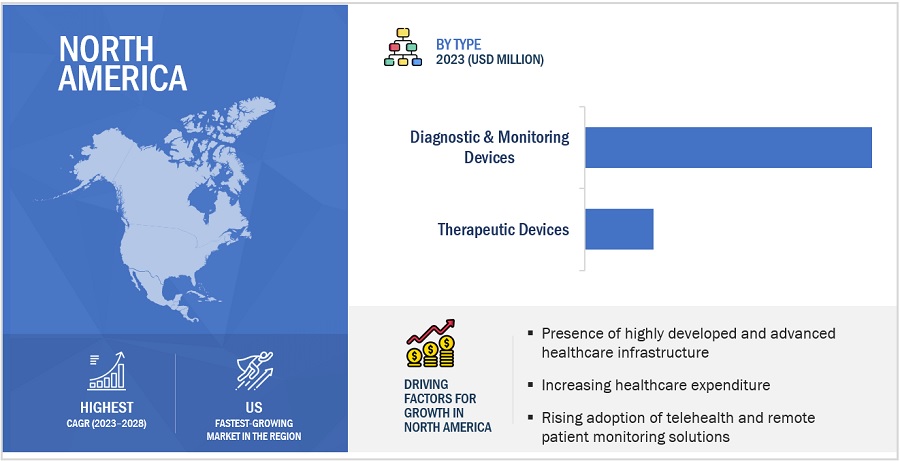

North America accounted for the largest share of the wearable healthcare devices industry in 2022.

Categorized into four primary regions, namely North America, Europe, the Asia Pacific, and the Rest of the World, the wearable healthcare devices market witnessed North America taking the forefront in 2022. It secured the largest market share, propelled by a robust research and development infrastructure within the region. North America is home to several prominent companies in the wearable healthcare devices sector, boasting substantial expertise, resources, and well-established distribution networks. These factors collectively contribute to the region's dominant position in the wearable healthcare devices industry.

The major players in this market are Apple Inc. (US), Fitbit (US), Abbott (US), Dexcom, Inc. (US), and Koninklijke Philips N.V. (Netherlands). These players lead the market because of their extensive product portfolios and wide geographic presence.

Scope of the Wearable Healthcare Devices Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$40.7 Billion |

|

Projected Revenue by 2028 |

$69.2 Billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 11.2% |

|

Market Driver |

Growing awareness about lifestyle management and home healthcare |

|

Market Opportunity |

Rising adoption of AI and 5G |

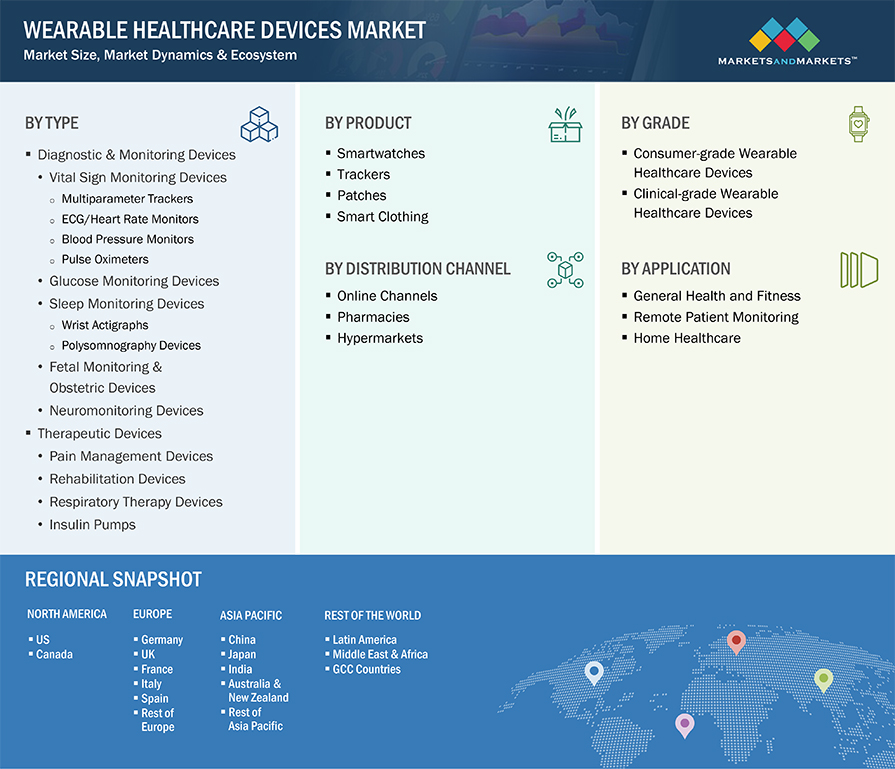

This report categorizes the wearable healthcare devices market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Smartwatches

- Trackers

- Patches

- Smart Clothing

By Type

-

Diagnostic & Monitoring Devices

-

Vital Sign

Monitoring Devices- Multiparameter Trackers

- ECG/Heart Rate Monitors

- Blood Pressure Monitors

- Pulse Oximeters

- Glucose Monitoring Devices

-

Sleep Monitoring Devices

- Wrist Actigraphs

- Polysomnography Devices

- Fetal Monitoring & Obstetric Devices

- Neuromonitoring Devices

-

Vital Sign

-

Therapeutic Devices

- Pain Management Devices

- Rehabilitation Devices

- Respiratory Therapy Devices

- Insulin Pumps

By Grade

- Consumer-grade Wearable Healthcare Devices

- Clinical-grade Wearable Healthcare Devices

By Distribution Channel

- Online Channels

- Pharmacies

- Hypermarkets

By Application

- General Health and Fitness

- Remote Patient Monitoring

- Home Healthcare

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

-

Rest of the World

- Latin America

- Middle East & Africa

- GCC Countries

Recent Developments of Wearable Healthcare Devices Industry:

- In October 2023, Google launched Google Pixel Watch 2.

- In September 2023, Apple Inc. (US) launched its Apple Watch Series 9.

- In June 2020, Philips launched the Avalon CL Fetal and Maternal Pod and Patch for continuous, non-invasive monitoring of the maternal heart rate, fetal heart rate, and uterine activity with a single-use, 48-hour, disposable electrode patch.

- In January 2023, Philips and Masimo expanded their partnership to enhance patient monitoring capabilities in home telehealth applications, utilizing the advanced health tracking features of the Masimo W1 watch. The W1 will integrate with Philips’s enterprise patient monitoring ecosystem to advance capabilities in telemonitoring & telehealth.

- In February 2021, Philips acquired BioTelemetry, a US-based provider of remote cardiac diagnostics and monitoring.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global wearable healthcare devices Market?

The global wearable healthcare devices market boasts a total revenue value of $69.2 Billion by 2028.

What is the estimated growth rate (CAGR) of the global wearable healthcare devices Market?

The global wearable healthcare devices market has an estimated compound annual growth rate (CAGR) of 11.2% and a revenue size in the region of $40.7 Billion in 2023. .