※レポートは、MarketsandMarkets社が作成したもので英文表記です。

レポートの閲覧に際してはMarketsandMarkets社のDisclaimerをご確認ください。

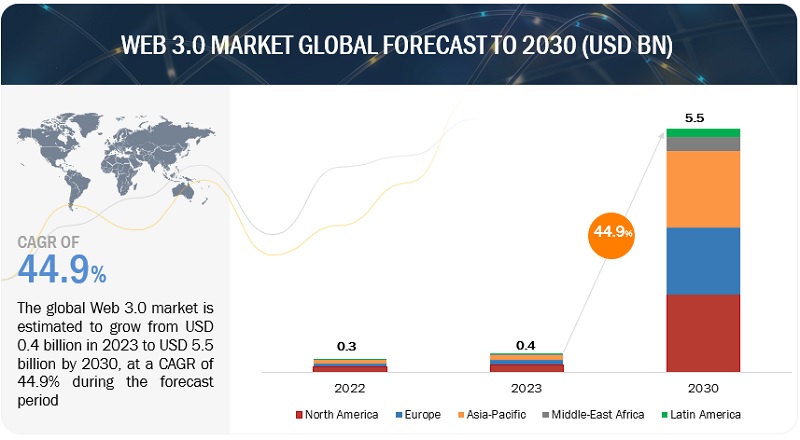

The global Web 3.0 Market is projected to grow from USD 0.4 billion in 2023 to USD 5.5 billion by 2030, at a CAGR of 44.9% during the forecast period. Web 3.0, the next phase of the internet, promises a more secure, private, and decentralized online experience compared to Web 2.0. This advancement, anchored in blockchain technology, prioritizes user data protection, granting individuals greater control over their information and reducing reliance on vulnerable central servers. Moreover, Web 3.0 signifies a shift in perspective, encouraging a forward-thinking outlook on the internet's potential, transcending its current capabilities, and fostering innovations that could reshape how we interact with digital content and services. While still emerging, Web 3.0 holds the potential to redefine the internet landscape and enhance user trust and autonomy in the digital realm.

Technology Roadmap of Web 3.0 till 2030

The Web 3.0 market report covers the technology roadmap till 2030, with insights into short-term, mid-term, and long-term developments.

Short-term roadmap (2023-2025)

- Growing interest in non-fungible tokens (NFTs) for digital collectibles and art.

- Enhanced AI-powered content recommendations and personalization in streaming services and e-commerce platforms.

- The development and adoption of Web 3.0 protocols allow users to control their own data and grant permissions to apps and services.

- Initial blockchain and cryptocurrency regulations aim to create legal structures emphasizing consumer protection and financial stability in the emerging technology space.

Mid-term roadmap (2025-2028)

- Decentralized Finance (DeFi) matures with more complex financial instruments, lending, and insurance services.

- Advanced AI-driven virtual assistants become capable of handling complex tasks, from scheduling appointments to content creation.

- Standardization of decentralized identity protocols enables secure and privacy-focused online identity management.

- Evolving regulations for decentralized technologies offer businesses and users a structured framework to navigate the legal landscape efficiently and with clarity.

Long-term roadmap (2029-2030)

- The vision of a fully decentralized internet starts to take shape, with a growing number of websites and applications hosted on blockchain-based infrastructure.

- Seamless integration of AI across web services, from content generation to virtual shopping assistants.

- Global adoption of open, secure, and interoperable Web 3.0 protocols establishes a new era of user-centric data control and digital rights management.

Global regulations for Web 3.0 harmonize legal requirements, enabling a unified digital economy operating within clear international boundaries.

Market Dynamics

Driver: Rising need for decentralized technology and applications

The escalating demand for decentralized technology and applications serves as a driving force for the widespread adoption of the Web 3.0 market. Rooted in cryptographic principles and distributed ledger technologies, Web 3.0 offers robust solutions to pressing digital challenges. Decentralization, a foundational element of Web 3.0, fortifies security by dispersing data across a network of nodes, mitigating single points of failure and bolstering resilience against cyber threats. Web 3.0 places an unwavering focus on data privacy and ownership, granting users full sovereignty over their personal information. This aligns closely with the mounting concerns surrounding data breaches and privacy infringements. Furthermore, the architecture of decentralization facilitates censorship resistance, guaranteeing unimpeded dissemination of information and ideas. Trustless transactions, executed via smart contracts, eliminate the need for intermediaries, thereby enhancing operational efficiency while reducing associated costs. Interoperability across decentralized technologies fosters seamless data and asset transfer between heterogeneous platforms. The inclusion of community-driven governance models and token economies empowers users, incentivizing active participation and catalyzing innovation on a global scale. As the demand for these decentralized attributes intensifies, the Web 3.0 market gains substantial traction, precipitating a transformative shift across industries and redefining the digital landscape to establish a more secure, transparent, and user-centric Internet ecosystem.

Restraint: Extensive regulatory scrutiny and evolving regulatory perspectives

An overarching constraint within the Web 3.0 market is the profound regulatory scrutiny and the dynamic nature of regulatory viewpoints. Regulators worldwide are in the process of formulating frameworks to address the unique attributes of Web 3.0, seeking a delicate balance between mitigating potential risks and harnessing its innovative potential. Nevertheless, the current landscape remains marked by ambiguity and a lack of consistent, cross-border regulatory standards concerning the classification of digital assets, services, and governance models intrinsic to Web 3.0. For instance, the legal status of smart contracts, a fundamental component of Web 3.0, lacks universal enforceability. This legal uncertainty restricts the broader institutional adoption of Web 3.0, especially by heavily regulated entities. Furthermore, governance structures within the Web 3.0 ecosystem are still evolving, with the reliability and effectiveness of decentralized autonomous organizations (DAOs) varying widely and occasionally being vulnerable, as evidenced by recent incidents in the DeFi sector. These regulatory and governance uncertainties collectively serve as a restraint in the Web 3.0 market, influencing the pace of its adoption and overall growth.

Opportunity: Ability to offer increased transparency

The ability to provide heightened transparency is a fundamental opportunity within the Web 3.0 market. Web 3.0 technologies, prominently blockchain and decentralized systems, introduce an unprecedented level of transparency in the digital landscape. Blockchain's immutable ledger ensures that data, once recorded, remains unalterable and visible to all participants, offering an indisputable record of transactions, data origins, and asset ownership. Supply chains leverage this to bolster accountability and reduce fraudulent activities. Smart contracts, integral to Web 3.0, automate and make transparent the execution of agreements, reducing the reliance on intermediaries and potential conflicts. In finance, decentralized finance (DeFi) applications provide transparent, trustless, and auditable financial services, democratizing access and mitigating manipulation risks. Overall, enhanced transparency not only fosters trust but also empowers users with greater authority over their data, identities, and assets. Businesses operate with greater efficiency, diminish fraud, and cultivate trust among stakeholders, making transparency a compelling and transformative opportunity within the Web 3.0 market.

Challenge: Limited scalability of blockchain technology

The limited scalability of blockchain technology presents a significant challenge in the emerging Web 3.0 market. While blockchain promises decentralization, security, and trust, its current infrastructure struggles to handle the growing demands of a global decentralized ecosystem. Blockchains such as Bitcoin and Ethereum face issues such as slow transaction processing times and high fees, hindering their ability to scale effectively. This scalability challenge impacts various aspects of Web 3.0 applications, from decentralized finance (DeFi) to non-fungible tokens (NFTs) and beyond. Users experience delays and increased costs, limiting mass adoption. To thrive in the Web 3.0 era, addressing scalability is imperative. Layer-2 protocols and interoperability efforts are underway, aiming to enhance blockchain scalability. However, achieving seamless, high-speed, and cost-effective transactions on a global scale remains a pressing challenge for the blockchain community as it seeks to build the decentralized future of the internet.

Web 3.0Market Ecosystem

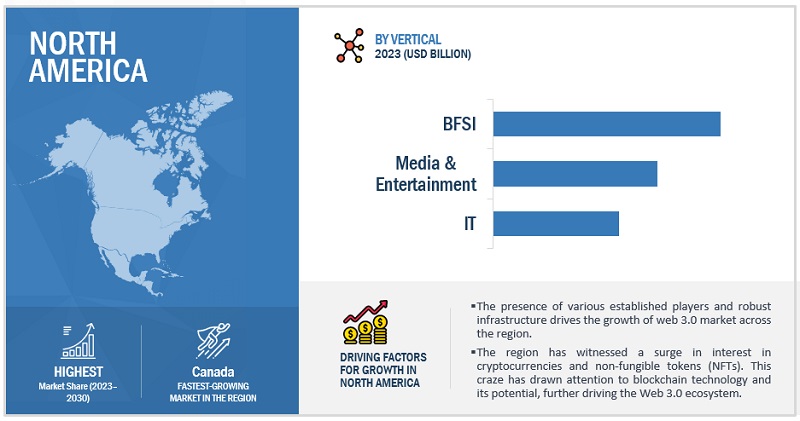

By vertical, BFSI accounts for the largest market size during the forecast period.

The BFSI sector is on the brink of a digital revolution as it embraces the principles of Web 3.0. This transformative shift capitalizes on blockchain, cryptocurrencies, and decentralized finance, ushering in an era of transparent, secure, and efficient financial services. However, this journey is not without challenges, from regulatory complexities to cybersecurity concerns, as it strives to reimagine traditional banking, financial services, and insurance within the Web 3.0 framework.

Based on the application layer, decentralized autonomous organizations hold the highest CAGR during the forecast period.

Decentralized Autonomous Organizations (DAOs) are self-governing entities run by code, enabling decentralized decision-making and management. DAOs utilize smart contracts on blockchain platforms to facilitate a wide range of activities, from governance and voting to investment and asset management, all while eliminating the need for intermediaries and fostering a trustless, global ecosystem.

By protocol layer, privacy & security protocols account for the largest market size during the forecast period.

Privacy & security protocols in Web 3.0's protocols layer employ advanced cryptographic techniques to ensure data confidentiality, integrity, and authenticity in a decentralized ecosystem. It enables secure user interactions and protects against data breaches and unauthorized access, crucial for safeguarding sensitive information and fostering trust in the decentralized web's applications and services.

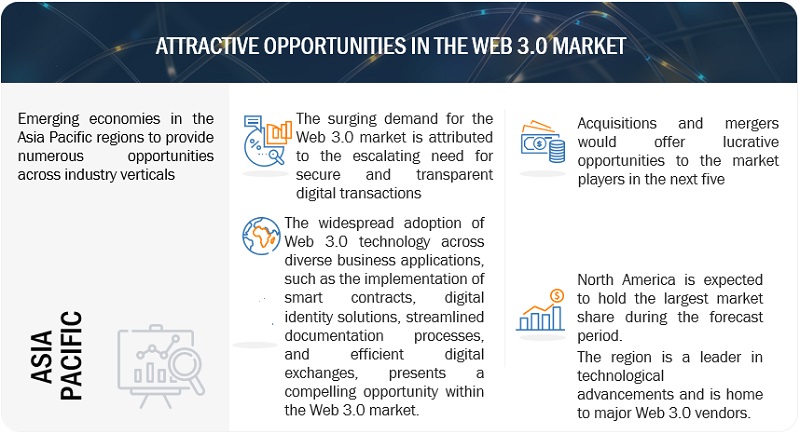

North America to account for the largest market size during the forecast period.

Web 3.0 adoption is surging across North America, driven by a robust embrace of decentralized technologies such as blockchain and smart contracts. This wave of transformation is particularly evident in the financial sector, where decentralized finance (DeFi) is gaining substantial ground, offering enhanced security, transparency, and trust that resonate with both businesses and investors. DeFi platforms, non-fungible tokens (NFTs), and blockchain-based applications are igniting innovation in various industries. Moreover, heightened concerns about data privacy and a growing desire for user empowerment are propelling the shift toward a more user-centric and decentralized digital landscape. Evolving regulatory frameworks further bolster this transition, making Web 3.0 adoption all the more appealing.

Key Market Players

The Web 3.0 vendors have implemented various types of organic and inorganic growth strategies, such as partnerships and agreements, new product launches, product upgrades, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global market for Web 3.0 includes IBM (US), AWS (US), Oracle (US), Coinbase (US), Fujitsu (Japan), Huawei Cloud (China), NTT DOCOMO (Japan), Chainanlysis (US), Ripple Labs (US), Consensys (US), Gemini (US), Binance (Malta), Ocean Protocol Foundation (Singapore), Helium Foundation (US), KUSAMA (Switzerland), Crypto.com (Singapore), Biconomy (Singapore), MakerDAO (US), Chainlink (Cayman Island), Web3 Foundation (Switzerland), HighStreet (US), PARFIN (UK), Ava Labs (US), Pinata (US), Covalent (Canada), Polygon Technology (Cayman Islands), Alchemy Insights (US), Decentraland (China), DAOstack (Israel), Kadena LLC (US), Sapien (US), Storj (US), and Brave (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

USD Billion |

|

Segments Covered |

Technology Stack, Infrastructure Layer, Protocol Layer, Utility Layer, Service Layer, Application Layer, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), AWS (US), Oracle (US), Coinbase (US), Fujitsu (Japan), Huawei Cloud (China), NTT DOCOMO (Japan), Chainanlysis (US), Ripple Labs (US), Consensys (US), Gemini (US), Binance (Malta), Ocean Protocol Foundation (Singapore), Helium Foundation (US), KUSAMA (Switzerland), Crypto.com (Singapore), Biconomy (Singapore), MakerDAO (US), Chainlink (Cayman Island), Web3 Foundation (Switzerland), HighStreet (US), PARFIN (UK), Ava Labs (US), Pinata (US), Covalent (Canada), Polygon Technology (Cayman Islands), Alchemy Insights (US), Decentraland (China), DAOstack (Israel), Kadena LLC (US), Sapien (US), Storj (US), and Brave (US) |

This research report categorizes the Web 3.0 market based on Technology Stack, Infrastructure Layer, Protocol Layer, Utility Layer, Service Layer, Application Layer, Vertical, and Region.

By Technology Stack:

- Layer 0 – Infrastructure

- Layer 1 – Protocol

- Layer 2 – Utility

- Layer 3 – Service

- Layer 4 - Application

By Infrastructure Layer:

- Networking

- Virtualization

- Computing

- Data Storage & Processing

- Others

By Protocol Layer:

- Consensus Algorithm

- Blockchain Protocol

- Privacy & Security Protocols

- Messaging & Communication Protocols

- Others

By Utility Layer:

- Content Delivery Networks

- Cryptocurrency

- Decentralized Exchanges (DEXs)

- Others

By Service Layer:

- Non-Fungible Tokens (NFTs)

- Web 3.0 Browsers & Wallets

- Identity & Access Management Services

- Decentralized Messaging & Communication Services

- Distributed Edge Cloud Services (DCES)

- Others

By Application Layer:

- Decentralized Applications (DApps)

- Decentralized Finance (DeFi)

- Decentralized Social Media

- Decentralized Autonomous Organizations (DAOs)

- Smart Contracts

- Others

By Vertical:

- BFSI

- Retail & eCommerce

- Healthcare & Life Sciences

- IT

- Media & Entertainment

- Telecommunication

- Logistics

- Energy & Utilities

- Government

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordic

- Rest of Europe

-

Asia Pacific

- China

- India

- ANZ

- Japan

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- KSA

- UAE

- Israel

- Turkey

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- Coinbase partnered with Truflation to offer real-time inflation information to the Web3 and blockchain ecosystem. This partnership aims to establish transparency and standardization in the investment environment, enabling Coinbase to make well-informed investment decisions by accessing accurate economic data.

- Animoca Brands has partnered with AWS to boost Web3 product and service development. Animoca Brands is now an official AWS Activate Provider, offering its portfolio companies access to AWS tools, resources, content, and expert support, facilitating their development on the AWS platform.

- IBM and FYI are partnered to use secure and trustworthy generative AI to help creatives collaborate more effectively, manage their businesses, and protect their data and intellectual property. This partnership is a significant step forward in the development of AI for creatives in Web 3.0.

- SailGP partnered with Oracle and leveraged Oracle's customer experience (CX) technology to fuel its latest fan engagement platform, known as The Dock. This innovative platform, integrated with Web 3.0, offers a free fan loyalty program.

- Fujitsu and Mitsubishi Heavy Industries collaborate to develop and deploy blockchain solutions for the energy sector. The two companies would work together to develop blockchain-based solutions for several energy-related use cases, including green energy trading, demand response, distributed energy resources, and carbon emissions trading.

Frequently Asked Questions (FAQ):

What is Web 3.0?

Web 3.0 is a concept representing a more intelligent, decentralized, and interconnected internet that uses technologies like artificial intelligence, semantic web, and blockchain to provide enhanced user experiences, seamless data integration, and improved information retrieval. It aims to evolve the web beyond static web pages and user-generated content by enabling machines to understand, interpret, and generate data, thereby facilitating more advanced applications and services.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Nordic, Spain, and Italy in the European region.

Which are key verticals adopting Web 3.0?

Key verticals adopting Web 3.0 include BFSI, Retail & eCommerce, Logistics, Government, Healthcare and Life Sciences, Telecommunication, Energy and utilities, IT, Media and entertainment, and other verticals (agriculture, education, and real estate & construction).

Which are the key drivers supporting the market growth for Web 3.0?

The key drivers supporting the market growth for the Web 3.0 market include the rising adoption of blockchain technologies, the rising demand for secure and transparent digital transactions, rising need for decentralized technology and applications.

Who are the key vendors in the market for Web 3.0?

The key vendors in the global Web 3.0market include IBM (US), AWS (US), Oracle (US), Coinbase (US), Fujitsu (Japan), Huawei Cloud (China), NTT DOCOMO (Japan), Chainanlysis (US), Ripple Labs (US), Consensys (US), Gemini (US), Binance (Malta), Ocean Protocol Foundation (Singapore), Helium Foundation (US), KUSAMA (Switzerland), Crypto.com (Singapore), Biconomy (Singapore), MakerDAO (US), Chainlink (Cayman Island), Web3 Foundation (Switzerland), HighStreet (US), PARFIN (UK), Ava Labs (US), Pinata (US), Covalent (Canada), Polygon Technology (Cayman Islands), Alchemy Insights (US), Decentraland (China), DAOstack (Israel), Kadena LLC (US), Sapien (US), Storj (US), and Brave (US).